Roth Ira 2024 Calculator Cissy Deloris

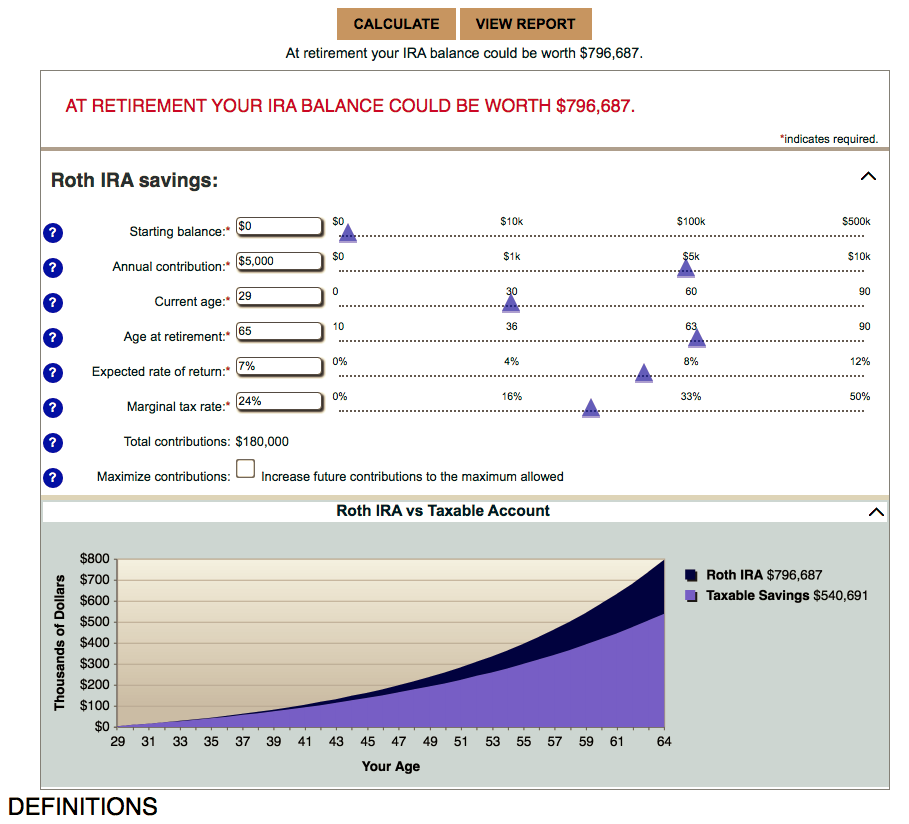

Roth Ira 2024 Calculator Cissy Deloris The amount you can contribute to a roth ira depends on your annual income. the roth ira contribution limit for 2024 is $7,000 in 2024 ($8,000 if age 50 or older). at certain incomes, the. This calculator estimates the balances of roth ira savings and compares them with regular taxable account. it is mainly intended for use by u.s. residents. for calculations or more information concerning other types of iras, please visit our ira calculator. current balance. annual contribution.

Roth Ira Calculator 2024 Staci Adelind Traditional and roth iras give you options for managing taxes on your retirement investments. contribution limits. unlike taxable investment accounts, you can’t put an unlimited amount of money. The roth ira has contribution limits, which are $6,500 for 2023 and $7,000 in 2024. if you’re age 50 or older, you can contribute an additional $1,000 as a catch up contribution. contributions. The ira calculator can be used to evaluate and compare traditional iras, sep iras, simple iras, roth iras, and regular taxable savings. for comparison purposes, roth ira and regular taxable savings will be converted to after tax values. to calculate roth ira with after tax inputs, please use our roth ira calculator. Roth ira income limits 2024. roth ira contribution limits 2024. single, head of household, or married filing separately (if you didn't live with spouse during year) less than $146,000. $7,000.

Roth Ira 2024 Compound Daily Compounding Interest Calculators The ira calculator can be used to evaluate and compare traditional iras, sep iras, simple iras, roth iras, and regular taxable savings. for comparison purposes, roth ira and regular taxable savings will be converted to after tax values. to calculate roth ira with after tax inputs, please use our roth ira calculator. Roth ira income limits 2024. roth ira contribution limits 2024. single, head of household, or married filing separately (if you didn't live with spouse during year) less than $146,000. $7,000. The amount you will contribute to your roth ira each year. this calculator assumes that you make your contribution at the beginning of each year. for 2024, the maximum annual ira contribution is $7,000 which is a $500 increase from 2023. it is important to note that this is the maximum total contributed to all of your ira accounts. Roth iras. a roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. you cannot deduct contributions to a roth ira. if you satisfy the requirements, qualified distributions are tax free. you can make contributions to your roth ira after you reach age 70 ½. you can leave amounts in your roth.

How To Use A Roth Ira Calculator Ready To Roth The amount you will contribute to your roth ira each year. this calculator assumes that you make your contribution at the beginning of each year. for 2024, the maximum annual ira contribution is $7,000 which is a $500 increase from 2023. it is important to note that this is the maximum total contributed to all of your ira accounts. Roth iras. a roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. you cannot deduct contributions to a roth ira. if you satisfy the requirements, qualified distributions are tax free. you can make contributions to your roth ira after you reach age 70 ½. you can leave amounts in your roth.

Start A Roth Ira For Free Step By Step Tutorial 2024 Compound Daily

Comments are closed.