Secured Credit Cards Quickly Explained

What Is A Secured Credit Card And How Does It Work Getty. a secured credit card requires you to make a cash deposit to the credit card issuer to open your account. with a secured credit card, the amount you deposit, or use to “secure” the. A secured credit card is a type of credit card that is backed by a cash deposit. the deposit is often equal to the credit limit, which tends to be equal to 50 percent to 100 percent of the amount.

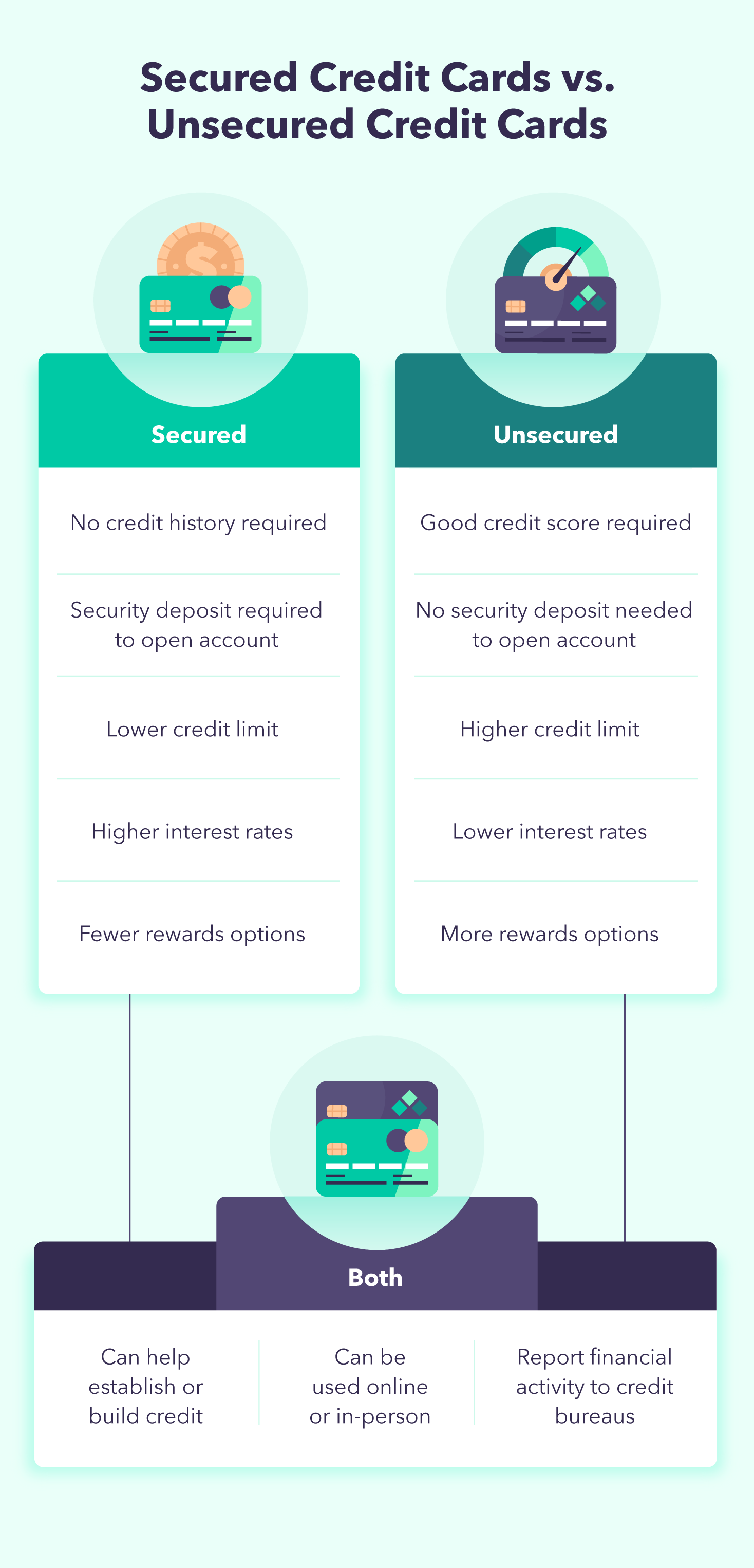

Secured Vs Unsecured Credit Cards Chime A secured credit card or secured line of credit is backed by your own cash when you open the account. the deposit you choose to make is generally your credit limit. so, if you make a deposit of $300, your credit limit is also $300. by securing the card with cash collateral, the credit card issuer’s risk is limited. The truth: secured credit cards are actually far less expensive than unsecured cards for bad credit. instead of high monthly, annual and application processing fees, secured cards require you to put down a refundable deposit, which you’ll ultimately get back. and many secured cards don’t charge annual fees as a result. A secured credit card is a credit card that’s “secured” by money you deposit as collateral with the credit card issuer. secured cards are designed for people who are trying to rebuild or build credit. this can include those who have bad credit or no credit history at all. unlike a debit card or prepaid card, a secured card is an actual. A secured credit card is a card that requires a cash security deposit when you open the account. the deposit reduces the risk to the credit card issuer: if you don't pay your bill, the issuer can.

How To Use A Secured Credit Card To Build Credit Self Credit Builder A secured credit card is a credit card that’s “secured” by money you deposit as collateral with the credit card issuer. secured cards are designed for people who are trying to rebuild or build credit. this can include those who have bad credit or no credit history at all. unlike a debit card or prepaid card, a secured card is an actual. A secured credit card is a card that requires a cash security deposit when you open the account. the deposit reduces the risk to the credit card issuer: if you don't pay your bill, the issuer can. A secured credit card is a credit card that requires a refundable cash deposit upfront to open your account. the deposit acts as collateral and typically determines the amount of your line of credit. for example, if you put down $200 as your security deposit, your credit limit will be $200. secured credit cards may be an ideal option if you. A secured credit card is a gateway for borrowers with low credit. like an unsecured card, you receive a credit limit and may even earn rewards. the main difference is that a secured credit card.

Secured Vs Unsecured Credit Cards Explained Mintlife Blog A secured credit card is a credit card that requires a refundable cash deposit upfront to open your account. the deposit acts as collateral and typically determines the amount of your line of credit. for example, if you put down $200 as your security deposit, your credit limit will be $200. secured credit cards may be an ideal option if you. A secured credit card is a gateway for borrowers with low credit. like an unsecured card, you receive a credit limit and may even earn rewards. the main difference is that a secured credit card.

What Is A Secured Credit Card And How Does It Work

Comments are closed.