Personal Line Of Credit Vs Credit Card Vs Loan Mortgage Risks And Benefits Explained In 5 Minutes

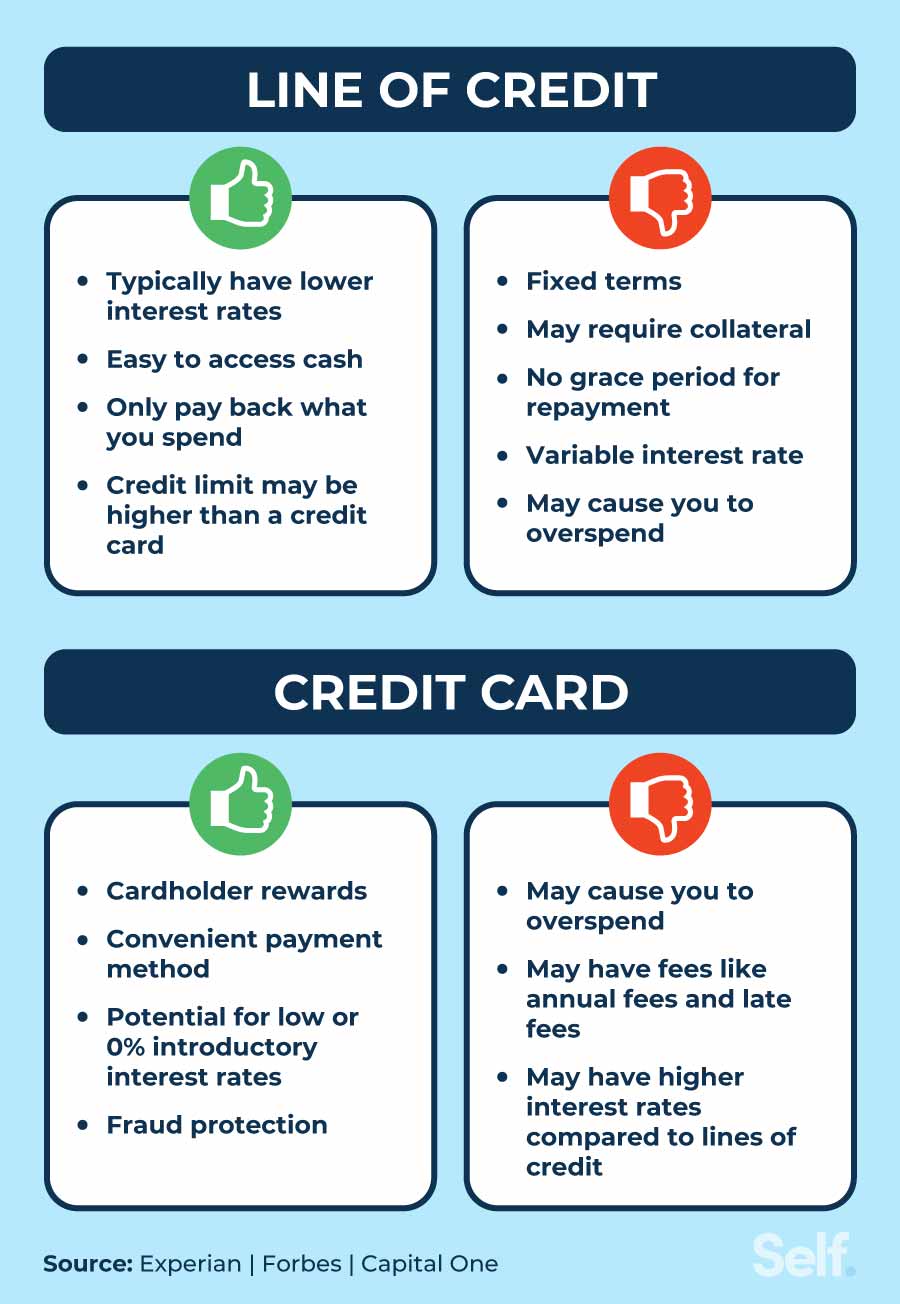

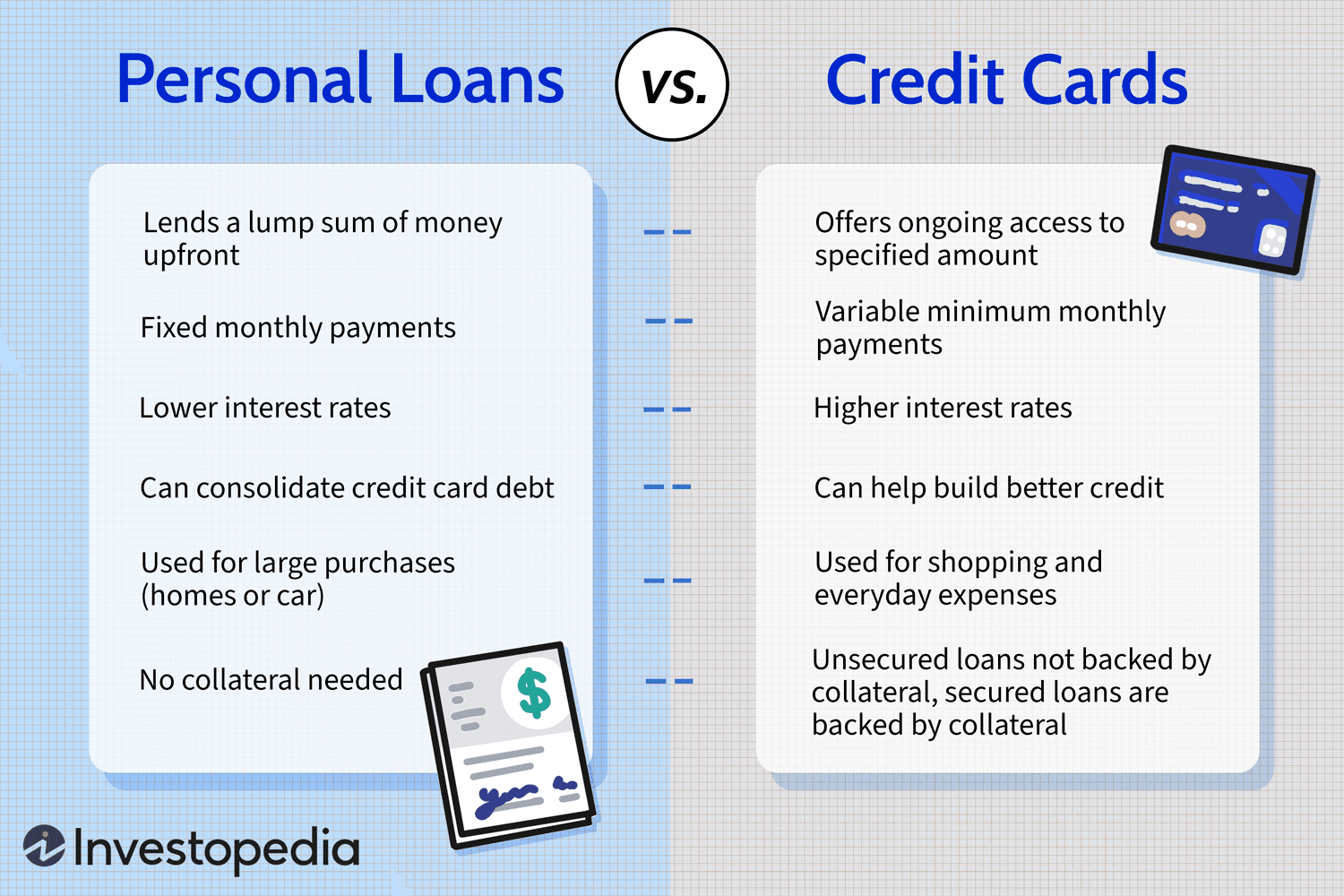

Line Of Credit Vs Credit Card The Key Differences Self Credit Bu Interest rates on personal loans are usually fixed, ranging from 3% to 36%. rates are determined based on your creditworthiness, which means if you have good credit and stable employment, you can. A personal loan is a type of installment loan, and a personal line of credit is a type of revolving credit. with a personal loan, you receive funds as a lump sum and make payments in even.

The Difference Between A Personal Line Of Credit And A Credit ођ When to choose a line of credit vs. a personal loan. depending on your situation, one of the two options might be a better fit than the other. for instance, a line of credit could be a good choice if:. Among your options may be a line of credit and a personal loan. a personal loan provides a lump sum of cash. a line of credit provides funds that you can draw from continuously for a certain period, up to a certain limit. personal loans have fixed interest rates. personal lines of credit have variable ones. Where personal loans and personal lines of credit really begin to differ is in how you receive the funds and repay them. as mentioned, personal loans provide a lump sum, while you can choose how. The difference comes in how you receive your funds. borrowing a personal loan means receiving a lump sum when you are approved, while a personal line of credit functions similarly to a credit card.

юааcreditюаб юааcardюаб юааvsюаб юааpersonalюаб юааloanюаб Whatтащs The юааdifferenceюаб Where personal loans and personal lines of credit really begin to differ is in how you receive the funds and repay them. as mentioned, personal loans provide a lump sum, while you can choose how. The difference comes in how you receive your funds. borrowing a personal loan means receiving a lump sum when you are approved, while a personal line of credit functions similarly to a credit card. Personal loans carry fixed interest rates while personal lines of credit usually have variable rates over time — it'll depend on the change in the prime rate set by the institution lending you. A personal line of credit (ploc) is a loan you use like a credit card. a lender approves you for a specific credit limit, and you draw only what you need and pay interest only on the amount you.

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-loan-and-line-credit-v2-c8a910fad66a476db1a4c013517eefbb.jpg)

Loan Vs Line Of Credit What S The Difference Personal loans carry fixed interest rates while personal lines of credit usually have variable rates over time — it'll depend on the change in the prime rate set by the institution lending you. A personal line of credit (ploc) is a loan you use like a credit card. a lender approves you for a specific credit limit, and you draw only what you need and pay interest only on the amount you.

Personal Loan Vs Line Of Credit Finance Strategists

Comments are closed.