Schd Is Still The King Of Dividend Etfs Heres Why

Schd Etf Is The King Here S Why Divident Etf Schd Etfођ The schwab u.s. dividend equity etf (schd) is one of the most popular dividend etfs in the marketplace and has been for years! today, it's grown to become the 2nd largest dividend focused etf in. The schwab u.s. dividend equity etf (schd) is one of the most popular dividend etfs available. for good reason too. for good reason too. it comes with a 5 star rating from morningstar.

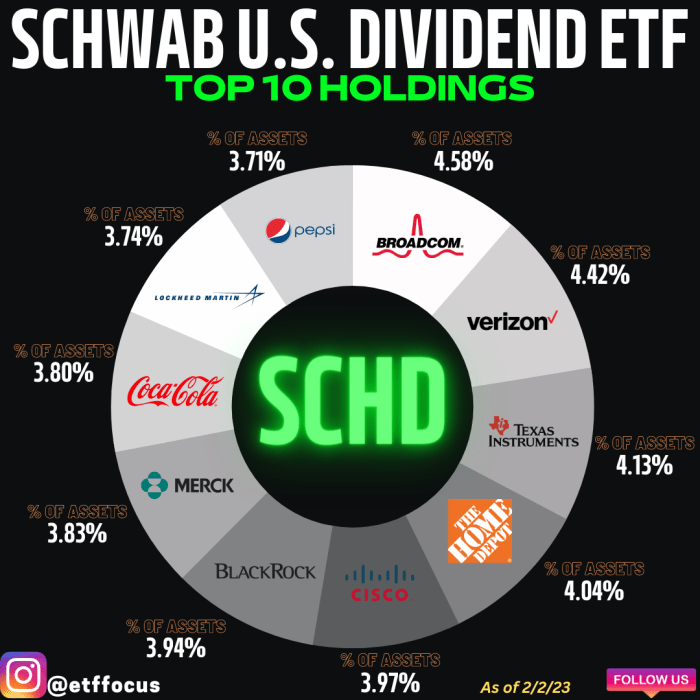

Schd Stringent Selection Process Helps Identify The Best Dividend Adding to its appeal is its larger than average dividend yield which currently stands at 3.74%. equally important, schd has demonstrated consistent dividend growth rates, with three year, five year, and ten year compounded annual growth rates at 13.3% respectively. the fund's resilience during bear markets is another point in its favor. Below are two examples of an etf model where one yields a 3.3% dividend like schd and one yields 1.59% like voo. first, the schd model with a $10000 investment over 10 years with an assumption of. For shareholders of the schwab u.s. dividend equity etf (schd) over the past several years, the past year and a half has been a rough ride. in 2023, its 4.6% return landed it in the 89th. Over the past three and five years, schd’s dividend growth rate was 9% and 13%, respectively, amongst the fastest growing dividends of any etf. in fact, schd’s most recently declared dividend.

юааschdюаб Is The Holy Grail юааof Dividendюаб юааetfsюаб юааhereтащsюаб юааwhyюаб Youtube For shareholders of the schwab u.s. dividend equity etf (schd) over the past several years, the past year and a half has been a rough ride. in 2023, its 4.6% return landed it in the 89th. Over the past three and five years, schd’s dividend growth rate was 9% and 13%, respectively, amongst the fastest growing dividends of any etf. in fact, schd’s most recently declared dividend. For investors looking to live off their dividends one day, schd can be an etf to look out for thanks to its solid track record of dividend growth. if you invested in a unit of schd 10 years ago (assuming 1st day of 2014) at $36.54 share, your yield on cost in the first year was just 2.87%. Schd is a top dividend growth focused etf that provides exposure to high quality companies across industries. the etf follows a formula that filters for dividend growth, with low management fees.

Comments are closed.