Schedule Risk Analysis In Excel Using Monte Carlo Simulation 5 5 Yo

Monte Carlo Simulation Template For Excel A successful risk analysis has three steps: (1) create the cpm schedule for the project, (2) estimate the uncertainty in the activity durations, and (3) perform a risk analysis of the schedule, usually with a monte carlo simulation method available in several software packages. step 1: cpm schedule—the foundation of a risk analysis. Step 2: create rows for your trials or iterations. step 3: generate your random value variables. step 4: verify your values. step 5: visualize your monte carlo simulation results. using other monte carlo simulation distribution types in excel. limitations of monte carlo simulations in excel. excel add ins for working with data.

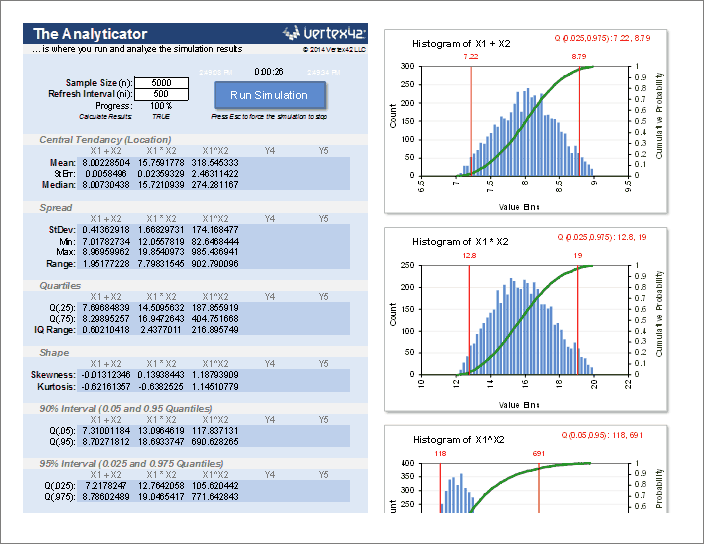

Schedule Risk Analysis In Excel Using Monte Carlo Simul Results from a schedule risk simulation. the schedule risk results from a monte carlo simulation are shown in the histogram for below. for a simple case study, it shows that the deterministic date of 13 april 2020 is less than 1% likely to be achieved following the current plan and without further risk mitigation actions. Many companies use monte carlo simulation as an important part of their decision making process. here are some examples. general motors, proctor and gamble, pfizer, bristol myers squibb, and eli lilly use simulation to estimate both the average return and the risk factor of new products. Monte carlo simulation is a mathematical technique used to model the probability of different outcomes in a process that cannot easily be predicted due to the intervention of random variables. it’s a powerful tool for understanding the impact of risk and uncertainty in various fields. Step 4: analyze the results. summarize and analyze the outcomes of your simulation runs. once you’ve run the simulation enough times (typically at least 1,000), you can start analyzing the data. use excel’s statistical functions like average, median, and stdev.p to summarize the results. create charts to visualize the distribution of outcomes.

Schedule Risk Analysis Using Monte Carlo Simulation Monte carlo simulation is a mathematical technique used to model the probability of different outcomes in a process that cannot easily be predicted due to the intervention of random variables. it’s a powerful tool for understanding the impact of risk and uncertainty in various fields. Step 4: analyze the results. summarize and analyze the outcomes of your simulation runs. once you’ve run the simulation enough times (typically at least 1,000), you can start analyzing the data. use excel’s statistical functions like average, median, and stdev.p to summarize the results. create charts to visualize the distribution of outcomes. Probabilistic method monte carlo. an alternative method for managing the risk in a project schedule is to create a probabilistic model of the project schedule, where activity durations are not described by unique values, but rather by probability distributions. monte carlo simulation is a process that generates random values for inputs that are. Getting started. locate and open the sra menu near the other functions groups alongside data explorer and risk optimizer. import the program's schedule file. configure the analysis model to be generated.depending on the base model in project or p6, you can avoid some of the options.

Comments are closed.