Monte Carlo Simulation Var Youtube

Monte Carlo Simulation Of Value At Risk Var In Excel Youtube In today's video we follow on from the monte carlo simulation of a stock portfolio in python and calculate the value at risk (var) and conditional value at r. Learn how to do monte carlo simulation of var (value at risk) in python using geometric brownian motion. we used scipy.stats python package to calculate the.

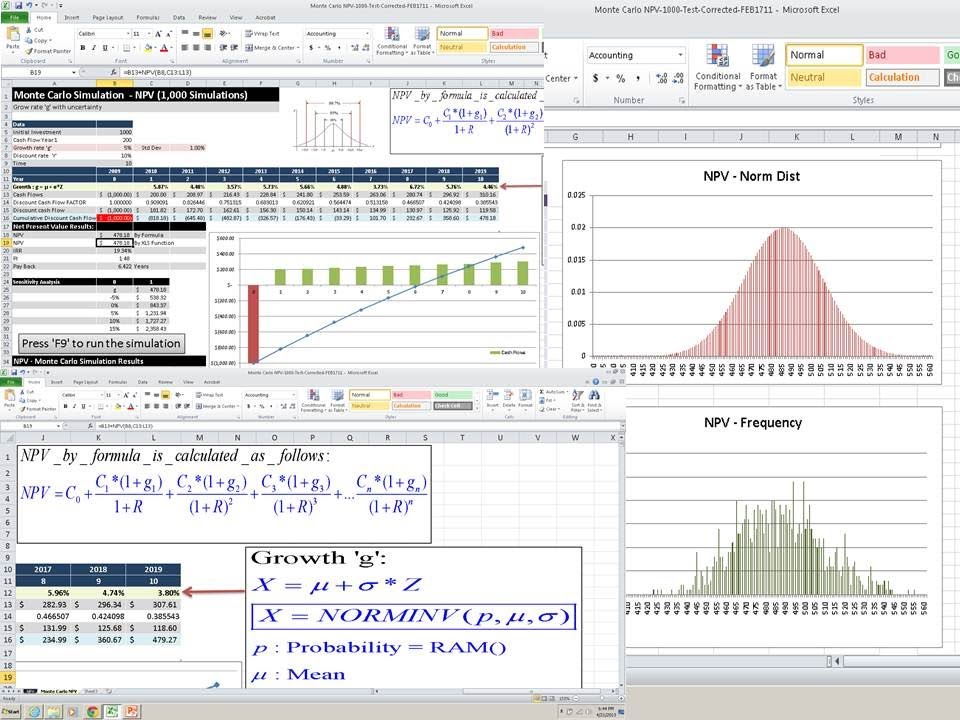

Monte Carlo Simulation Npv Example Youtube #var #valueatrisk #montecarloplease subscribe: subscription center?add user=mjmacartymonte carlo simulation in excel to estimate va. Monte carlo var is a method for calculating value at risk (var) that uses a computational technique called monte carlo simulation to generate random scenarios based on historical data. it is more flexible and can accommodate non linear relationships and correlations between assets compared to other var methods like the variance covariance. There are three methods of calculating value at risk (var) including the historical method, the variance covariance method, and the monte carlo simulation. 1. historical method. Step 1 – determine the time horizon t for our analysis and divide it equally into small time periods, i.e. dt = t n). for illustration, we will compute a monthly var consisting of twenty two trading days. therefore n = 22 days and \delta t δt = 1 day. in order to calculate daily var, one may divide each day per the number of minutes or.

Monte Carlo Simulation Var Youtube There are three methods of calculating value at risk (var) including the historical method, the variance covariance method, and the monte carlo simulation. 1. historical method. Step 1 – determine the time horizon t for our analysis and divide it equally into small time periods, i.e. dt = t n). for illustration, we will compute a monthly var consisting of twenty two trading days. therefore n = 22 days and \delta t δt = 1 day. in order to calculate daily var, one may divide each day per the number of minutes or. 90% eurvalue at risk. do your calculations three times, using sample sizes m of 100, 1000, and 10,000. compare your results for the different sample sizes, and compare them with the corresponding results you obtained for exercise 10.3. solution. monte carlo value at risk: numerical transformations based upon the monte carlo method were applied. Step 2: create rows for your trials or iterations. step 3: generate your random value variables. step 4: verify your values. step 5: visualize your monte carlo simulation results. using other monte carlo simulation distribution types in excel. limitations of monte carlo simulations in excel. excel add ins for working with data.

Monte Carlo Simulation In Trading Youtube 90% eurvalue at risk. do your calculations three times, using sample sizes m of 100, 1000, and 10,000. compare your results for the different sample sizes, and compare them with the corresponding results you obtained for exercise 10.3. solution. monte carlo value at risk: numerical transformations based upon the monte carlo method were applied. Step 2: create rows for your trials or iterations. step 3: generate your random value variables. step 4: verify your values. step 5: visualize your monte carlo simulation results. using other monte carlo simulation distribution types in excel. limitations of monte carlo simulations in excel. excel add ins for working with data.

Comments are closed.