Renovation Loans

Home Renovation Loan 2021 Complete Guide Blackk Finance Compare personal loans for home improvement projects from top lenders with low rates, no fees and flexible terms. see qualifications, pros and cons, and how to apply for each loan option. Learn about different types of renovation loans to buy and fix up a home, or to improve your existing property. compare features, benefits, and requirements of fannie mae, freddie mac, fha, va, and usda renovation loans.

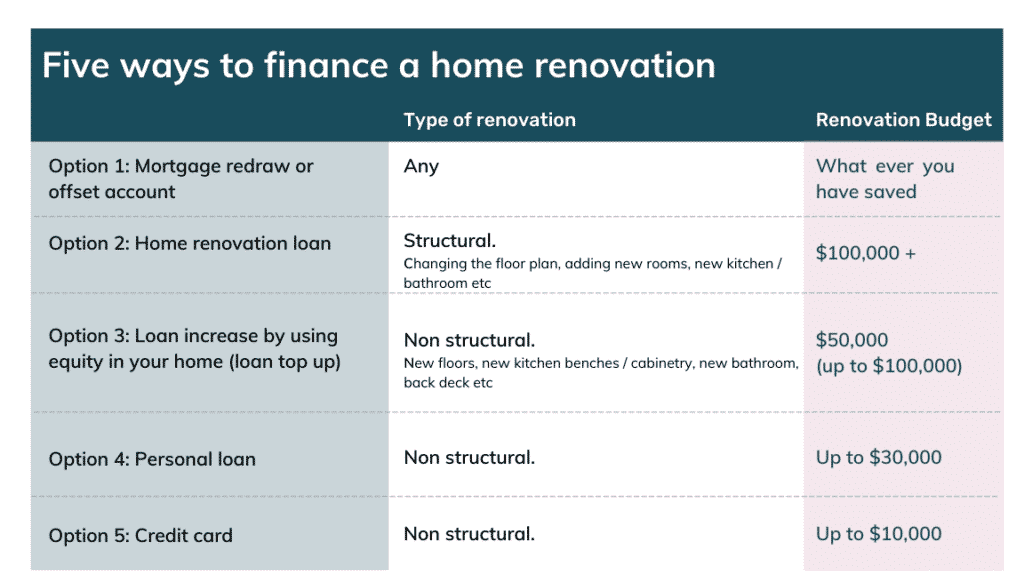

Renovation Loans Explained Nfm Lending Learn about different types of home renovation loans, such as fannie mae homestyle, freddie mac choicerenovation, fha 203(k), helocs and personal loans. compare pros and cons, interest rates, eligibility and costs of each option. 5 types of home improvement loans. various types of home improvement loans are available to help you fund repairs, upgrades and home improvement projects of all kinds. 1. home equity loan. a home equity loan is a very helpful and lower cost option if you’re looking to fund home improvement projects. this loan allows you to tap into the equity. Learn how a renovation loan can help you fund extensive repairs or upgrades to a property, and compare different types of renovation loans. find out the pros and cons of each loan option, and how to get preapproved for a renovation loan. A home improvement loan is a personal loan that borrowers can use for home remodels, repairs and renovations. home improvement loans are unsecured, which means the home is not used as collateral.

Comments are closed.