Maximum Simple Ira Match 2024 Lola Sibbie

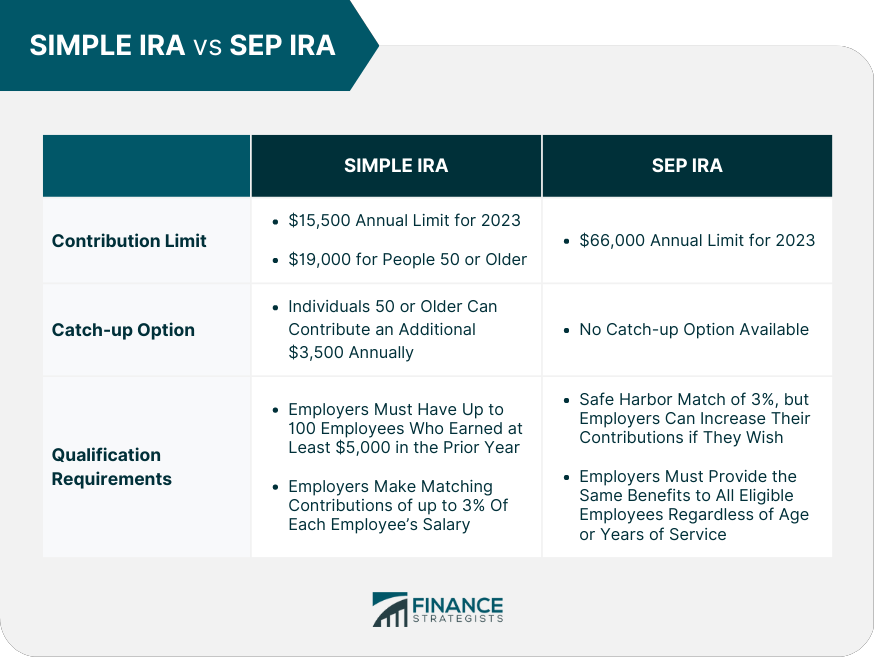

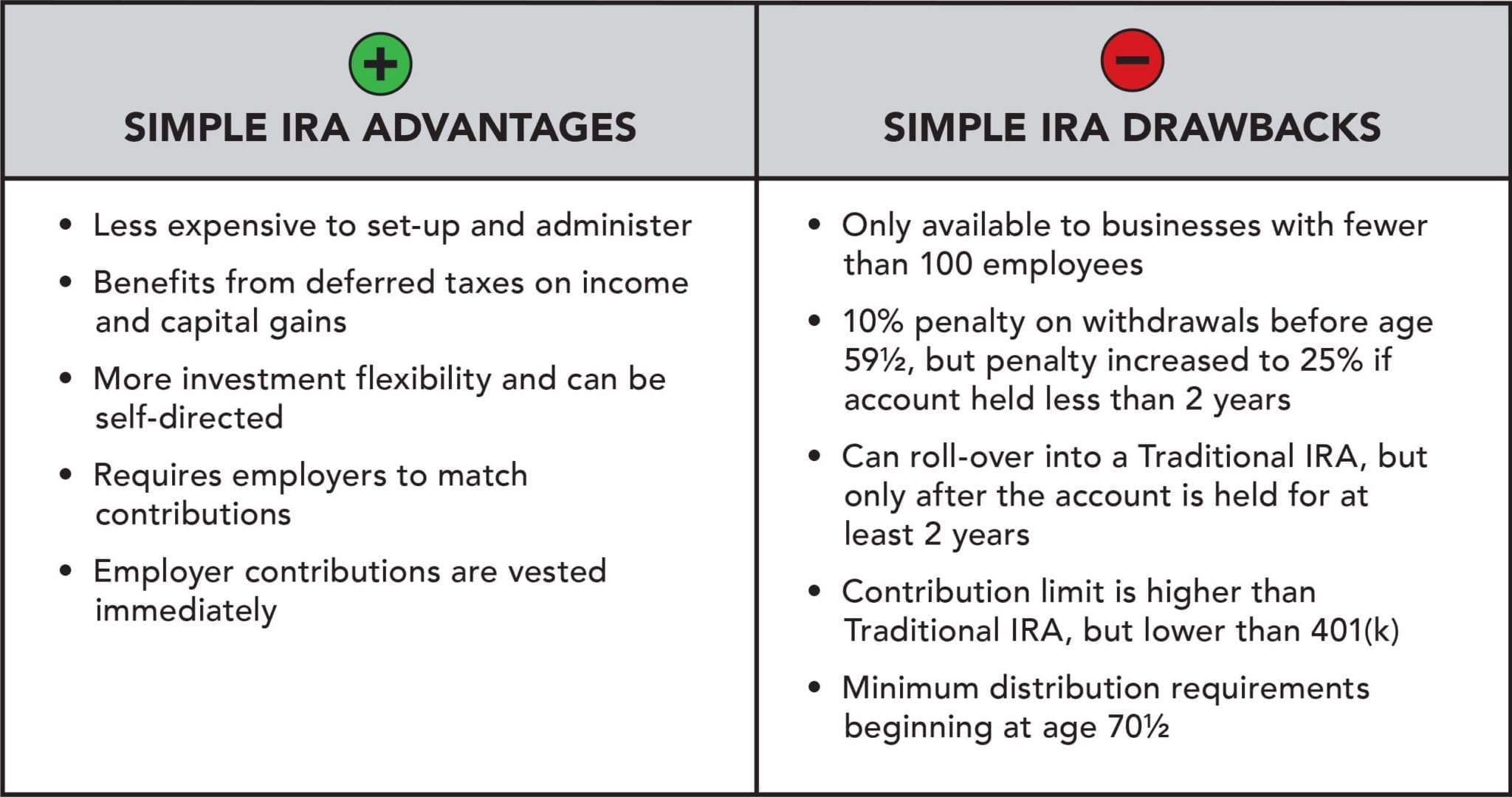

Maximum Simple Ira Match 2024 Lola Sibbie The catch up contribution limit for simple ira plans is $3,500 in 2023 and 2024 ($3,000 in 2015 2022). employer matching contributions the employer is generally required to match each employee's salary reduction contributions on a dollar for dollar basis up to 3% of the employee's compensation. For 2024, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2023. workers age 50 or older can make additional catch up contributions of $3,500, for a total of $19,500.

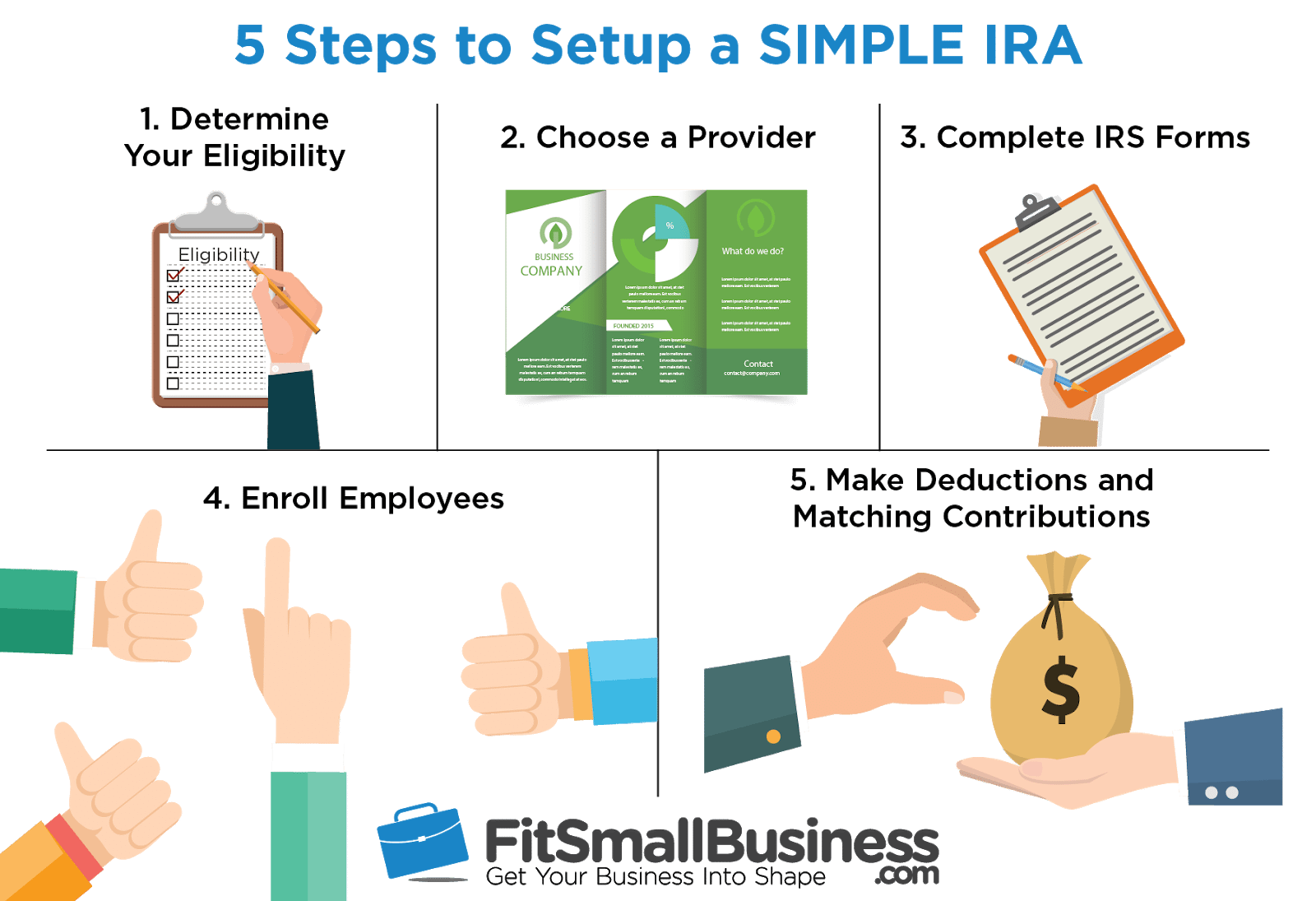

Simple Ira Matching Rules 2024 Star Anallese A simple ira plan provides small employers with a simplified method to contribute toward their employees' and their own retirement savings. employees may choose to make salary reduction contributions and the employer is required to make either matching or nonelective contributions. contributions are made to an individual retirement account or. The maximum simple ira employee contribution limit is $16,000 in 2024 (an increase from $15,500 in 2023). employees who are 50 or older are also eligible to make additional catch up contributions. The 2024 simple ira contribution limit for employees is $16,000. that's up from the 2023 limit of $15,500. catch up contributions for those age 50 and older remain the same for both years at $3,500. Yes, simple ira limits are lower than 401 (k) limits. the 2024 contribution limit for simple iras is $16,000, with an additional $3,500 catch up contribution for savers 50 or older. the 2024.

Simple Ira Limits 2024 And 2024 Dolli Gabriel The 2024 simple ira contribution limit for employees is $16,000. that's up from the 2023 limit of $15,500. catch up contributions for those age 50 and older remain the same for both years at $3,500. Yes, simple ira limits are lower than 401 (k) limits. the 2024 contribution limit for simple iras is $16,000, with an additional $3,500 catch up contribution for savers 50 or older. the 2024. Key points. you can contribute up to $16,000 to a simple ira in 2024, up from $15,500 in 2023. workers 50 and older can make an additional $3,500 catch up contribution. employers can either. The most employees can contribute to simple iras in 2023 is $15,500, with an additional $3,500 catch up contribution for those age 50 and older. in 2024, the simple ira employee contribution limit increases to $16,000, with an additional $3,500 catch up contribution for those age 50 and older. employers may contribute either a flat 2% of your.

Simple Ira Limits 2024 Winni Karilynn Key points. you can contribute up to $16,000 to a simple ira in 2024, up from $15,500 in 2023. workers 50 and older can make an additional $3,500 catch up contribution. employers can either. The most employees can contribute to simple iras in 2023 is $15,500, with an additional $3,500 catch up contribution for those age 50 and older. in 2024, the simple ira employee contribution limit increases to $16,000, with an additional $3,500 catch up contribution for those age 50 and older. employers may contribute either a flat 2% of your.

Maximum Simple Ira Contribution 2024 Over 50 Lelah Natasha

Comments are closed.