Life Insurance Taxation вђ The Definitive Guide

Life Insurance Taxation The Definitive Guide In a permanent life insurance policy – which can include whole life, universal life, variable life, variable universal life, and indexed universal life coverage – the cash value is allowed to grow on a tax deferred basis. this means that there is no tax due on the gain that takes place unless or until it is withdrawn. The graph below shows a 40 year old male non smoker buying $100,000 of whole life insurance for $2,103 year. at age 56, the cash value (red line) crosses the acb (yellow line). this is when he needs to start paying tax on withdrawals. the acb increases until age 70 when ncpi (blue line) becomes greater than the premium (green line).

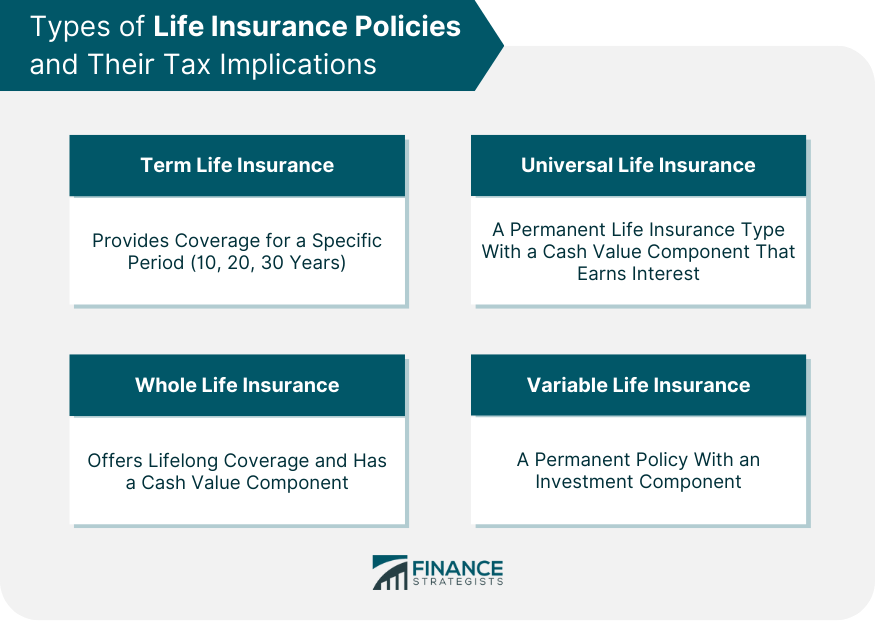

Is Life Insurance Taxable Finance Strategists Key takeaways. under most circumstances you don’t pay a sales tax on life insurance premiums. however, states typically charge insurers a tax on the premiums they collect. you cannot deduct life. You’ll be taxed on the amount you received minus the policy basis, or the total premium payment you made on the policy. this taxable amount reflects the investment gains that you took out. say. Yes, for the amount above the premiums paid. policy loans. yes, under specific circumstances. selling the life insurance policy. yes. here are a few key aspects: death benefit payouts: generally, the lump sum paid to beneficiaries upon the death of the insured is not considered taxable income. Do beneficiaries pay taxes on life insurance? whether you own a policy or are a beneficiary, here's what you should know about taxes on death benefits.

Comments are closed.