Retirement Plan Contribution Limits 2018 Seeking Alpha

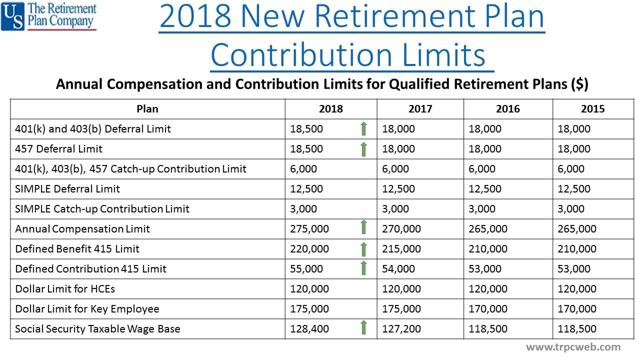

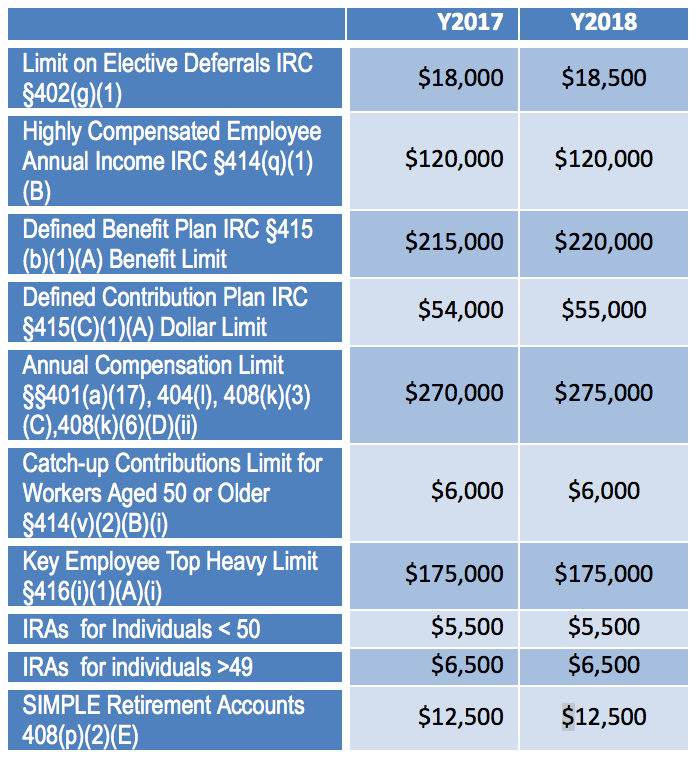

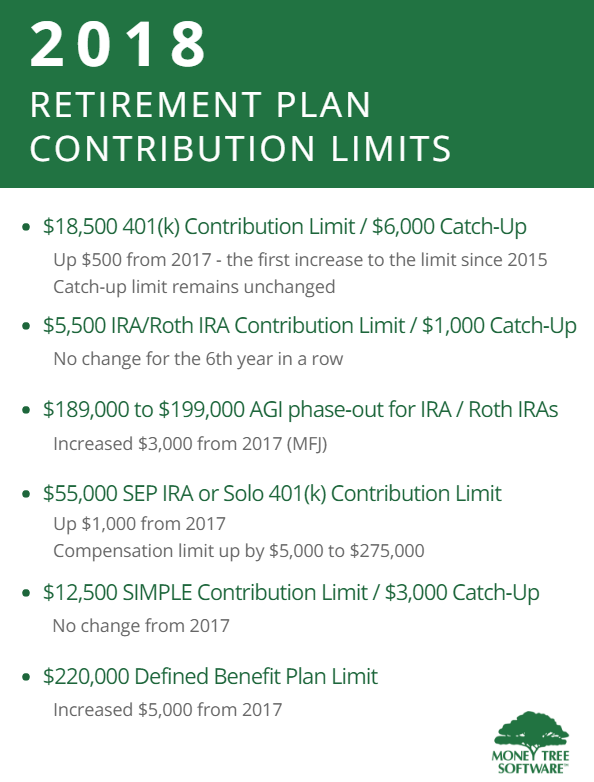

Retirement Plan Contribution Limits 2018 Seeking Alpha (2017). “2018 ira deduction limits – effect of modified agi on deduction if you are covered by a retirement plan at work.” retrieved from irs.gov . this article was written by. The good news is that both the 401(k) deferral limit and overall contribution benefit limits increased, as did the maximum compensation limit. most of the others remain unchanged from their 2017 levels. here's a rundown of the 2018 limits: compensation and benefit limits . annual compensation limit increases from $270,000 to $275,000.

2018 Annual Qualified Retirement Plan Contribution Limits In 2018, each person can give any person, tax free, any amount up to the annual limit of $15,000 (i.e. $30,000 as a couple), without using any of the $11.2 million gift tax exemption. Note: the main types of defined contribution retirement plans, such as a 401k, 401a, 403b, have contribution limits up to $61,000 in 2022. this limit includes both employee and employer contributions. 401 (k), 403 (b), 457, and thrift savings plan contribution limits. for 2018, the contribution limit for employees into these types of accounts is rising from $18,000 to $18,500. for participants. The irs announced that the 2018 dollar limitations on retirement plan contributions, outlined in ir 2017 177 and notice 2017 64, were unchanged by p.l. 115 97, known as the tax cuts and jobs act . although the new law made changes to the method of calculating cost of living increases, after applying the new methods, the contribution limits are.

2018 Retirement Plan Limits Announced By Irs Moneytree Software 401 (k), 403 (b), 457, and thrift savings plan contribution limits. for 2018, the contribution limit for employees into these types of accounts is rising from $18,000 to $18,500. for participants. The irs announced that the 2018 dollar limitations on retirement plan contributions, outlined in ir 2017 177 and notice 2017 64, were unchanged by p.l. 115 97, known as the tax cuts and jobs act . although the new law made changes to the method of calculating cost of living increases, after applying the new methods, the contribution limits are. For 2018, the contribution limit for employees into these types of accounts is rising from $18,000 to $18,500. for participants who will be age 50 and older by the end of 2018, the catch up. Ira contribution limits have changed for the new year. take a look at some adjustments to phaseout ranges for 2018.

Infographics Irs Announces Revised Contribution Limits For 401 K For 2018, the contribution limit for employees into these types of accounts is rising from $18,000 to $18,500. for participants who will be age 50 and older by the end of 2018, the catch up. Ira contribution limits have changed for the new year. take a look at some adjustments to phaseout ranges for 2018.

Comments are closed.