Life Insurance Tax Benefits In India Eligibility Criteria

Life Insurance Tax Benefits In India 2024 Policybachat The income tax act of 1961 lists specific fixed eligibility criteria for claiming term insurance tax benefits. any individual seeking term insurance tax benefits must fulfil the following requirements: any individual seeking to avail of the term insurance tax benefits in india must be an indian individual or a hindu undivided family (huf). Phase 1: entry advantage. in this stage, you are eligible for tax deductions under sections 80c, 80ccc and 80d of the income tax act. section 80c is for life insurance, 80ccc is for pension plans, and 80d is for health insurance. phase 2: earnings advantage. your investment in the life insurance policy will grow over time and is tax free.

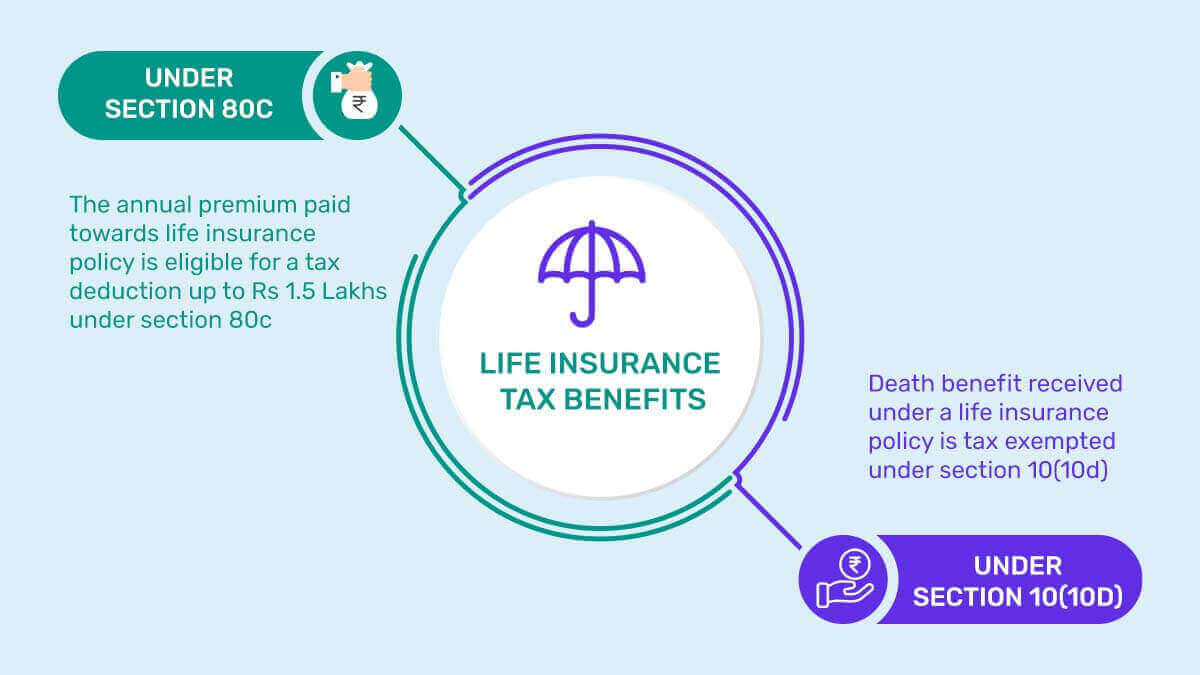

Life Insurance Tax Benefits In India Eligibility Criteria Eligibility criteria to claim term insurance tax benefit. in india, to claim tax benefits on life insurance premiums under section 80c of the income tax act, 1961, certain eligibility criteria must be met. policy ownership: the policyholder must be an individual taxpayer or a hindu undivided family (huf). only policies owned by the taxpayer or. The annual premium for your term plan should not exceed 10% of the sum assured. if the annual premium exceeds 10% of the sum assured, tax benefits will be applied proportionately. for example, if your annual premium on ₹1 crore term plan is ₹12 lakh, then you can claim a tax deduction of only ₹10 lakh amount under section 80c. The deduction available under section 80c of the income tax act, 1961 is a key tax advantage provided by life insurance in india. this provision permits individuals to deduct the premium paid towards life insurance policies. in a financial year, the highest permissible deduction limit under section 80c is ₹1.5 lakh. The insurance company is liable to deduct tax at 5% of the income component of the payment, before releasing the payment to the taxpayer. here, the tds would be on the net maturity proceeds i.e., on rs 65,000 (1,10,000 45,000). the tds would be 5% on rs 65,000 amounting to rs 3,250.

Life Insurance Tax Benefits Options In India Hdfc Life The deduction available under section 80c of the income tax act, 1961 is a key tax advantage provided by life insurance in india. this provision permits individuals to deduct the premium paid towards life insurance policies. in a financial year, the highest permissible deduction limit under section 80c is ₹1.5 lakh. The insurance company is liable to deduct tax at 5% of the income component of the payment, before releasing the payment to the taxpayer. here, the tds would be on the net maturity proceeds i.e., on rs 65,000 (1,10,000 45,000). the tds would be 5% on rs 65,000 amounting to rs 3,250. 1) deduction allowable from income for payment of life insurance premium (section 80c) * (a) life insurance premia paid in order to effect or to keep in force an insurance on the life of the assessee or on the life of the spouse or any child of assessee & in the case of huf, premium paid on the life of any member thereof under an insurance. As per the latest amendment, the maturity benefit of ulips issued after february 1, 2023, will only qualify for the section 10 (10d) tax exemption if the annual premium paid does not exceed ₹2.5 lakhs. section 10 (10d) provision ensures that the payouts received from a life insurance policy are exempt from tax and subject to certain conditions.

Comments are closed.