Master Class Calculating Value At Risk Var Final Steps

Value At Risk Definition How It Works History And Methods Of Value at risk (var) = λ × z value of standard normal cumulative distribution corresponding with a specified confidence level. for example for a confidence level of 99% the z value is 2.326 (excel’s function ‘normsinv (.99) may be used to determine the z value) and the. and the daily value at risk (var)=2.326 λ. Two detailed step by step walkthrough (s) are presented that show you how to calculate value at risk (var) in excel using the variance co variance (vcv) approach as well as the historical simulation approach. the last section looks at known issues in value at risk (var) calculations and results, including the most recent challenges to var from.

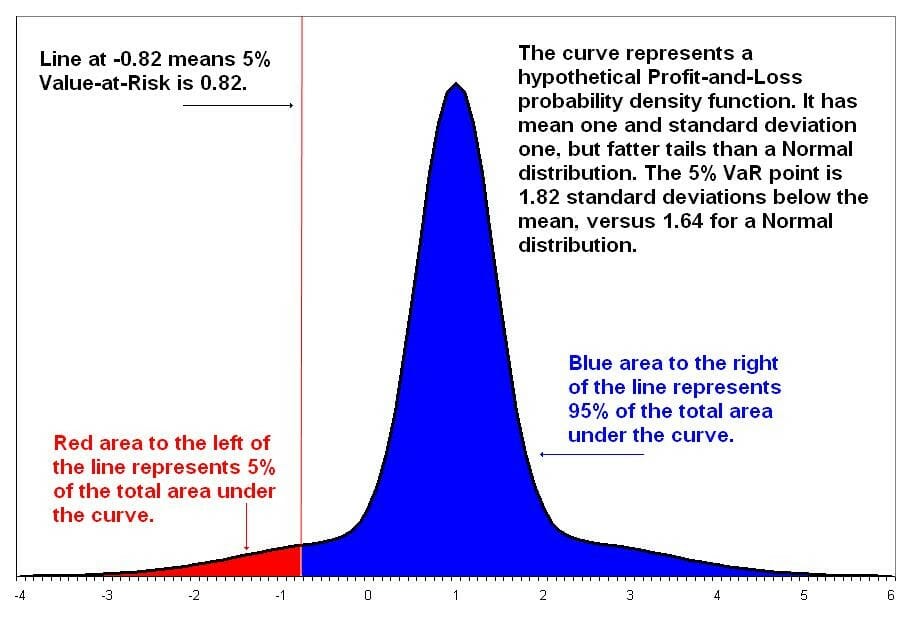

Master Class Calculating Value At Risk Var Final Steps Implementing value at risk (var) the objective of a value at risk (var) implementation is to perform daily var analysis of positions within a portfolio. such a process would be the first step in shifting the current emphasis from calculating var to managing var. within the process the focus should be on: positions with low coverage levels. Methodology: using volatility to estimate value at risk. the variance of the daily ipc returns between 1 95 and 12 96 was 0.000324. the standard deviation was 0.018012 or 1.8012%. 2.33 * 1.8012% = 0.041968 or 4.1968%. we can conclude that we could expect to lose no more than 4.1968% of the value of our position, 99% of the time. In its most general form, the value at risk measures the potential loss in value of. risky asset or portfolio over a defined period for a given confidence interval. thus, if the var on an asset is $ 100 million at a one week, 95% confidence level, there is a only. 5% chance that the value of the asset will drop more than $ 100 million over any. Var. value at risk is a statistical metric to compute a portfolio's risk. it displays the highest possible loss and a given confidence level. it considers the market price and the volatility in a given time frame. investors, analysts, and regulators widely use var to measure the risks in their portfolios.

Value At Risk Learn About Assessing And Calculating Var In its most general form, the value at risk measures the potential loss in value of. risky asset or portfolio over a defined period for a given confidence interval. thus, if the var on an asset is $ 100 million at a one week, 95% confidence level, there is a only. 5% chance that the value of the asset will drop more than $ 100 million over any. Var. value at risk is a statistical metric to compute a portfolio's risk. it displays the highest possible loss and a given confidence level. it considers the market price and the volatility in a given time frame. investors, analysts, and regulators widely use var to measure the risks in their portfolios. The calculation of value at risk (var) for a portfolio can be complex, especially for large numbers of positions. this video shows how the calculation is per. Value at risk (var) is a risk management used to estimate the maximum potential loss within a specified time frame and confidence level. it is commonly employed to assess and manage risk exposure in institutional portfolios. var is determined by three factors a specific percentage or value of the loss, the period over which risk is evaluated.

Calculating Value At Risk Approach Specific Steps The calculation of value at risk (var) for a portfolio can be complex, especially for large numbers of positions. this video shows how the calculation is per. Value at risk (var) is a risk management used to estimate the maximum potential loss within a specified time frame and confidence level. it is commonly employed to assess and manage risk exposure in institutional portfolios. var is determined by three factors a specific percentage or value of the loss, the period over which risk is evaluated.

Comments are closed.