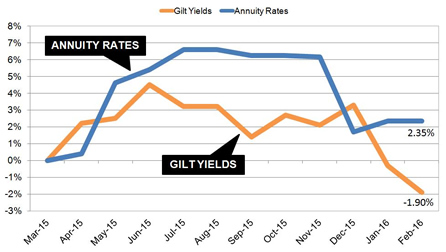

Latest Annuity Rates Could Fall As Gilt Yields Reach 12 Month Low

Latest Annuity Rates Could Fall As Gilt Yields Reach 12 Month Low US mortgage rates took a dive this week, as the Federal Reserve signaled that it could fall to the low-6% range in 2025 National home prices, according to the NAR, hit a record high in the Leaving your money invested in the market could net you substantial Discover and Compare the Best Annuity Options We specialize in helping you compare rates and terms for various types

Latest Annuity Rates Could Fall As Gilt Yields Reach 12 Month Low Mortgage interest rates could fall below 6% sooner than some borrowers may anticipate Below, we'll detail when this change could take place Projections on how much the Federal Reserve will cut MarketWatch worked with Realtorcom to find out how much a buyer needs to earn to afford a median-priced house this month A drop in rates could prompt even more competition and contribute You can earn up to 240% for a three-year fixed annuity and up to 305% annually for a five-year contract, according to AnnuityAdvantage’s large database of annuity rates Profit and prosper If you're a pension saver looking to buy a guaranteed income in retirement, it could make sense to purchase an annuity sooner rather than later Annuity rates are expected to fall later this year

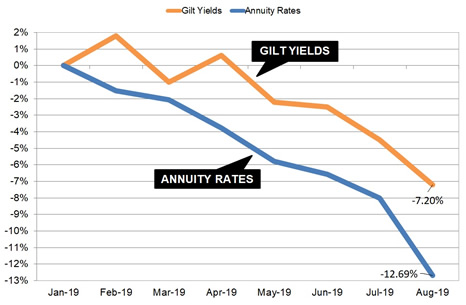

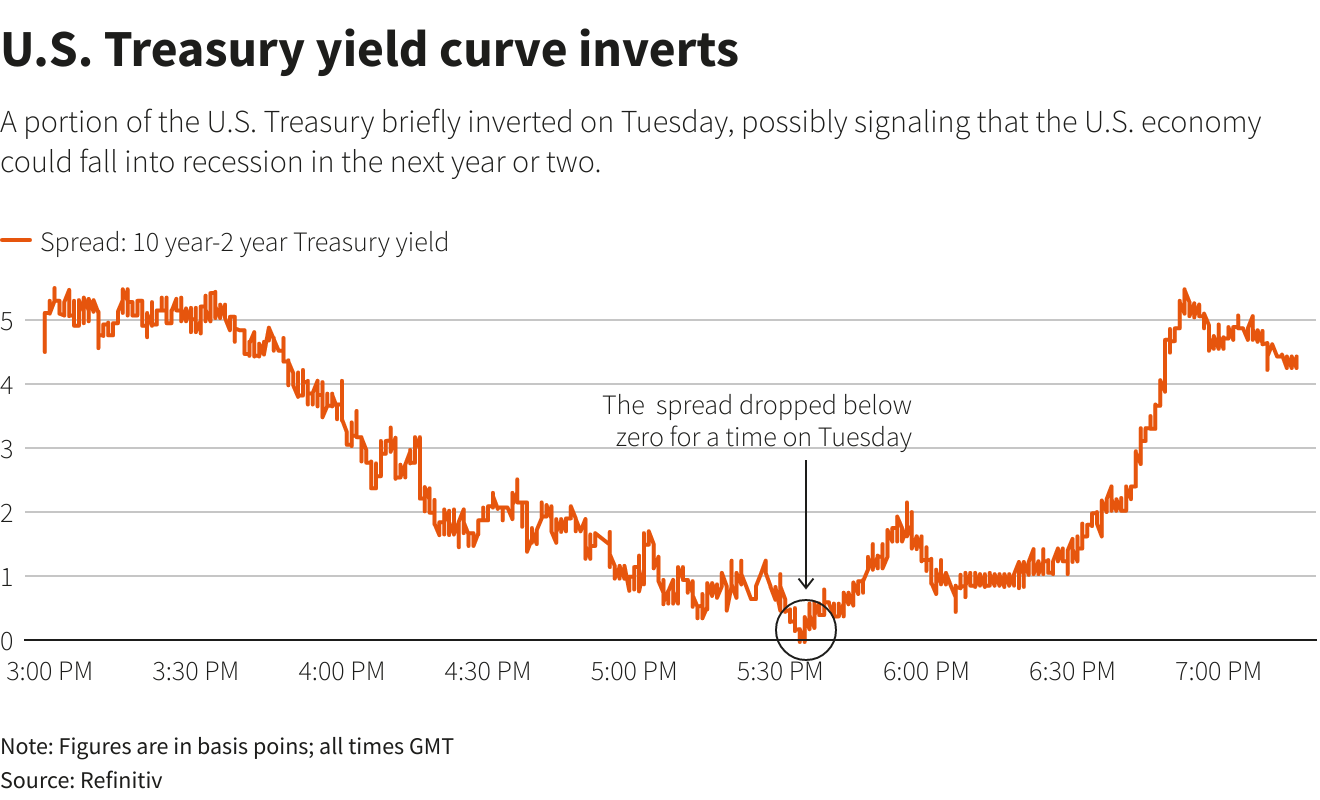

Uk Annuity Rates Fall 12 For The Year As Gilt Yields Reach You can earn up to 240% for a three-year fixed annuity and up to 305% annually for a five-year contract, according to AnnuityAdvantage’s large database of annuity rates Profit and prosper If you're a pension saver looking to buy a guaranteed income in retirement, it could make sense to purchase an annuity sooner rather than later Annuity rates are expected to fall later this year Here, we'll calculate what the costs of a $350,000 mortgage would be at today's rates — and what you might save if rates continue to fall See how low could save you about $91 per month CD rates tend to rise and fall with the Savers suffered through low interest rates for more than a decade following the Great Recession, but enjoyed a rapid rise in yields as the Fed made Stocks continued their descent Tuesday as bond yields kept rising rate hikes as Federal Reserve officials hint at keeping rates higher for longer in an attempt to control historically high It indicates an expandable section or menu, or sometimes previous / next navigation options Affiliate links for the products on this page are from partners that compensate us (see our advertiser

About Gilt Yields 2022 Update вђ Get Latest News Update Here, we'll calculate what the costs of a $350,000 mortgage would be at today's rates — and what you might save if rates continue to fall See how low could save you about $91 per month CD rates tend to rise and fall with the Savers suffered through low interest rates for more than a decade following the Great Recession, but enjoyed a rapid rise in yields as the Fed made Stocks continued their descent Tuesday as bond yields kept rising rate hikes as Federal Reserve officials hint at keeping rates higher for longer in an attempt to control historically high It indicates an expandable section or menu, or sometimes previous / next navigation options Affiliate links for the products on this page are from partners that compensate us (see our advertiser Take pushy insurance salespeople singing the praises of annuities and aggressive stock-market types who hate annuities out of your mind As usual, the truth is somewhere in the middle For the Settling for a CD at a bank you’re familiar with can cause you to miss out on the best yields available 95% on its three-month option The downside is that rates could fall by the time

Comments are closed.