Monetizing Voluntary Carbon Emission Reductions

Reducing The Council S Carbon Emissions Horsham District Council Demand for carbon credits and carbon monetization may grow to 15 times its current level by 2030, and 100 times by 2050. voluntary offset transactions that totaled about $320 million in 2019 may approach $200 billion in 2050. 1. trading on carbon isn’t the only way to find value. consumers reward companies that pursue decarbonization in their. The lse has stated that the voluntary carbon market designation would provide three benefits: (1) increasing financing for emissions reduction activities, (2) increasing transparency and regulatory frameworks for the global voluntary carbon market, and (3) enabling companies and investors to access a market for purchasing carbon credits.

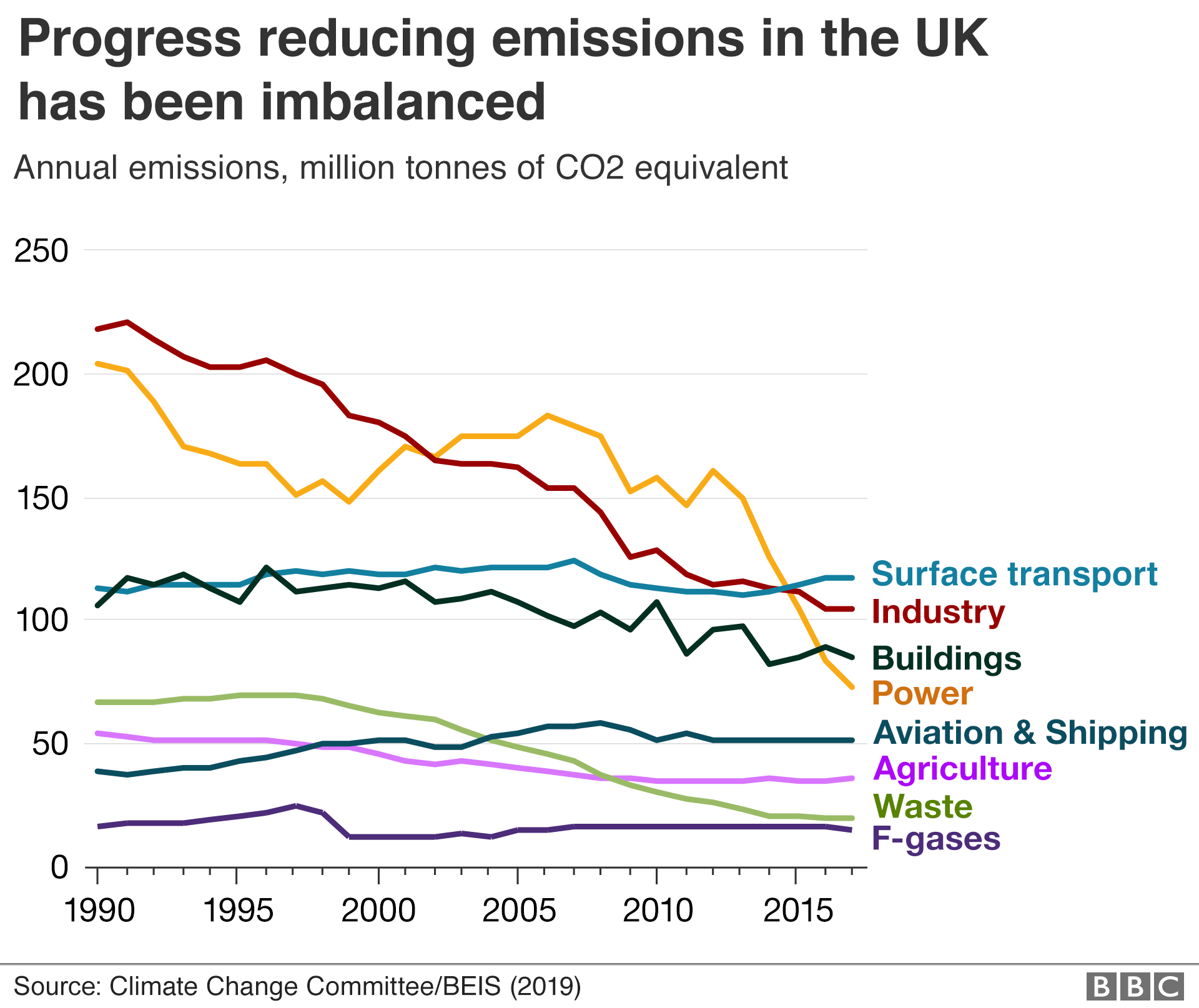

Climate Change Uk Can T Go Climate Neutral Before 2050 Bbc News These emission reductions payment agreements, or erpas, can also help developing countries build a track record of generating and selling carbon credits or applying them to their own emission reductions targets. over the last two decades, the world bank has made $2 billion in emission reduction payments through more than 200 erpas in 65. A blueprint for scaling voluntary carbon markets to meet the climate challenge. the trading of carbon credits can help companies—and the world— meet ambitious goals for reducing greenhouse gas emissions. here is what it would take to strengthen voluntary carbon markets so they can support climate action on a large scale. This is a meaningful difference, illustrating the dual role voluntary carbon credits can play in addressing climate change: in the short term, voluntary carbon credits from projects focused on emissions avoidance reduction can help accelerate the transition to a decarbonized global economy, for example by driving investment into renewable. These emission reduction credits are also in alignment with article 6 of the paris agreement. countries can trade them as internationally transferred mitigation outcomes in international carbon markets that are governed by the rules of the paris agreement, as well as in voluntary carbon markets. critically, rbcf helps build technical capacity.

Sustainable Management Of Co2 This is a meaningful difference, illustrating the dual role voluntary carbon credits can play in addressing climate change: in the short term, voluntary carbon credits from projects focused on emissions avoidance reduction can help accelerate the transition to a decarbonized global economy, for example by driving investment into renewable. These emission reduction credits are also in alignment with article 6 of the paris agreement. countries can trade them as internationally transferred mitigation outcomes in international carbon markets that are governed by the rules of the paris agreement, as well as in voluntary carbon markets. critically, rbcf helps build technical capacity. Carbon markets are a critical tool in corporate emission reduction efforts. the voluntary carbon market needs to grow more than 15 fold by 2030 to support the investment required to deliver the 1.5°c pathway. the taskforce for scaling voluntary carbon markets has released its blueprint for creating large scale carbon credit trading markets. The world needs to reduce emissions fast to keep within 1.5˚c. the science tells us we need to cut global emissions in half by 2030 to be on a pathway to net zero by 2050. it also tells us that one third of cost effective emissions reductions required by 2030 (up to 10gt per year) can be delivered through natural climate solutions (ncs), which.

Comments are closed.