Retirement Contribution Limits Increasing In 2018 Doyle Wealth Managem

Retirement Contribution Limits Increasing In 2018 Doyle Wealt For 2018, the contribution limit for employees into these types of accounts is rising from $18,000 to $18,500. for participants who will be age 50 and older by the end of 2018, the catch up. Bob doyle. doyle wealth management, one of the larger investment management firms in st. petersburg with more than $922 million in team assets, got quite a bit of national recognition in 2018. bob doyle, president and a founding shareholder, made forbes list of top wealth advisors, while chris jay, senior wealth manager, and cassandra smalley.

2023 Retirement Plan Contribution Limits вђ Focused Wealth Management Employer sponsored 401(k)s are a smart choice for long term savers. here are some of the perks you'll enjoy if you open one. For those of you who are contributing to a tax advantaged retirement account, such as a 401(k), we have some great news: the irs has increased contribution limits for 2018. now you can stash. The 2018 ira contribution limit is $5,500, the same as it was last year. in fact, the last time the limit was increased was in 2013, when it grew by $500 to the current level. image source: getty. Founded in 2005, dwm provides honest, unbiased investment advice and wealth management for everyone from young professionals just starting out to retirees. we are fee only advisors, which means we don’t sell financial products. we’re not in this business for the commission. rather, our fiduciary duty is to help you find the most suitable.

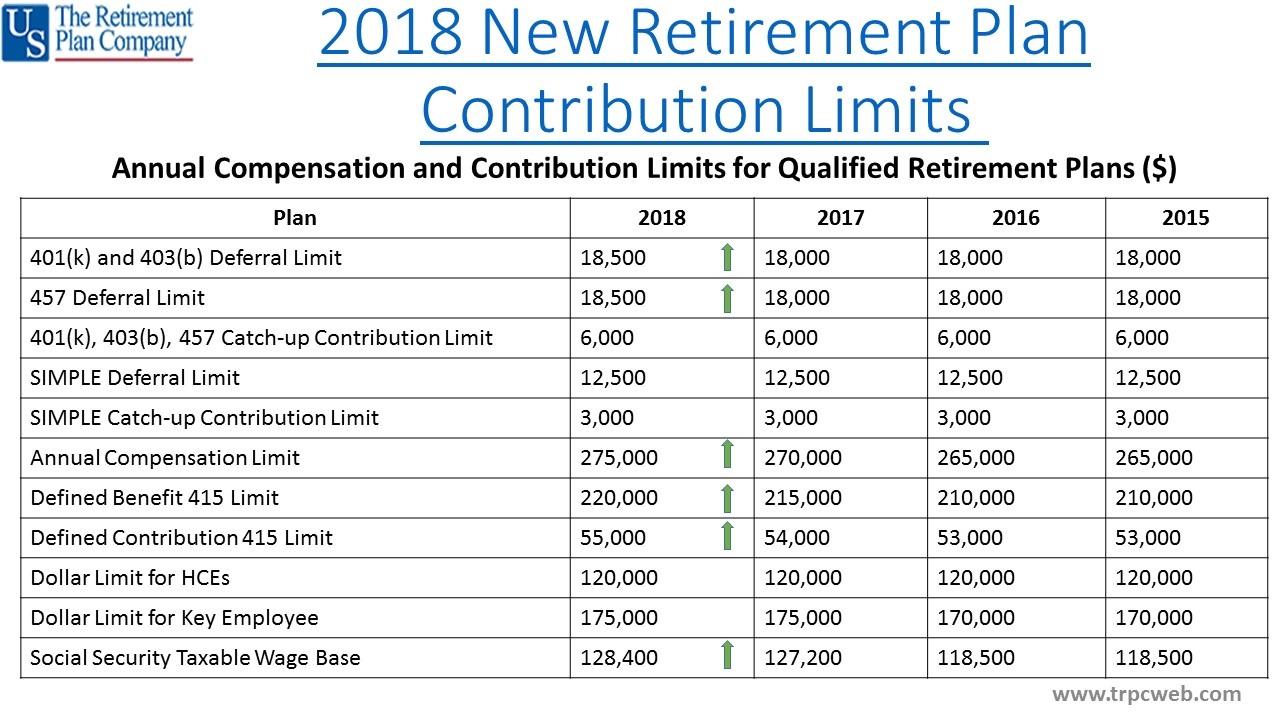

Retirement Plan Contribution Limits Rise For 2018 The 2018 ira contribution limit is $5,500, the same as it was last year. in fact, the last time the limit was increased was in 2013, when it grew by $500 to the current level. image source: getty. Founded in 2005, dwm provides honest, unbiased investment advice and wealth management for everyone from young professionals just starting out to retirees. we are fee only advisors, which means we don’t sell financial products. we’re not in this business for the commission. rather, our fiduciary duty is to help you find the most suitable. You will need to pay attention to irs contribution, age, and income limits for iras to avoid making a mistake that could cost you in additional taxes for each year an excess contribution remains in your retirement account. 2019 ira contribution and income limits. the standard limit for ira contributions increased by $500 in 2019, to $6,000 for. The irs announced on thursday that the limit on elective deferral for contributions to 401 (k) plans, 403 (b) plans, most 457 plans, and the federal government’s thrift savings plan will increase from $18,000 in 2017 to $18,500 for 2018. however, the catch up contribution limit for those 50 and older remains $6,000 (notice 2017 64).

Retirement Plan Contribution Limits 2018 Seeking Alpha You will need to pay attention to irs contribution, age, and income limits for iras to avoid making a mistake that could cost you in additional taxes for each year an excess contribution remains in your retirement account. 2019 ira contribution and income limits. the standard limit for ira contributions increased by $500 in 2019, to $6,000 for. The irs announced on thursday that the limit on elective deferral for contributions to 401 (k) plans, 403 (b) plans, most 457 plans, and the federal government’s thrift savings plan will increase from $18,000 in 2017 to $18,500 for 2018. however, the catch up contribution limit for those 50 and older remains $6,000 (notice 2017 64).

2018 Retirement Account Contribution Limits Ron Henry

Comments are closed.