Personal Finance Advice For College Students And Recent Graduates

Personal Finance Advice For College Students And Recent Graduates Many 2021 college graduates will have some student loans to pay off. for the class of 2021, the average student loan debt is $36,900, and the average monthly student loan payment is $433.creating. Even if they’re paying off debt, alex rezzo, a certified financial planner and the founder of andante financial in the los angeles area, urges new grads to start saving for retirement right away.

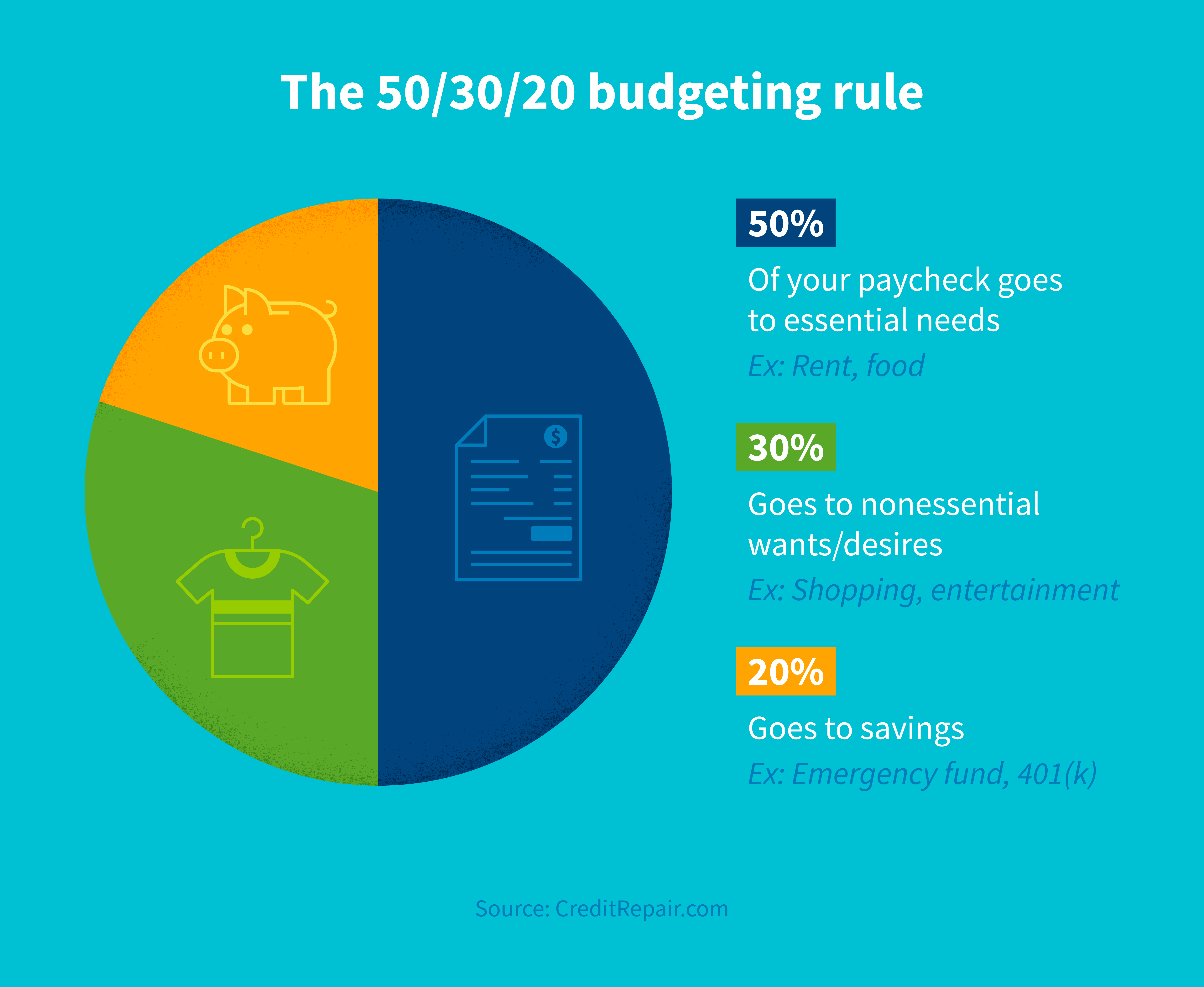

13 Pieces Of Financial Advice For College Graduates Creditrepair Having a bit of a cushion can be beneficial during the school year, especially if things don’t go according to plan with your side gig or part time work. federal direct subsidized and. Here are five first steps you can take now. 1. build a budget you can stick to. the best budgets account for your needs, wants and financial goals. a 50 30 20 budget might be a good place to start. Here are their words of wisdom, personal finance tips, and more for college graduates. saving money tip: save when you can, where you can "when you're just starting out, saving for retirement. 3. build up your credit score. your credit score determines more than just the cards in your wallet. it can also determine how much you pay for a variety of financial tools, from car insurance to.

Recent Graduates Here S Some Financial Advice Financial Advice Here are their words of wisdom, personal finance tips, and more for college graduates. saving money tip: save when you can, where you can "when you're just starting out, saving for retirement. 3. build up your credit score. your credit score determines more than just the cards in your wallet. it can also determine how much you pay for a variety of financial tools, from car insurance to. Spend 50% on needs like rent, groceries and minimum loan payments. spend 30% on splurges like trips, takeout and concert tickets. spend 20% on savings and extra payments on high interest debt. 2. A $1,000 initial investment (graduation gifts!) with additional $100 investments each month for 40 years, earning a not unreasonable 7% rate of return, would add up to $280,000. a check in.

Financial Advice For New College Graduates 3 Focus Areas To Master Spend 50% on needs like rent, groceries and minimum loan payments. spend 30% on splurges like trips, takeout and concert tickets. spend 20% on savings and extra payments on high interest debt. 2. A $1,000 initial investment (graduation gifts!) with additional $100 investments each month for 40 years, earning a not unreasonable 7% rate of return, would add up to $280,000. a check in.

юааfinancialюаб юааadviceюаб юааfor Collegeюаб юааstudentsюаб A Graduateтащs Tips

Comments are closed.