Ratings Flood

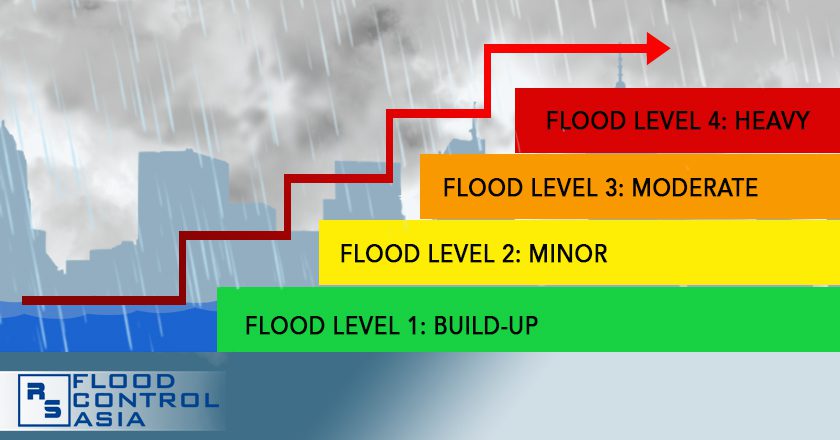

The Levels Of Flooding And How To Prepare For Them Rs Flood Control Flood maps, known officially as flood insurance rate maps, show areas of high and moderate to low flood risk. they are shown as a series of zones munities use the maps to set minimum building requirements for coastal areas and floodplains; lenders use them to determine flood insurance requirements. Fema is updating the national flood insurance program's (nfip) risk rating methodology through the implementation of a new pricing methodology called risk rating 2.0. the methodology leverages industry best practices and cutting edge technology to enable fema to deliver rates that are actuarily sound, equitable, easier to understand and better reflect a property’s flood risk.

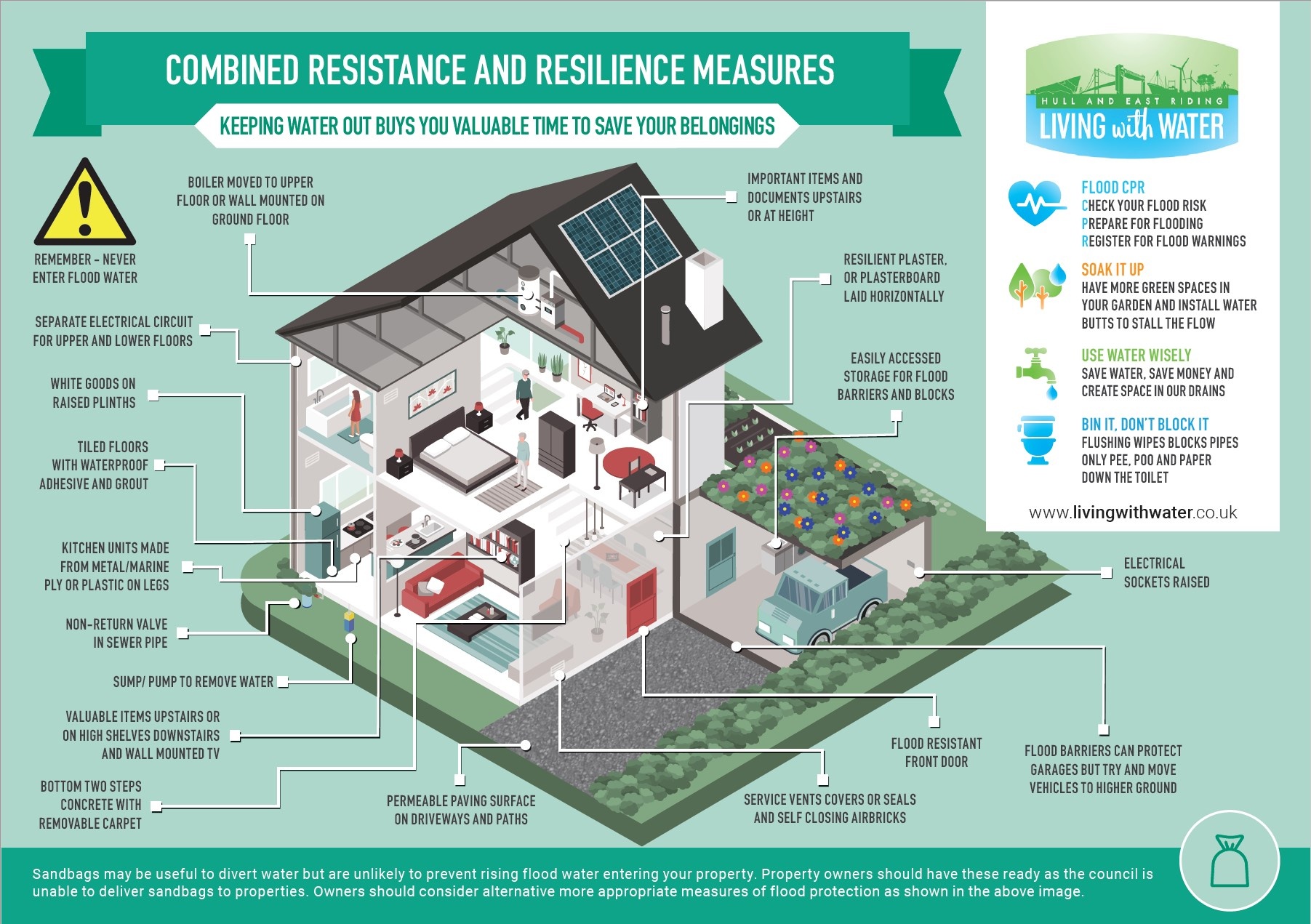

Flood Resilience Ratings вђ A Practical Solution To Rising Flood Risk Flood maps are one tool that communities use to know which areas have the highest risk of flooding. fema maintains and updates data through flood maps and risk assessments. flood maps show how likely it is for an area to flood. any place with a 1% chance or higher chance of experiencing a flood each year is considered to have a high risk. A flood risk map showing an area’s risk of flooding in the future (floodfactor) while fema maps and flood factor ratings can certainly help you get a sense of a property’s flood risk, you. In communities that participate in the national flood insurance program (nfip), flood insurance is mandatory for properties located in high risk flood zones if mortgages are federally backed. 99%. over the past 20 years, 99% of counties in the u.s. have experienced a flood event. 40%. over 40% of nfip claims are from outside the high risk zones. In this article, we will introduce the basics of flood insurance, risk rating 2.0, and other steps to reduce flood risk. risk rating 2.0 is modernizing nfip by ensuring flood insurance rates are based upon each individual property’s risk to flooding and improves equity by reducing insurance premiums for policyholders who were previously.

Flood Resilience Ratings вђ A Practical Solution To Rising Flood Risk In communities that participate in the national flood insurance program (nfip), flood insurance is mandatory for properties located in high risk flood zones if mortgages are federally backed. 99%. over the past 20 years, 99% of counties in the u.s. have experienced a flood event. 40%. over 40% of nfip claims are from outside the high risk zones. In this article, we will introduce the basics of flood insurance, risk rating 2.0, and other steps to reduce flood risk. risk rating 2.0 is modernizing nfip by ensuring flood insurance rates are based upon each individual property’s risk to flooding and improves equity by reducing insurance premiums for policyholders who were previously. Flood insurance premiums are based on the risk rating of the building to be insured: the higher the risk, the higher the flood insurance premium. what is risk rating 2.0: equity in action? risk rating 2.0: equity in action is fema’s new, individualized approach to risk assessment, built on years of investment in flood hazard information. According to fema, the benefits of risk rating 2.0 are: a more accurate picture of risk at the individual property level. rates that are easier for policyholders and insurance agents to understand. reflection of more types of flood risk than is currently shown. use of up to date actuarial practices to set rates.

Flood Zones How To Determine If You Need To Carry Flood Insurance Flood insurance premiums are based on the risk rating of the building to be insured: the higher the risk, the higher the flood insurance premium. what is risk rating 2.0: equity in action? risk rating 2.0: equity in action is fema’s new, individualized approach to risk assessment, built on years of investment in flood hazard information. According to fema, the benefits of risk rating 2.0 are: a more accurate picture of risk at the individual property level. rates that are easier for policyholders and insurance agents to understand. reflection of more types of flood risk than is currently shown. use of up to date actuarial practices to set rates.

Comments are closed.