Pros And Cons Of Using Credit Cards

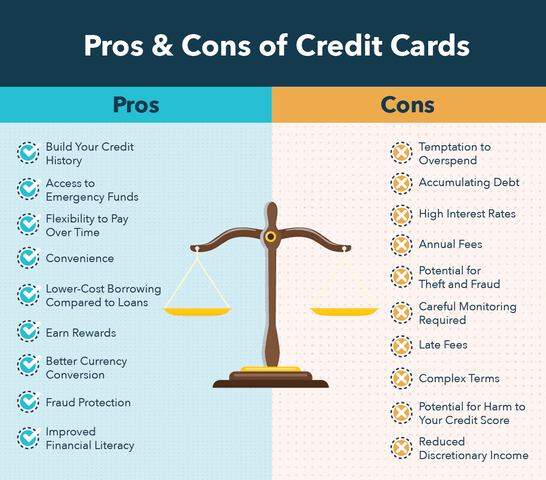

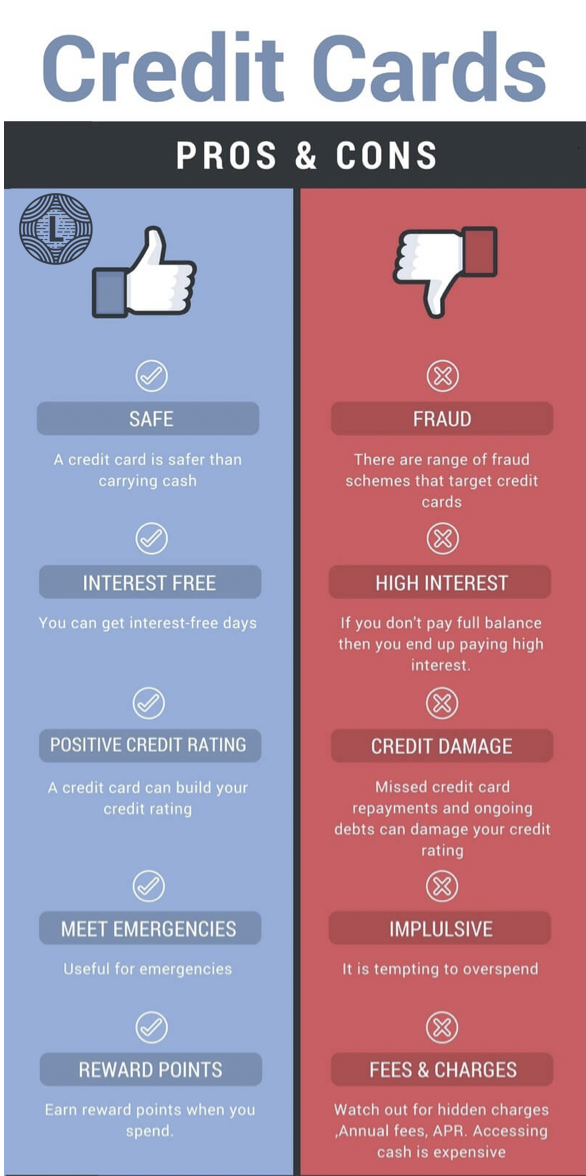

The Advantages Disadvantages Of Credit Cards Hanover Mortgages Convenience. one of the biggest advantages of using a credit card for spending is the ease of use. it’s a lot simpler to keep a card in your wallet than a wad of cash, and you don’t have to. Credit cards can be a convenient way to manage your finances, but they can also be expensive and risky. compare the pros and cons of credit cards to decide whether you should get one. 13 benefits of using a credit card. some of the pros that come with paying on plastic include: a credit card is safer than carrying cash.

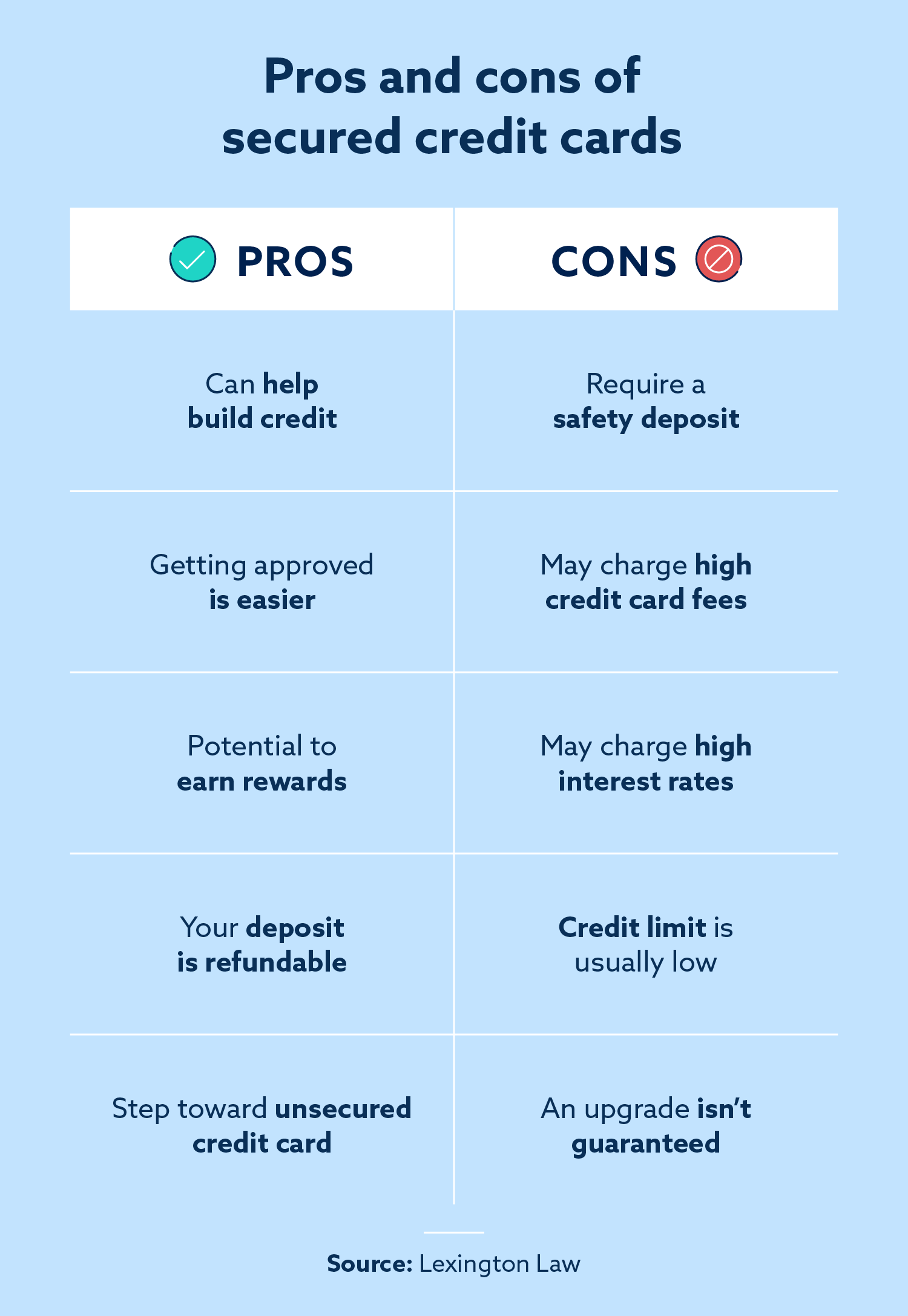

What Are The Pros And Cons Of Secured Credit Cards Hanover Mortgages Pros and cons of credit cards. when used responsibly, the best credit cards come with benefits and convenience — but there are risks, too. check out these advantages and disadvantages of credit. Cons. high interest: credit cards typically have far higher average interest rates than loans and most other financing, so the cost of carrying credit card debt can far outweigh any returns you. The average interest rate on a credit card is more than 20%, according to the federal reserve. "if the card isn't paid in full each month, balances can grow significantly and become more difficult. Credit cards can be a great financial tool, but – as with other financial tools – you need to be aware of their pros and cons. understanding the terms of your credit card agreement, paying your balance on time and carefully managing your spending can help you make the most of your credit card, establish a strong credit history and use your.

Credit Card Pros Cons Youtube The average interest rate on a credit card is more than 20%, according to the federal reserve. "if the card isn't paid in full each month, balances can grow significantly and become more difficult. Credit cards can be a great financial tool, but – as with other financial tools – you need to be aware of their pros and cons. understanding the terms of your credit card agreement, paying your balance on time and carefully managing your spending can help you make the most of your credit card, establish a strong credit history and use your. Credit card pros. credit card cons. can help you build credit if you’re careful about the way you use the card. access to credit could lead to debt and spending beyond your means. may earn rewards. typically need to pay interest if you carry a balance month to month. protection against unauthorized charges. Pros. convenience. credit cards give you purchasing power worldwide — locally and overseas, in stores, online and by phone. many credit cards (especially visa and mastercard cards) are accepted.

Pros And Cons Of Credit Cards Swipe Loanry Credit card pros. credit card cons. can help you build credit if you’re careful about the way you use the card. access to credit could lead to debt and spending beyond your means. may earn rewards. typically need to pay interest if you carry a balance month to month. protection against unauthorized charges. Pros. convenience. credit cards give you purchasing power worldwide — locally and overseas, in stores, online and by phone. many credit cards (especially visa and mastercard cards) are accepted.

Everything You Need To Know About The Pros And Cons Of Credit Cards

Comments are closed.