Save Your Bank Account From Online Scam Phone Pay Frauds Exposed

Types Of Online Banking Scams How To Secure Bank Account Director. [email protected]. (202) 512 8678. rebecca shea. director. [email protected]. (202) 512 6722. most of us have come across that online deal that seems simply too good to pass up. or we’ve received an urgent text or email from someone claiming to represent the government requesting a past due payment. 2024 spotlight: text scams. text message based scams are an especially popular type of phone based scams. the federal trade commission (ftc) says one reason may be that texting is cheap and easy. according to its 2022 consumer sentinel network data book , americans lost over $330 million to text scams in 2022.

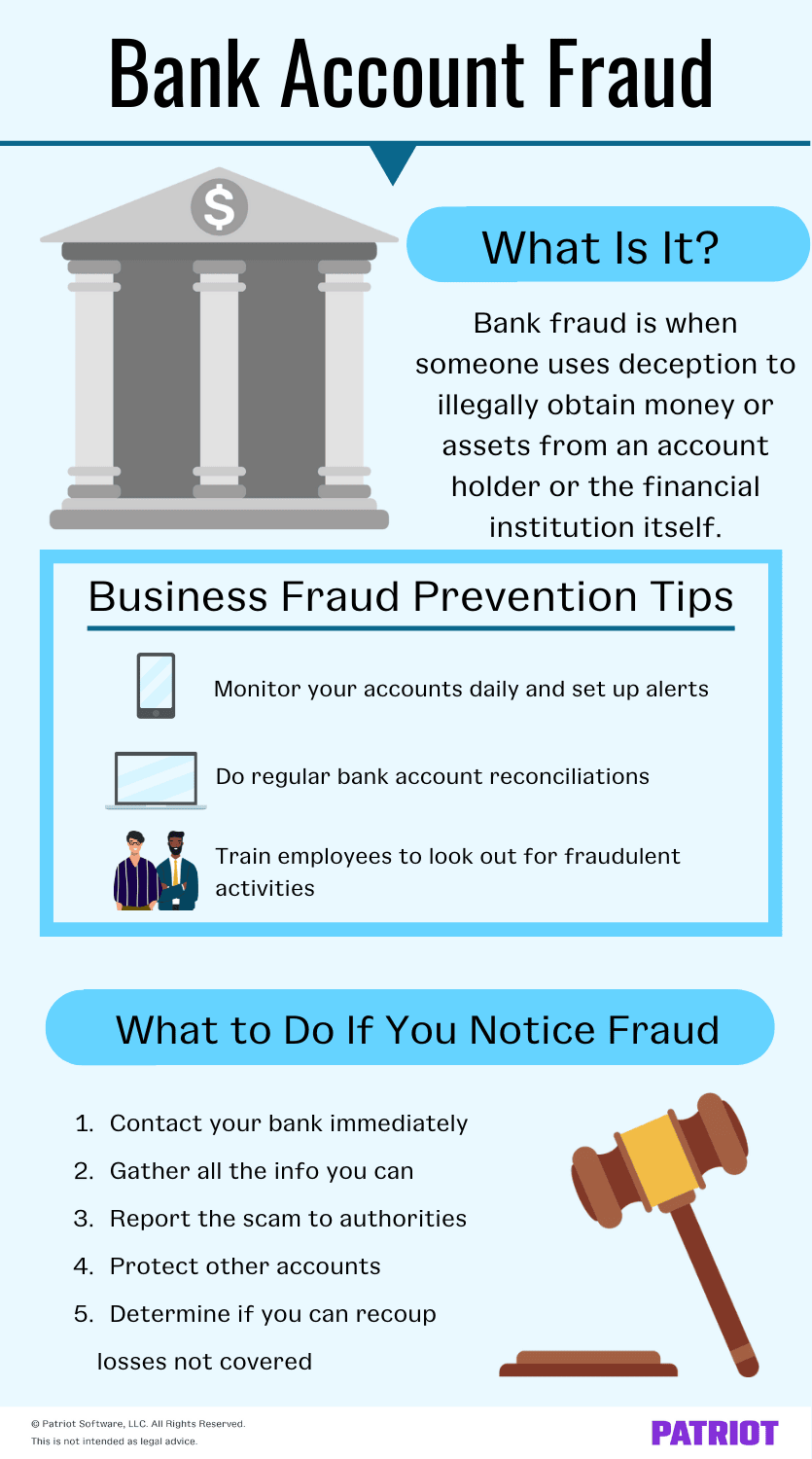

Bank Account Fraud What To Do If You Notice Fraud To find out if there's an actual issue with your account, contact the bank via a channel you know to be legitimate, like the customer service number printed on your bank statement or the back of a debit card. here are some other ways to bank online safely and avoid scams: choose a unique account password. 5. regularly update your devices and scan for malware. malicious software, or malware, can infect your device and allow fraudsters to steal your information or break into your bank accounts. keep your devices updated and regularly run an antivirus or antimalware scan to look for and remove infections. But you can be proactive about keeping your funds safe. here are three common bank scams and how to avoid them. 1. automatic debit scams. an automatic debit scam occurs when a scammer gets your. 1. peer to peer payment app scams. about 79 percent of americans use peer to peer (p2p) apps, like paypal, venmo, or zelle, at least once a week. these apps are convenient and easy to use, and scammers like them because it’s typically the user’s responsibility to ensure that transactions are legitimate.

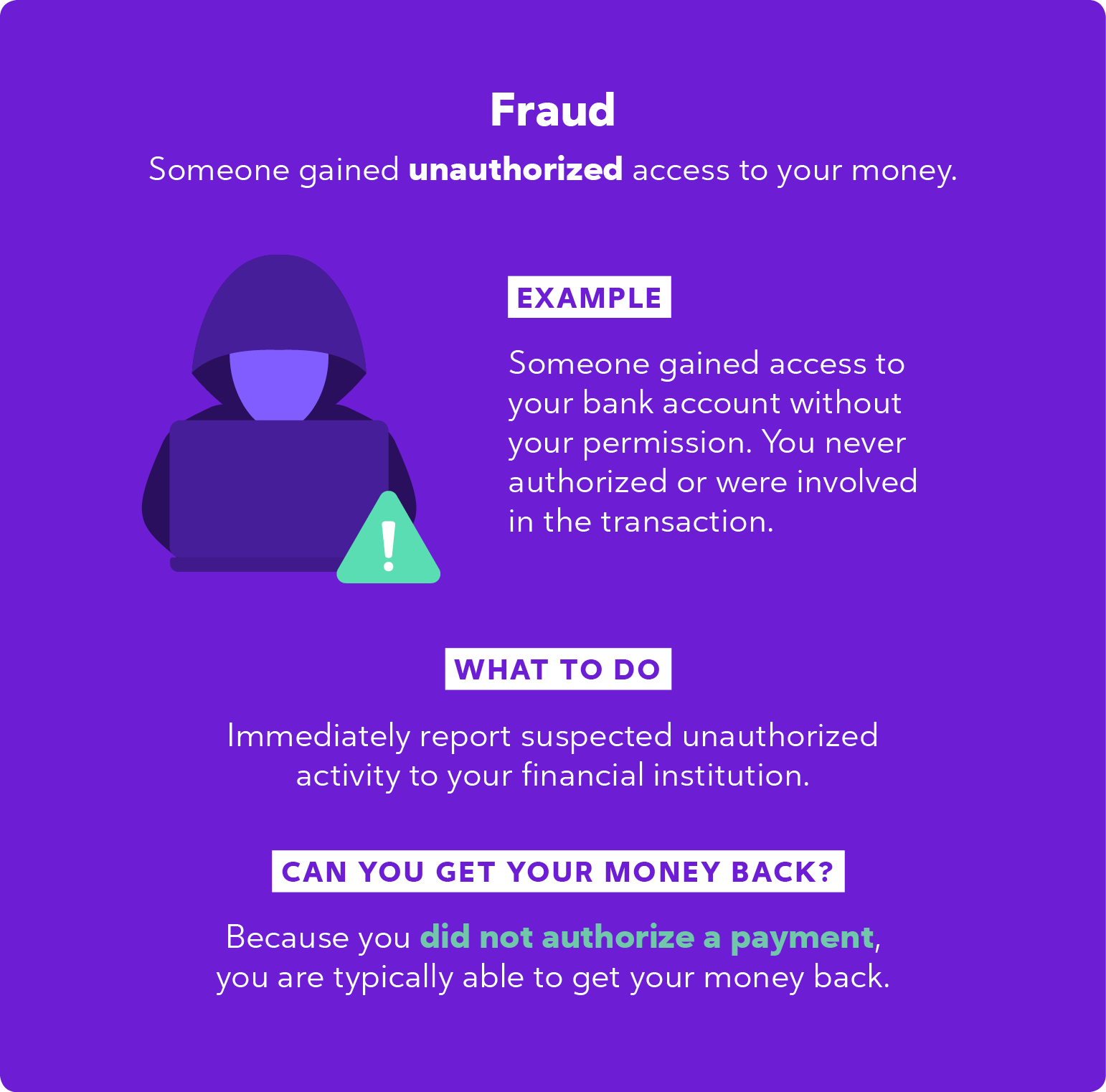

Understanding Fraud Scams Zelle But you can be proactive about keeping your funds safe. here are three common bank scams and how to avoid them. 1. automatic debit scams. an automatic debit scam occurs when a scammer gets your. 1. peer to peer payment app scams. about 79 percent of americans use peer to peer (p2p) apps, like paypal, venmo, or zelle, at least once a week. these apps are convenient and easy to use, and scammers like them because it’s typically the user’s responsibility to ensure that transactions are legitimate. Typically, phishing scams require you to click on a link and complete an action like confirming personal information. the message may even mention suspicious activity on a personal account. 6. But there’s an easy way to avoid malvertising and protect your bank account from hackers: installing ad blockers. many ad blocking tools are free and easy to download. by blocking ads, your chance of interacting with an infected ad is removed, weisman says. 6. utilize features and tools provided by your bank.

Comments are closed.