Quick Ratio Formula Step By Step Calculation With Examples

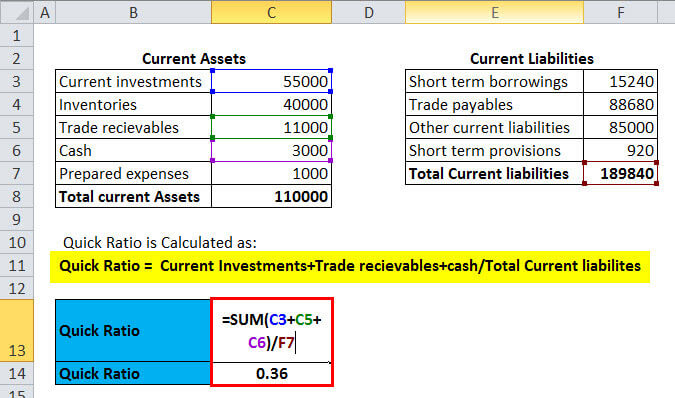

Quick Ratio Formula Step By Step Calculation With Examples The calculator below can be used for quick ratio formula accounting. this calculator would help the reader understand the concept and their personal liquidity better. excel template. using an excel sheet can be easier in a lot of cases. therefore, let us understand how to carry out quick ratio formula finance through the template below. These assets are known as “quick” assets since they can quickly be converted into cash. the quick ratio formula. quick ratio = [cash & equivalents marketable securities accounts receivable] current liabilities. or, alternatively, quick ratio = [current assets – inventory – prepaid expenses] current liabilities. example. for.

Quick Ratio Formula Step By Step Calculation With Examples Formula for the quick ratio. there are a few different ways to calculate the quick ratio. the most common approach is to add the most liquid assets and divide the total by current liabilities. Step 2: calculate quick ratio apply the qr formula: quick ratio = liquid assets current liabilities = $110,000 $90,000 ≈ 1.22. company b’s quick ratio is approximately 1.22, suggesting that it has $1.22 in liquid assets available to cover each dollar of its short term liabilities. Formula for quick ratio. to calculate the quick ratio, use the following formula: quick ratio (or acid test ratio) = quick assets current liabilities. example. the data below was obtained from fine trading company's balance sheet. current assets: cash: $90,000; marketable securities: $65,000; accounts receivable: $200,000; prepaid expenses. The quick ratio or acid test ratio is a liquidity ratio that measures the ability of a company to pay its current liabilities when they come due with only quick assets. quick assets are current assets that can be converted to cash within 90 days or in the short term. cash, cash equivalents, short term investments or marketable securities, and.

:max_bytes(150000):strip_icc()/Quick_ratio-5c720ee246e0fb00010762ee.jpg)

Quick Ratio Formula Step By Step Calculation With Examples Formula for quick ratio. to calculate the quick ratio, use the following formula: quick ratio (or acid test ratio) = quick assets current liabilities. example. the data below was obtained from fine trading company's balance sheet. current assets: cash: $90,000; marketable securities: $65,000; accounts receivable: $200,000; prepaid expenses. The quick ratio or acid test ratio is a liquidity ratio that measures the ability of a company to pay its current liabilities when they come due with only quick assets. quick assets are current assets that can be converted to cash within 90 days or in the short term. cash, cash equivalents, short term investments or marketable securities, and. The quick ratio is a metric which measures a firm’s ability to pay its current debts without selling additional inventory or raising additional capital. it is calculated as the dollar value of a firm’s “quick” assets (cash equivalents, securities, and receivables), divided by the firm’s current debt. the quick ratio is often compared. Quick ratio = cash current assets less inventory and prepaid expenses current liabilities less bank overdraft and cash credit. = (225000 – 15000 – 65000) (111000 – 6000 – 10000) = 145000 95000 = 1.53. and, current ratio = current assets current liabilities = 225000 111000 = 2.03.

Comments are closed.