Ppt Chapter 13 Compound Interest Future Value And Present Value

Ppt Chapter 13 Compound Interest Future Value And Present Value Period 1 = $10,000 x 1.04 = $10,400 find the fv of an investment how to: section 13 1 compound interest and future value. find the fv of an investment how to: section 13 1 compound interest and future value principal = $10,0008% annual interest rate,compounded semi annually find the fv at the end of three years. find the period interest rate: 8. Divide the principal by $100 as you are using table 13 2. [$800 ÷ 100 = 8] find the corresponding value by intersecting the number of days (28) and annual interest rate (7.5%) = 0.5769413 multiply this value by 8 = $4.62 the compounded interest is $4.62.

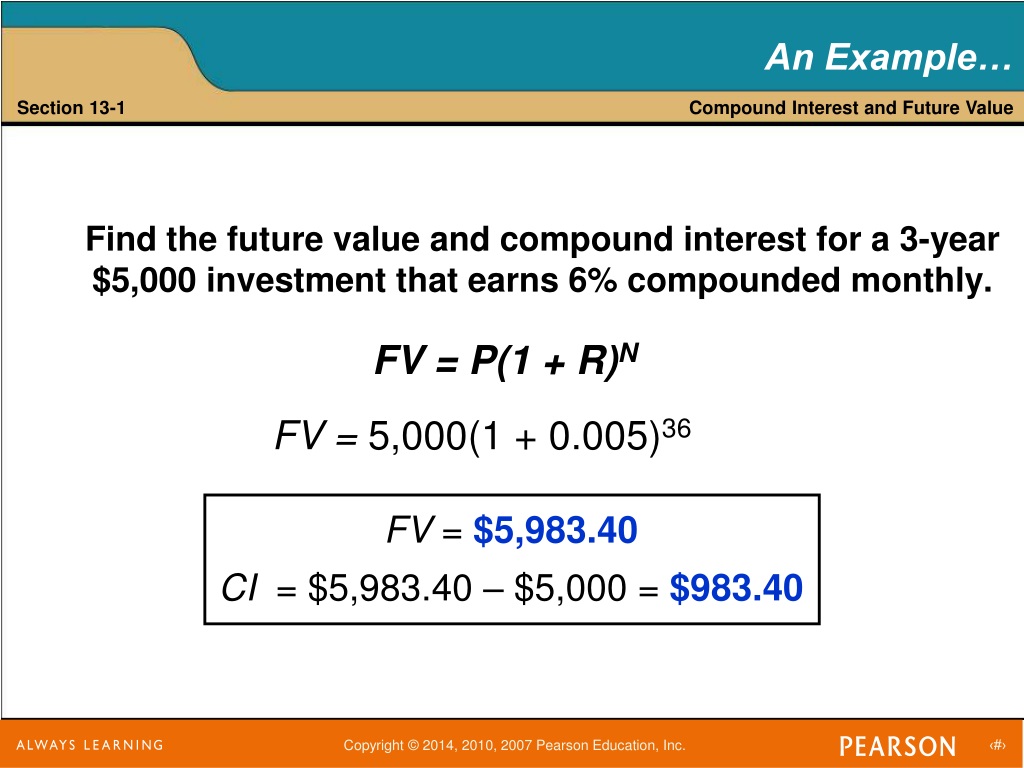

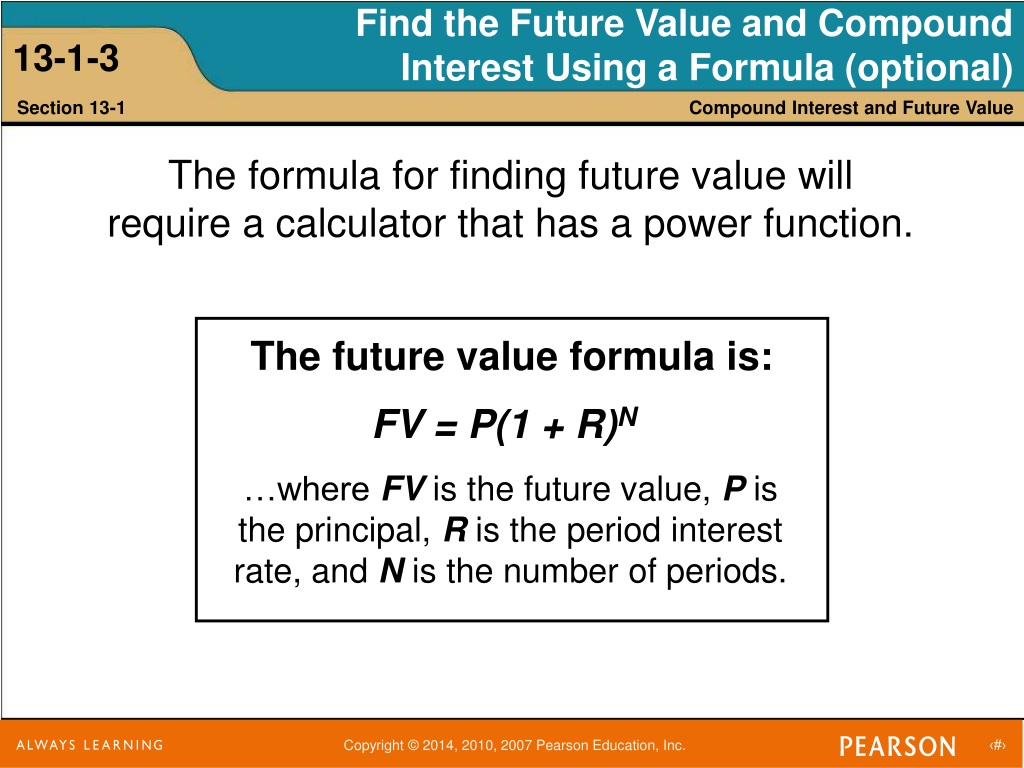

Ppt Chapter 13 Compound Interest Future Value And Present Value How to: find the compound interest section 13 1 compound interest and future value compound interest = future value – original principal first end of year = $800 x 1.13 = $904 second end of year =$904 x 1.13 = $ third end of year = $ x 1.13 = $1,154.32 the fv of this loan is $1, in this example, the compound interest is equal to: ci = $1. Present value • for example, if $1.00 is to be received in one year and the interest rate is 6%, you will have to invest $0.9434 ($1.00 1.06). • thus, $0.9434 is the present value of $1.00 to be received in one year at 6% interest. present value • the general formula for the present value (pv) of a future value (fv) to be received or. Lu 19 1: compound interest (future value) – the big picture. learning unit objectives. lu 19 2: present value the big picture. compare present value (pv) with compound interest (fv). compute present value using algebraic formulas and with a financial calculator. check the present value answer by compounding. 19 2. The compound interest formula can be used to calculate the future value (fv) of an investment given the present value (pv), interest rate per period (i), and number of compounding periods (n). an example calculates that $1500 compounded quarterly at 6.75% annually for 10 years results in a future value of $2929.

Ppt Chapter 13 Compound Interest Future Value And Present Value Lu 19 1: compound interest (future value) – the big picture. learning unit objectives. lu 19 2: present value the big picture. compare present value (pv) with compound interest (fv). compute present value using algebraic formulas and with a financial calculator. check the present value answer by compounding. 19 2. The compound interest formula can be used to calculate the future value (fv) of an investment given the present value (pv), interest rate per period (i), and number of compounding periods (n). an example calculates that $1500 compounded quarterly at 6.75% annually for 10 years results in a future value of $2929. 13.1.5 find the interest compounded daily using a table • table 13 2 gives compound interest for $100 compounded daily (using 365 days as a year.) • pay attention to the table value given. table 13 2 uses $100 as the principal amount; other tables may use $1, $10 or other amounts. 13. 1 find the future value by compounding manually n dividing the annual interest rate by the annual number of interest periods gives us the period interest rate. n 12% annual interest rate divided by 2 interest periods yields a period interest rate of 6%, for example. n using i= p x r x t, we can calculate the interest period, simplifying the.

Comments are closed.