Life Insurance Types Explained Term Life Whole Life Universal Lifeо

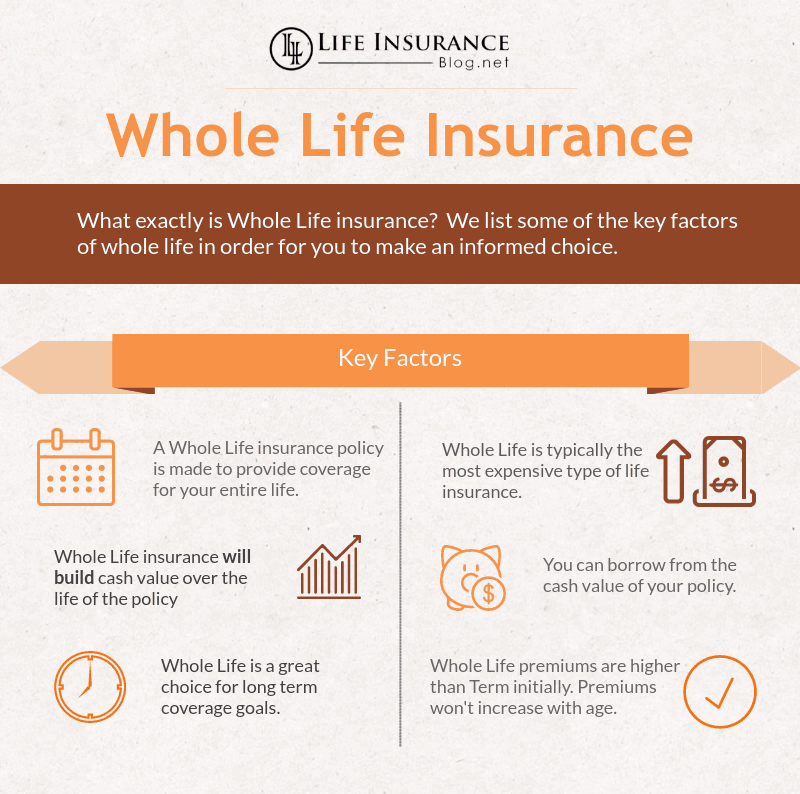

Life Insurance Types Explained Term Life Whole Life Whole life insurance is a permanent life insurance policy that has a fixed premium and death benefit. the cash value within a whole life insurance policy builds at a fixed interest rate, such as 2. Life insurance policy types can be put into two main buckets: term life and cash value life insurance. one of the choices for cash value life insurance is whole life insurance. knowing the main.

Term Life Insurance Vs Whole And Universal Life Insurance Universal life (ul) and whole life are two types of permanent life insurance. their differences include the fact that universal life policies provide flexible premiums and death benefits but have. Whole life is the more expensive, but predictable, permanent life insurance option. universal life, by contrast, gives you more flexibility in your premium, but may not provide as much of a return. The best type of life insurance for you will depend on your coverage needs and budget. here’s everything you need to know about the most popular types of life insurance policies, including how they work, pros and cons, how long they last, and who they’re best for. term life insurance. whole life insurance. universal life insurance. There are two primary differences between term life insurance and whole life insurance: how long coverage lasts. whether the policy has a cash value account. term life insurance locks in rates and.

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

юааtermюаб Vs юааwholeюаб юааlifeюаб юааinsuranceюаб Whatтащs The Difference The best type of life insurance for you will depend on your coverage needs and budget. here’s everything you need to know about the most popular types of life insurance policies, including how they work, pros and cons, how long they last, and who they’re best for. term life insurance. whole life insurance. universal life insurance. There are two primary differences between term life insurance and whole life insurance: how long coverage lasts. whether the policy has a cash value account. term life insurance locks in rates and. Term life insurance has relatively low premiums for coverage that lasts a set amount of time, usually 10, 20 or 30 years. whole life insurance tends to cost more, but policies typically last your. Term coverage only protects you for a limited number of years, while whole life provides lifelong protection—as long as you keep up with the premium payments. term life is just insurance.

Comments are closed.