Roth Ira Conversion Ladder Millionin10

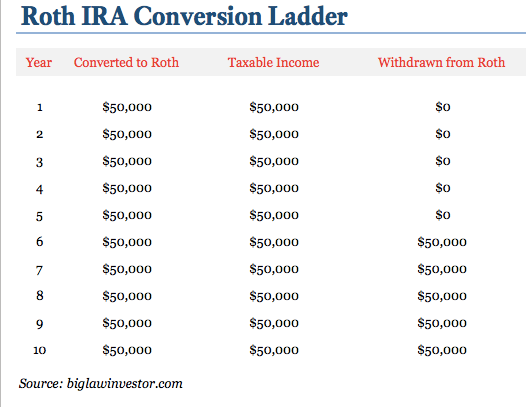

Roth Ira Conversion Ladder Millionin10 AJ_Watt / Getty Images Want to retire early? A Roth IRA conversion ladder could help you tap your tax-sheltered retirement accounts before age 59½—without the usual 10% penalty With a Roth A Roth IRA conversion ladder is a strategy that allows you to access retirement savings early To do this, you convert a portion of your traditional IRA funds to a Roth IRA over a number of years

The Roth Ira Conversion Ladder вђ Biglaw Investor JGI / Jamie Grill / Getty Images In a Roth IRA conversion, you can roll funds from a pretax retirement account, like a traditional IRA, into a Roth, thus avoiding income taxes on the distributions The Roth IRA — a popular retirement account — is similar to a traditional IRA in that you can regularly contribute to the account and watch your investments grow so you have a nest egg to tap However, high-income people still have a way into a Roth with a Roth IRA conversion This is also known as a backdoor Roth IRA This investment strategy is relatively easy to do but comes with Robert Powell: Lots of people are interested in doing a Roth IRA conversion, especially with the possibility of tax rates going up in the not-too-distant future Here to talk with me about that is

Roth Ira Conversion Ladder Millionin10 However, high-income people still have a way into a Roth with a Roth IRA conversion This is also known as a backdoor Roth IRA This investment strategy is relatively easy to do but comes with Robert Powell: Lots of people are interested in doing a Roth IRA conversion, especially with the possibility of tax rates going up in the not-too-distant future Here to talk with me about that is In this case, it might make sense to consider a 529 conversion to a Roth IRA To convert a 529 to a Roth IRA, you should contact the company you have or want to open your Roth IRA with the money in your Roth IRA will be able to grow tax-free and be withdrawn tax-free when you are retired There are ways to make the process of a Roth conversion less taxing I’m a financial The backdoor Roth generally starts with an after-tax contribution to a traditional IRA, followed by a conversion to a Roth IRA First, you make an after-tax contribution to a traditional IRA A Roth IRA conversion ladder could help you tap your tax-sheltered retirement accounts before age 59½—without the usual 10% penalty With a Roth conversion ladder, you shift money from a tax

Roth Ira Conversion Ladder Update Millionin10 In this case, it might make sense to consider a 529 conversion to a Roth IRA To convert a 529 to a Roth IRA, you should contact the company you have or want to open your Roth IRA with the money in your Roth IRA will be able to grow tax-free and be withdrawn tax-free when you are retired There are ways to make the process of a Roth conversion less taxing I’m a financial The backdoor Roth generally starts with an after-tax contribution to a traditional IRA, followed by a conversion to a Roth IRA First, you make an after-tax contribution to a traditional IRA A Roth IRA conversion ladder could help you tap your tax-sheltered retirement accounts before age 59½—without the usual 10% penalty With a Roth conversion ladder, you shift money from a tax SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below A Roth conversion ladder can be a smart strategy that allows you to move funds gradually from A Roth IRA conversion ladder is a strategy that allows you to access retirement savings early To do this, you convert a portion of your traditional IRA funds to a Roth IRA over a number of years

Comments are closed.