Roth Conversion Ladder For F I R E Retirement Hack 5 Year Rule

Roth Conversion Ladder For F I R E Retirement Hack 5 Year Rule We share our plan to use a roth conversion ladder for f.i.r.e using the 5 year rule. thanks so much for watching.*****. The roth ira five year rule. the roth ira has two “five year rules” that dictate when you can pull out your earnings and conversions without penalty. the five year rule for earnings (aka accrued interest) states that you can’t withdraw earnings penalty free until: you reach age 59 ½, and. your roth ira is at least five years old.

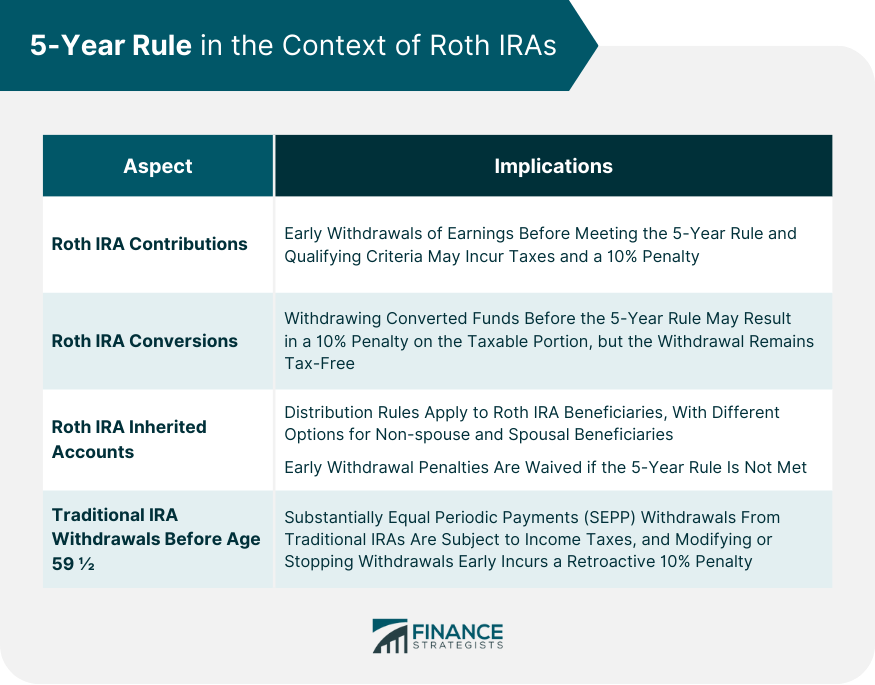

What Is A Roth Conversion Ladder Part 1 A Powerful Early Note: the 5 year aging requirement applies to all roth iras, even if the account holder is 59½ or older. in addition to withdrawals from originally owned roth iras, it covers inherited roth iras based on when the original owner made the first contribution. a separate 5 year aging rule covers conversions from traditional iras to roth iras. With a roth conversion ladder, you shift money from a tax deferred retirement account —such as a traditional ira or 401 (k)—into a roth ira. but unlike a standard roth ira conversion, you do. The five year rule is a fundamental aspect of roth conversions that can essentially determine the tax treatment of your converted funds. because roth iras offer significant tax advantages like tax. 5 year rule for roth ira withdrawals. the first roth ira five year rule is used to determine if the earnings (such as investment gains, dividends, and interest) from your roth ira are tax free. to.

Navigating The Roth Conversion 5 Year Rule Youtube The five year rule is a fundamental aspect of roth conversions that can essentially determine the tax treatment of your converted funds. because roth iras offer significant tax advantages like tax. 5 year rule for roth ira withdrawals. the first roth ira five year rule is used to determine if the earnings (such as investment gains, dividends, and interest) from your roth ira are tax free. to. The roth ira has a set of guidelines, known as the five year rule, that can impact taxes and penalties on your withdrawals. the rules apply to withdrawing earnings, conversions, and inherited iras. A roth ira conversion ladder is a strategy that allows you to access retirement savings early. to do this, you convert a portion of your traditional ira funds to a roth ira over a number of years. by spacing out conversions, you can effectively access your retirement savings early without restrictions. but you’ll have to wait five years.

Mastering The Five Year Rule For Roth Ira Conversions The roth ira has a set of guidelines, known as the five year rule, that can impact taxes and penalties on your withdrawals. the rules apply to withdrawing earnings, conversions, and inherited iras. A roth ira conversion ladder is a strategy that allows you to access retirement savings early. to do this, you convert a portion of your traditional ira funds to a roth ira over a number of years. by spacing out conversions, you can effectively access your retirement savings early without restrictions. but you’ll have to wait five years.

5 Year Rule Explanation Strategies In Retirement Planning

Comments are closed.