Return To Sender Time To Comment On Remittance Transfer Disclosures

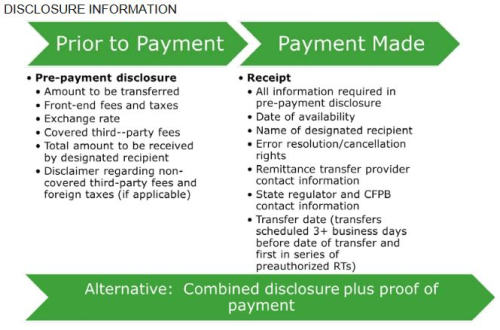

Return To Sender Time To Comment On Remittance Transfer Disclosures As an alternative to providing two separate disclosures, the rule permits credit unions to provide a combined written disclosure prior to payment, so long as the provider also provides proof of payment once the remittance transfer is made. see, 12 cfr § 1005.31(b)(3). 31(a)(2) written and electronic disclosures. 1. e sign act requirements. if a sender electronically requests the remittance transfer provider to send a remittance transfer, the disclosures required by § 1005.31(b)(1) may be provided to the sender in electronic form without regard to the consumer consent and other applicable provisions of the electronic signatures in global and national.

Sample Return To Sender Pdf The remittance transfer rule gives senders 30 minutes to cancel a remittance transfer and receive a refund. special cancellation rules apply to transfers scheduled three or more business days before the transfer date. senders do not have to wait at a branch or store front until the 30 minutes expires. The new federal law’s protections only apply to transfers that qualify as remittances, and that are sent by remittance transfer providers. for example: a money transfer sent to someone in the united states through a remittance transfer provider would not be covered because the transfer is not an international money transfer. Remittance transfer provider to send a remittance transfer to a designated recipient “state” means any state, territory, or possession of the u.s.; d.c.; puerto rico; or any political subdivision thereof designated recipient any person specified by a sender to receive a remittance transfer at a location in a foreign country 4. The information required by paragraph (b) (1) of this section may be disclosed orally if: (i) the transaction is conducted orally and entirely by telephone; (ii) the remittance transfer provider complies with the requirements of paragraph (g) (2) of this section; (iii) the provider discloses orally a statement about the rights of the sender.

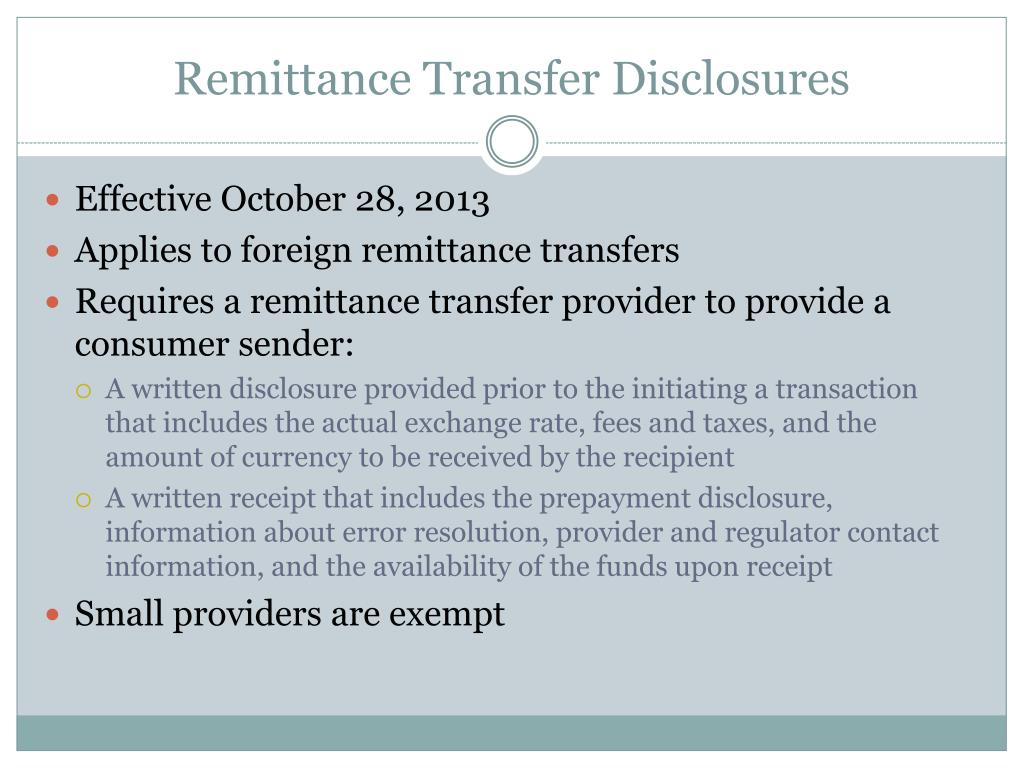

Ppt Regulatory Compliance Update Powerpoint Presentation Free Remittance transfer provider to send a remittance transfer to a designated recipient “state” means any state, territory, or possession of the u.s.; d.c.; puerto rico; or any political subdivision thereof designated recipient any person specified by a sender to receive a remittance transfer at a location in a foreign country 4. The information required by paragraph (b) (1) of this section may be disclosed orally if: (i) the transaction is conducted orally and entirely by telephone; (ii) the remittance transfer provider complies with the requirements of paragraph (g) (2) of this section; (iii) the provider discloses orally a statement about the rights of the sender. A remittance transfer provider may correct an error, without investigation, in the amount or manner alleged by the sender, or otherwise determined, to be in error, but must comply with all other applicable requirements of § 1005.33. 11. procedure for sending a new remittance transfer after a sender provides incorrect or insufficient information. Official interpretation. 31(a)(2) written and electronic disclosures. 1. e sign act requirements. if a sender electronically requests the remittance transfer provider to send a remittance transfer, the disclosures required by § 1005.31(b)(1) may be provided to the sender in electronic form without regard to the consumer consent and other applicable provisions of the electronic signatures in.

Comments are closed.