Sample Letter To Creditor Database Letter Template Collection

Sample Letter To Creditor Database Letter Template Collection 2. the full name and mailing address of the original creditor for this alleged debt; 3. documentation showing you have verified that i am responsible for this debt, or a copy of any judgment; 4. Collection and charge off account dispute letters. collections and charge offs show up on your credit report when an account is so far in arrears — usually after 180 consecutive days of no payments — the original creditor has “charged off” the account. in some cases, the original creditor may hire a collection agency to attempt to.

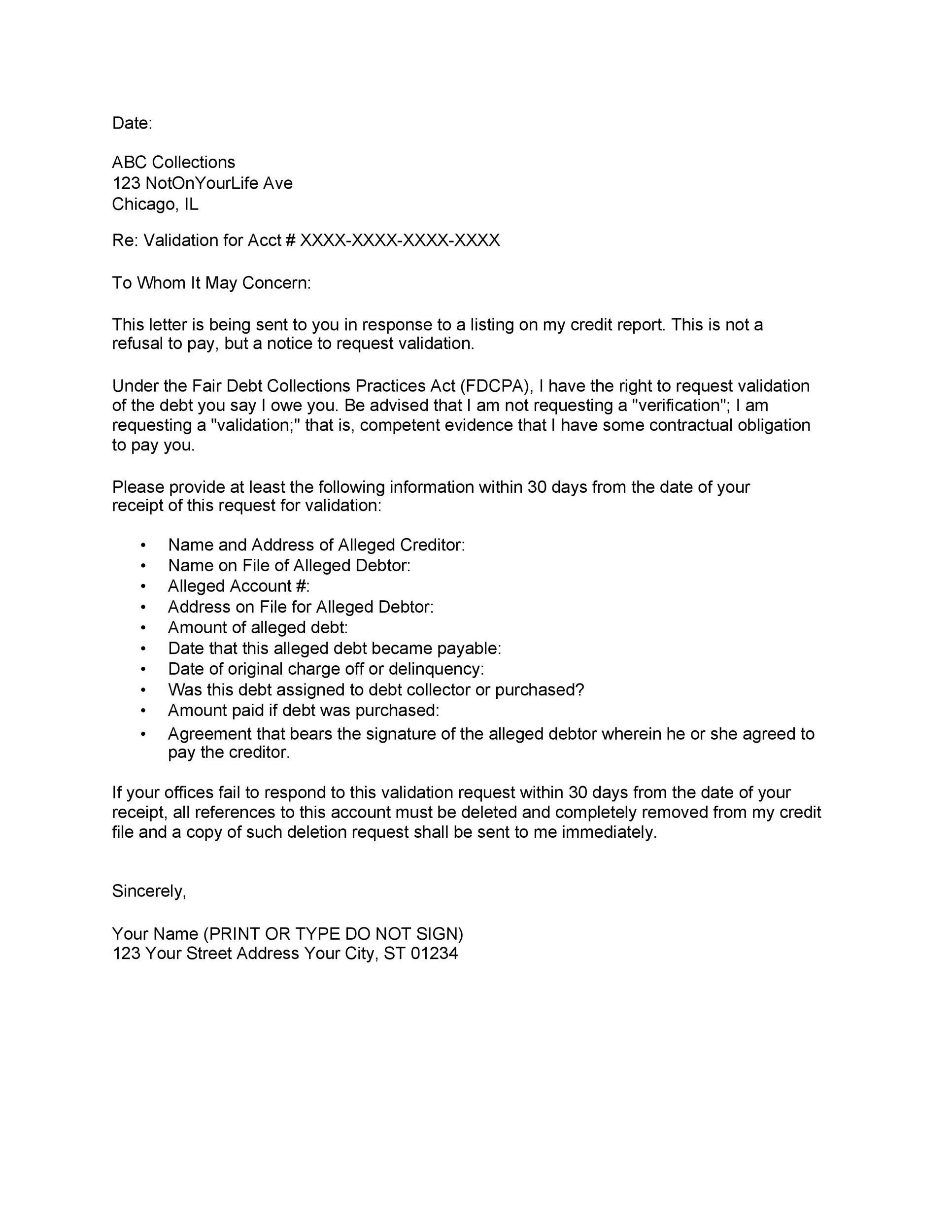

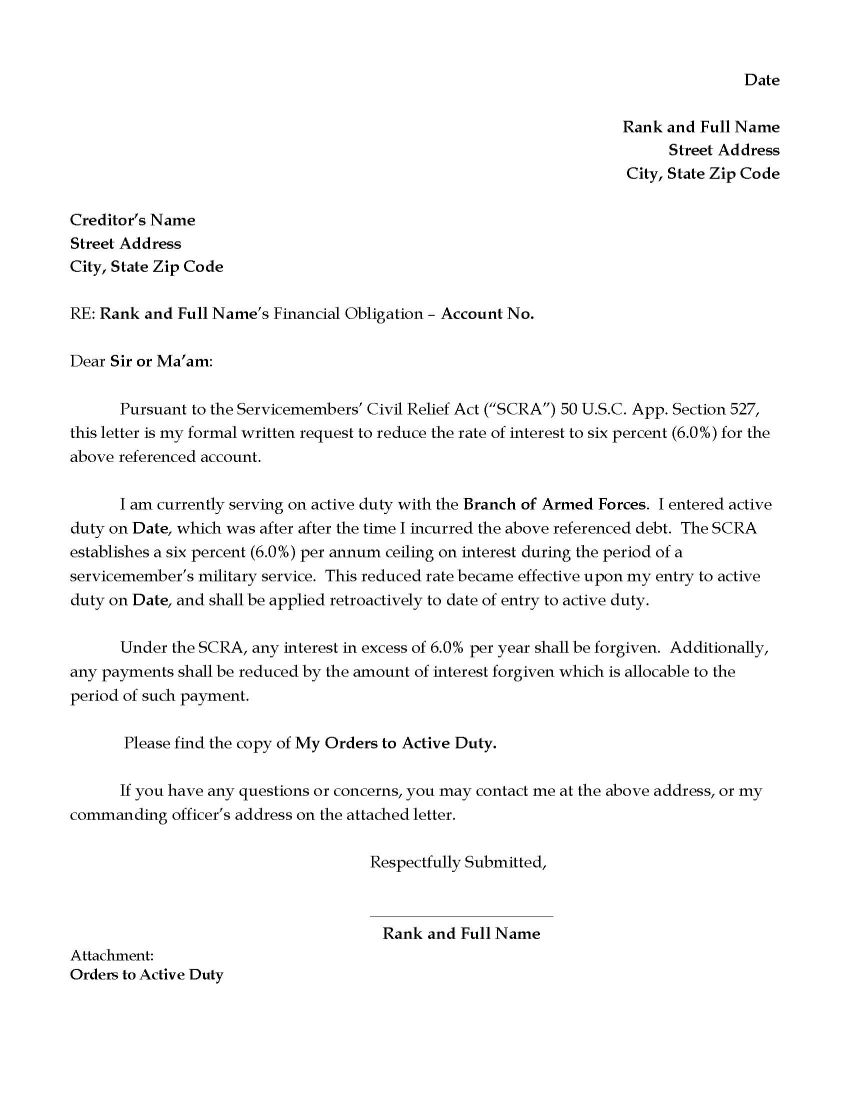

10 Sample Letter Of Credit Format Template And Examples Of Letter Dear [collection agency name], i am writing to formally dispute the above referenced debt. under the fair debt collection practices act, i request that you provide me with the following: 1. detailed documentation or proof of the debt, including the original creditor’s name and the amount you claim i owe. 2. 623 credit report dispute letter sample template. use this template to ask data furnishers to verify and remove errors on your credit report(s). <date> <your name> <your address> <your email> <date of birth> <social security number (optional)> <driver’s license number (optional)> <creditor collection agency name> < creditor collection agency. Use this letter to dispute a debt and to tell a collector to stop contacting you. if you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must stop all collection activities until it verifies the debt. your name your street address city, state zip code. date . You can customize this sample credit letter and send it to debt collectors who on a debt that has an expired statute of limitations. be careful that you don't say anything in your letter that could . even acknowledging that you owe the debt can restart the clock, giving the collector more time to sue you. of 07.

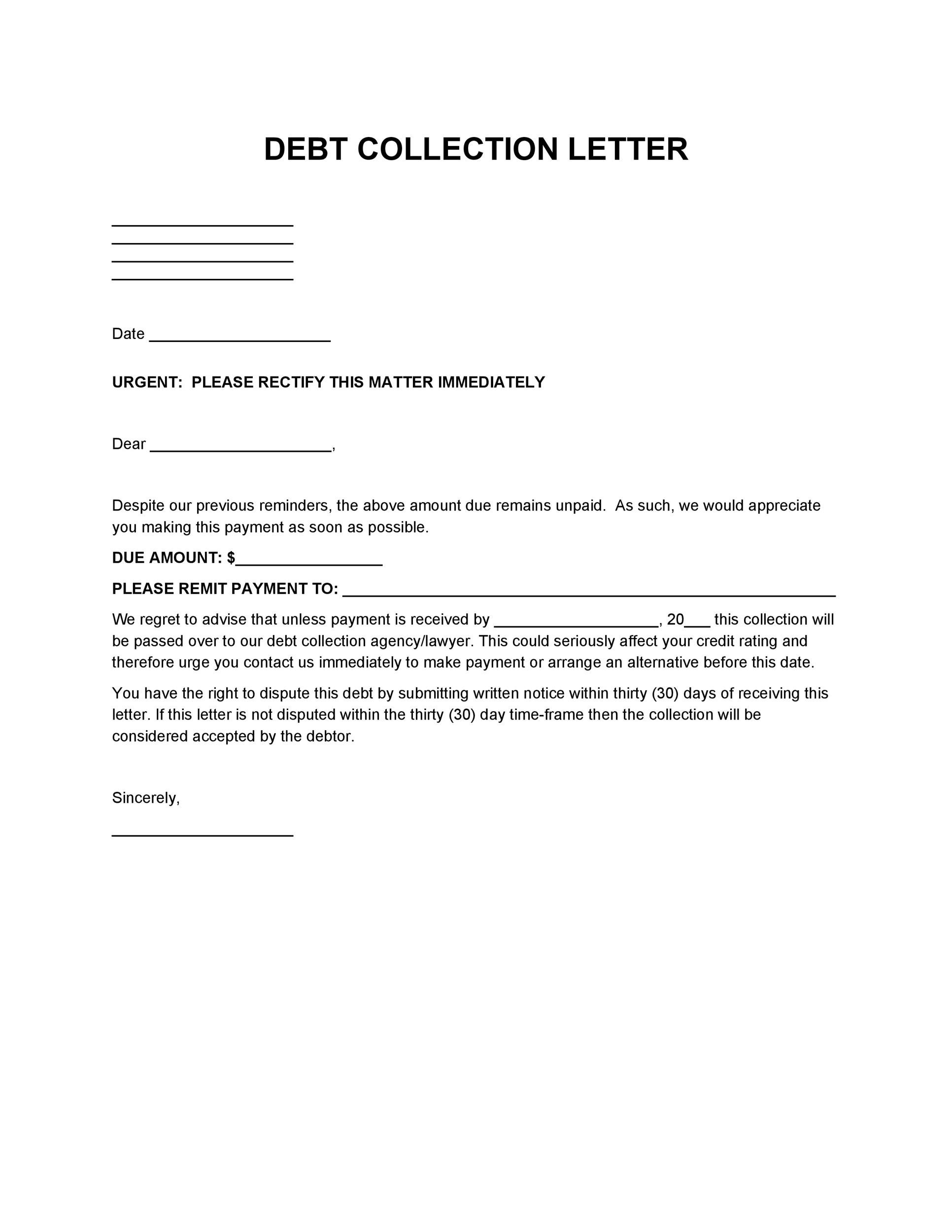

44 Effective Collection Letter Templates Samples бђ Templatelab Use this letter to dispute a debt and to tell a collector to stop contacting you. if you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must stop all collection activities until it verifies the debt. your name your street address city, state zip code. date . You can customize this sample credit letter and send it to debt collectors who on a debt that has an expired statute of limitations. be careful that you don't say anything in your letter that could . even acknowledging that you owe the debt can restart the clock, giving the collector more time to sue you. of 07. Sample letters to dispute information on a credit report. if you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as the credit reporting company. download our sample letter and instructions to submit a dispute. A credit report dispute letter is used to remove an invalid collection from a person’s credit history that was either paid, falsely listed, or if the debt is more than seven years old. all three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone. by law, the credit bureau.

Sample Letter To Creditor Database Letter Template Collection Sample letters to dispute information on a credit report. if you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as the credit reporting company. download our sample letter and instructions to submit a dispute. A credit report dispute letter is used to remove an invalid collection from a person’s credit history that was either paid, falsely listed, or if the debt is more than seven years old. all three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone. by law, the credit bureau.

44 Effective Collection Letter Templates Samples бђ Templatelab

Comments are closed.