Pros And Cons Of Using Credit Cards For B2b Transactions Omoney

Pros And Cons Of Using Credit Cards For B2b Transactions Omoney The pandemic has changed the way businesses interact financially giving way to a more digital route for b2b payment methods. modes of b2b payments such as cash and cheques were going down and being replaced by other modes of payments such as credit cards, opening an escrow account, wire transfers, and other online modes of b2b payments. this digital trend is only growing by the day and appears. On top of that, you pay transaction fees, which are split into different categories depending on how your customers pay: card present (in person payments): 2.6% $0.10 per transaction. card not present (online payments like ecommerce api, checkout, or electronic invoicing): 2.9% $0.30 per payment.

Pros And Cons Of Using Credit Cards For B2b Transactions Omoney Commercial cards . one of the most popular b2b payment methods among buyers, commercial cards are credit cards for businesses. commercial card transactions are processed through card networks like visa and mastercard, while card issuers — typically financial institutions but sometimes american express or discover — approve or deny the. Pros: it takes less time to finalize than paper checks (the second most popular option) simplifies the process for recurring payments. keeps costs low with transaction rates that hover around $.29 on average—far below typical wire transfer or credit card fees. offers the ability to refund erroneous payments. 1. credit cards. credit cards are one of the most popular payment methods for b2b payments. business credit cards are especially prevalent in the uk, netherlands, us, australia, and singapore. credit card payments often mean high processing fees for merchants. but despite the high fees, more than 75% of businesses accept credit card payments. B2b payments occur when one business provides goods or services to another business, followed by an invoicing process where the providing business issues an invoice to the purchasing business detailing the amount due and payment terms. payment methods for b2b transactions include options such as bank transfers, checks, credit or debit cards, or.

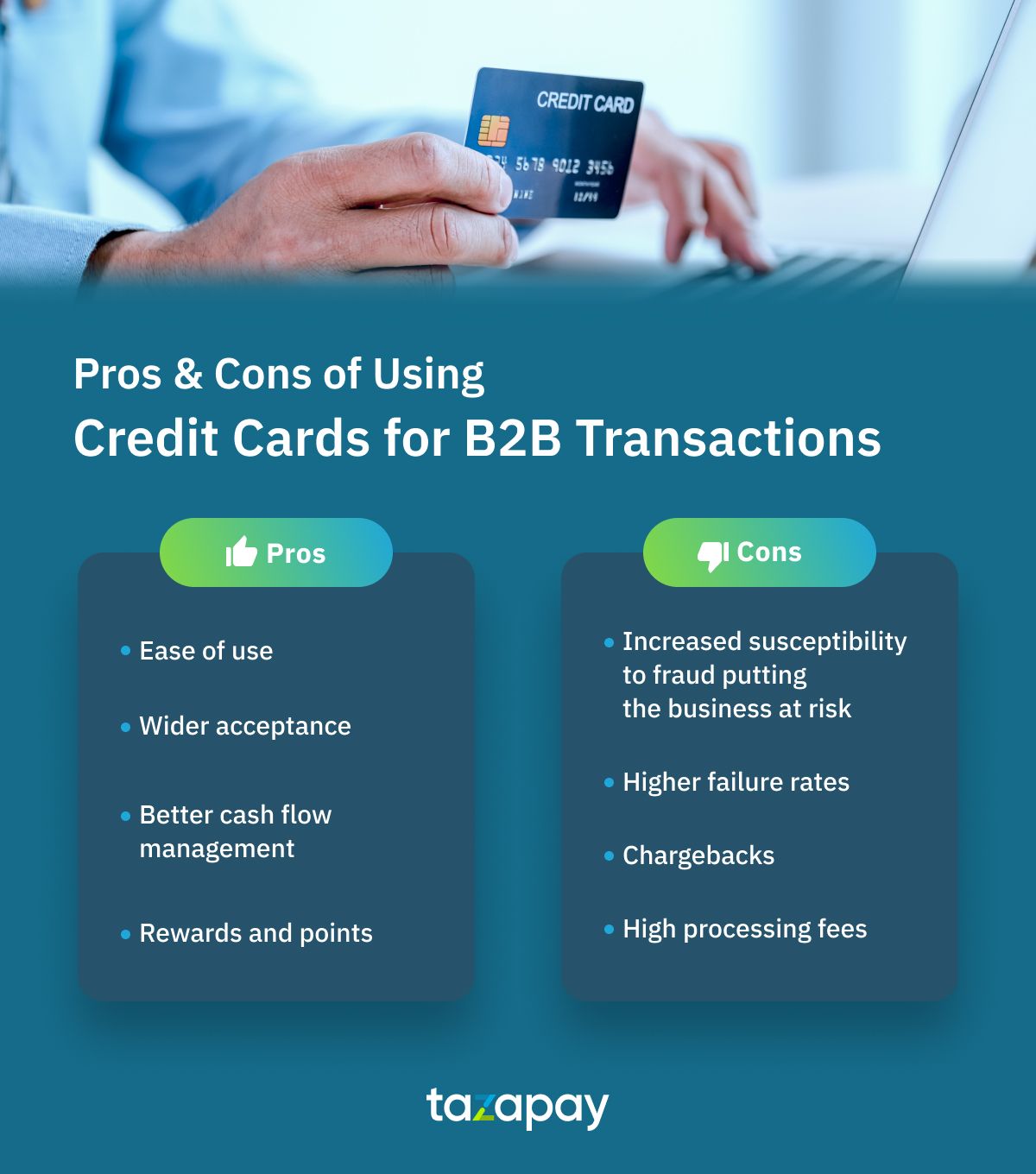

15 Advantages And Disadvantages Of Credit Cards Finder 1. credit cards. credit cards are one of the most popular payment methods for b2b payments. business credit cards are especially prevalent in the uk, netherlands, us, australia, and singapore. credit card payments often mean high processing fees for merchants. but despite the high fees, more than 75% of businesses accept credit card payments. B2b payments occur when one business provides goods or services to another business, followed by an invoicing process where the providing business issues an invoice to the purchasing business detailing the amount due and payment terms. payment methods for b2b transactions include options such as bank transfers, checks, credit or debit cards, or. Cons of accepting credit cards. like any business decision, there are drawbacks to accepting credit cards for b2b transactions. here are some disadvantages to consider before making a payment form decision. high transaction fees. the most significant disadvantage of accepting credit cards is the high transaction fees. Although credit cards currently comprise a smaller fraction of b2b sales, the total sales volume is huge. according to recent data, online u.s. b2b ecommerce sales are expected to generate $3 trillion by the end of 2027, as offline b2b sales begin to flatten. by not accepting credit cards, you are potentially missing out on revenue.

Everything You Need To Know About The Pros And Cons Of Credit Cards Cons of accepting credit cards. like any business decision, there are drawbacks to accepting credit cards for b2b transactions. here are some disadvantages to consider before making a payment form decision. high transaction fees. the most significant disadvantage of accepting credit cards is the high transaction fees. Although credit cards currently comprise a smaller fraction of b2b sales, the total sales volume is huge. according to recent data, online u.s. b2b ecommerce sales are expected to generate $3 trillion by the end of 2027, as offline b2b sales begin to flatten. by not accepting credit cards, you are potentially missing out on revenue.

Comments are closed.