Retirement Preparation For Gig Economy Workers Engineer Your Finances

Retirement Preparation For Gig Economy Workers Engineer Your Finances When it comes to retirement preparation, the tips are usually pretty uniform. usually, you just commit the maximum amount of money that your employer will match, taking advantage of easy, free money! if you’re a gig worker, you are probably out of luck in this regard. For gig economy workers, the solo 401k offers several advantages. these include high contribution limits, potential tax deductions, and the ability to make either traditional (pre tax) or roth (after tax) contributions. this flexibility is particularly beneficial given the income variability in the gig economy.

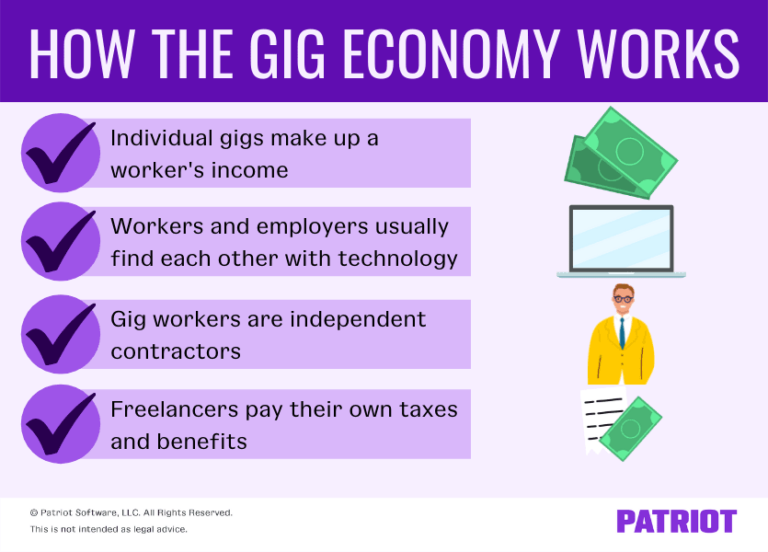

Gig Economy Who Are Gig Workers What Is The Gig Economy Here, nine financial experts from kiplinger advisor collective each share one important thing self employed small business owners and gig economy workers should know about saving and planning for. Christine benz dec 16, 2020. changes have been coming fast and furiously for workers in the gig economy. before the pandemic, the number of gig workers a broad coalition that includes delivery. Financial advisors can help integrate such automation into a broader financial plan, keeping gig workers on track towards achieving financial stability and retirement readiness. tax considerations for gig workers. for gig economy workers, understanding and managing self employment tax is a significant part of their financial landscape. 1 the future of employment – 30 telling gig economy statistics.smallbizgenius a rollover of qualified plan assets into an ira is not your only option. before deciding whether to keep assets in your current employer's plan, to roll assets to a new employer's plan, to take a cash distribution or to roll assets into an ira, clients should be sure to consider potential benefits and limitations.

Infographic Why The Gig Economy Is Taking Over 9 5 Jobs вђ Startupanz Financial advisors can help integrate such automation into a broader financial plan, keeping gig workers on track towards achieving financial stability and retirement readiness. tax considerations for gig workers. for gig economy workers, understanding and managing self employment tax is a significant part of their financial landscape. 1 the future of employment – 30 telling gig economy statistics.smallbizgenius a rollover of qualified plan assets into an ira is not your only option. before deciding whether to keep assets in your current employer's plan, to roll assets to a new employer's plan, to take a cash distribution or to roll assets into an ira, clients should be sure to consider potential benefits and limitations. But if you're a gig worker who can afford to invest right now, here are six smart ways to grow your nest egg. image source: getty images. 1. roth ira. a roth ira is one of the simplest ways to. When you were a full time employee, you were used to getting a w 2 form from your employer each year. now, because you are a gig worker, freelancer, or sole proprietor, you will receive a 1099 misc form (most likely) unless you have made under $600. depending on the type of freelancing you are doing, you might receive both a 1099 and w 2.

Comments are closed.