Payment Trends 2024 Berte Melonie

Payment Trends 2024 Berte Melonie Anticipate continued payments industry transformation in 2024, with frontrunners streamlining processes and leveraging defi and ai. iso 20022, upcoming psd3 directives, and increasing payment offerings from bigtechs will all help to accelerate change. technology advancements are on track to revolutionize productivity and enhance data security. Five payment trends to help power your business in 2024 and beyond. february 08, 2024. with so many opportunities and risks amid an uncertain year ahead, forecasting payments, j.p. morgan’s annual payments trends, details five trends for treasury and payments executives to keep top of mind. introduction. building core strength. fortified.

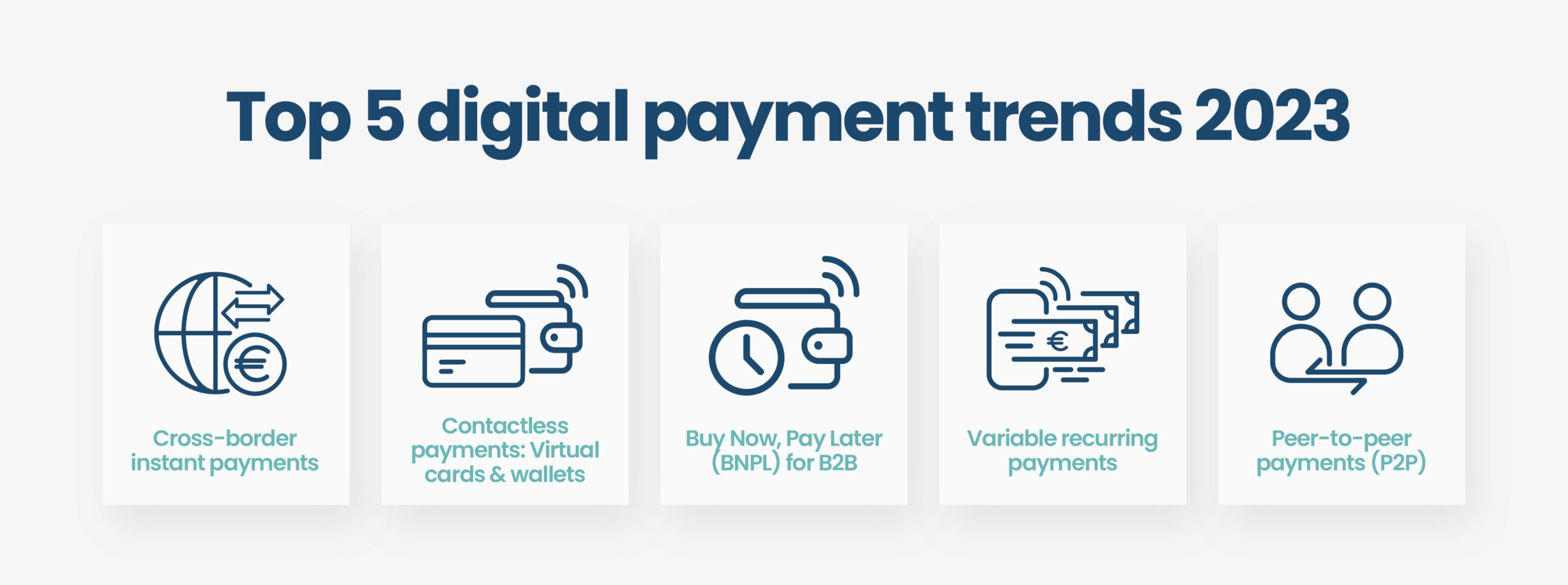

Payment Trends 2024 Berte Melonie The swift adoption of digital payments across consumer and business landscapes has unlocked a wealth of opportunities while also presenting new challenges. in our 2024 payments trends paper, we delve into the fundamental forces shaping the industry’s near to medium term future. from the rise of embedded finance driven by real time payments to. Additional emerging payment trends in 2024. beyond these focal trends, several additional developments are shaping the u.s. payment landscape: real time payments: services like zelle and the clearing house rtp system are gaining traction for their swift and convenient fund transfers. biometric authentication: biometrics, such as fingerprints. Here are three payment trends positioned to boom in 2024, and three that could be a bust. boom: open and secure payment data sharing last year, two significant developments – the fednow launch and the cfpb’s proposed personal financial data rights rule – changed how banks and customers share their payment data. This contrasts payment processing trends in traditionally more ‘mature’ markets, like the uk, where card usage lingers. 2. providing value added services as key differentiators. it will be some time before the psd3 regulations are implemented – but it remains a top payment trend to keep on top of in 2024. its practical implementation.

Payment Trends 2024 Berte Melonie Here are three payment trends positioned to boom in 2024, and three that could be a bust. boom: open and secure payment data sharing last year, two significant developments – the fednow launch and the cfpb’s proposed personal financial data rights rule – changed how banks and customers share their payment data. This contrasts payment processing trends in traditionally more ‘mature’ markets, like the uk, where card usage lingers. 2. providing value added services as key differentiators. it will be some time before the psd3 regulations are implemented – but it remains a top payment trend to keep on top of in 2024. its practical implementation. Global cashless payment volumes are projected to increase by more than 80% by 2025 (pwc), and by 2027 real time payments will account for nearly 28% of all electronic payments globally (aci. Acquiring and merchant services are often thought of as relatively static, but in 2023, that wasn’t the case. “there is likely to be more competition in 2024 and beyond for merchants and other clients to offer solutions in acquiring,” keyes says. bringing account to account payments to instant transfers will also be a trend to watch in 2024.

Payment Trends 2024 Berte Melonie Global cashless payment volumes are projected to increase by more than 80% by 2025 (pwc), and by 2027 real time payments will account for nearly 28% of all electronic payments globally (aci. Acquiring and merchant services are often thought of as relatively static, but in 2023, that wasn’t the case. “there is likely to be more competition in 2024 and beyond for merchants and other clients to offer solutions in acquiring,” keyes says. bringing account to account payments to instant transfers will also be a trend to watch in 2024.

Comments are closed.