Retirement Contribution Limits For 2023

Annual Retirement Plan Contribution Limits For 2023 Social K Highlights of changes for 2023. the contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government's thrift savings plan is increased to $22,500, up from $20,500. the limit on annual contributions to an ira increased to $6,500, up from $6,000. For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional iras and roth iras can't be more than: $6,000 ($7,000 if you're age 50 or older), or. if less, your taxable compensation for the year. the ira contribution limit does not apply to: rollover contributions. qualified reservist repayments.

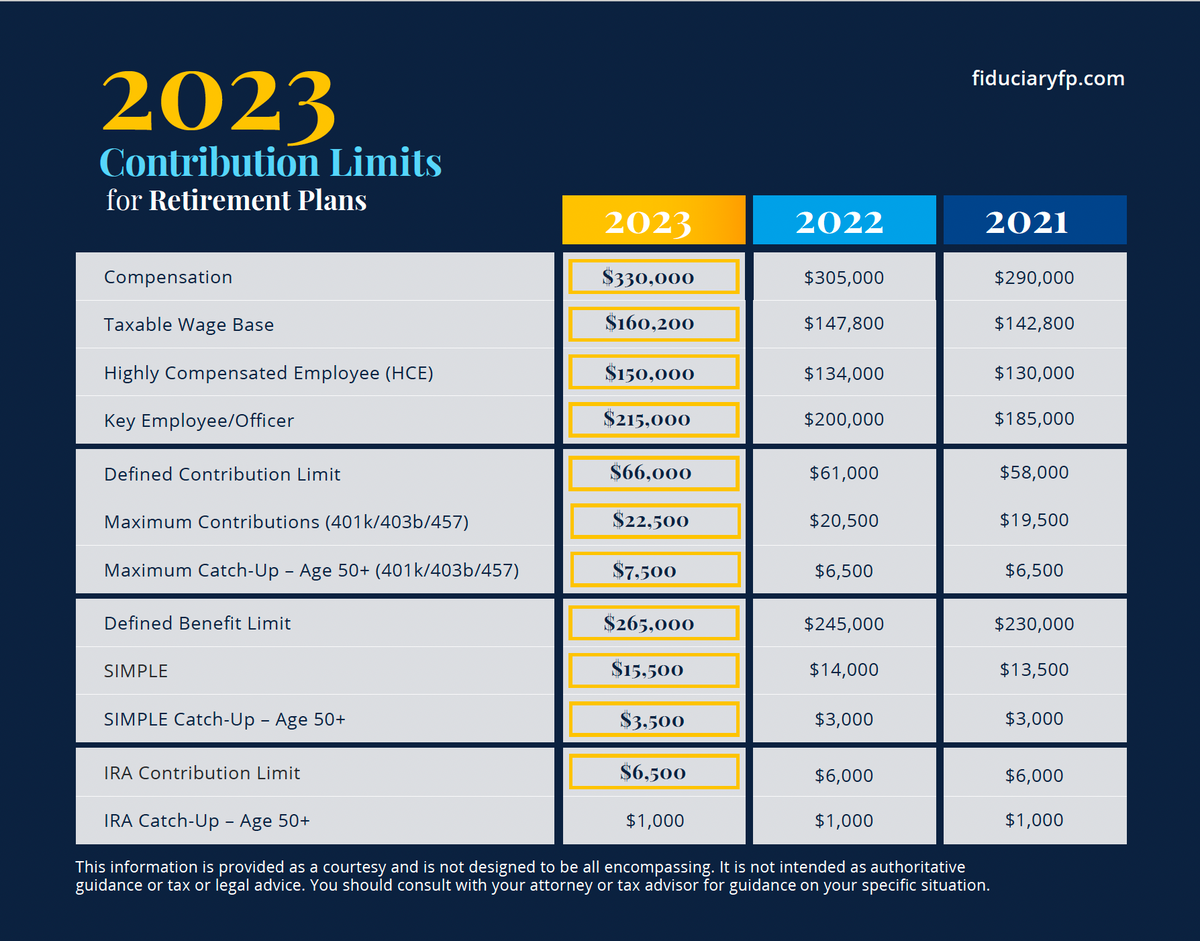

2023 Contribution Limits For Retirement Plans Fiduciary Financial The irs has released 2023 inflation adjusted contribution limits, phase out ranges, and income limits for various retirement accounts. ( ir 2022 188 ; notice 2022 55, 2022 45 irb) for 2023, the amount an individual can contribute to a 401(k), 403(b), and most 457 plans increases to $22,500, up from $20,500 in 2022. Workplace retirement plan contribution limits for 2023. for those with a 401(k), 403(b), or 457 plan through an employer, your new maximum contribution limit will go up to $22,500 in 2023. The irs sets the maximum that you and your employer can contribute to your 401 (k) each year. in 2023, the most you can contribute to a roth 401 (k) and contribute in pretax contributions to a traditional 401 (k) is $22,500. in 2024, this rises to $23,000. those 50 and older can contribute an additional $7,500 in 2023 and 2024. Here are some of the changes for 2023: the contribution limit for employees who participate in 401 (k), 403 (b), most 457 plans and the federal government's thrift savings plan will increase to $22,500. the limit on annual contributions to an ira will increase to $6,500. the ira catch‑up contribution limit for individuals age 50 and over is.

Here S The Latest 401k Ira And Other Contribution Limits For 2023 The irs sets the maximum that you and your employer can contribute to your 401 (k) each year. in 2023, the most you can contribute to a roth 401 (k) and contribute in pretax contributions to a traditional 401 (k) is $22,500. in 2024, this rises to $23,000. those 50 and older can contribute an additional $7,500 in 2023 and 2024. Here are some of the changes for 2023: the contribution limit for employees who participate in 401 (k), 403 (b), most 457 plans and the federal government's thrift savings plan will increase to $22,500. the limit on annual contributions to an ira will increase to $6,500. the ira catch‑up contribution limit for individuals age 50 and over is. The limit on total employer and employee contributions for 2023 was $66,000 ($73,500 with catch up). the irs adjusts retirement plan contribution limits annually for inflation. basic limits. For 2024, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older. this amount is up modestly from 2023, when the individual 401 (k) contribution limit was.

Retirement Plan Limits For 2023 Innovative Cpa Group The limit on total employer and employee contributions for 2023 was $66,000 ($73,500 with catch up). the irs adjusts retirement plan contribution limits annually for inflation. basic limits. For 2024, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older. this amount is up modestly from 2023, when the individual 401 (k) contribution limit was.

Comments are closed.