Know Your Customer Process

Know Your Customer Kyc Process Guide For Banking Processmaker Learn what kyc is, why it is important, and how it works in the financial industry. this guide covers the key components, steps, and regulations of the kyc process, as well as the types of kyc documents and solutions. Learn what kyc is, why it is important, and how it works for financial institutions. find out the key components, procedures, and technologies of kyc, as well as the challenges and penalties for non compliance.

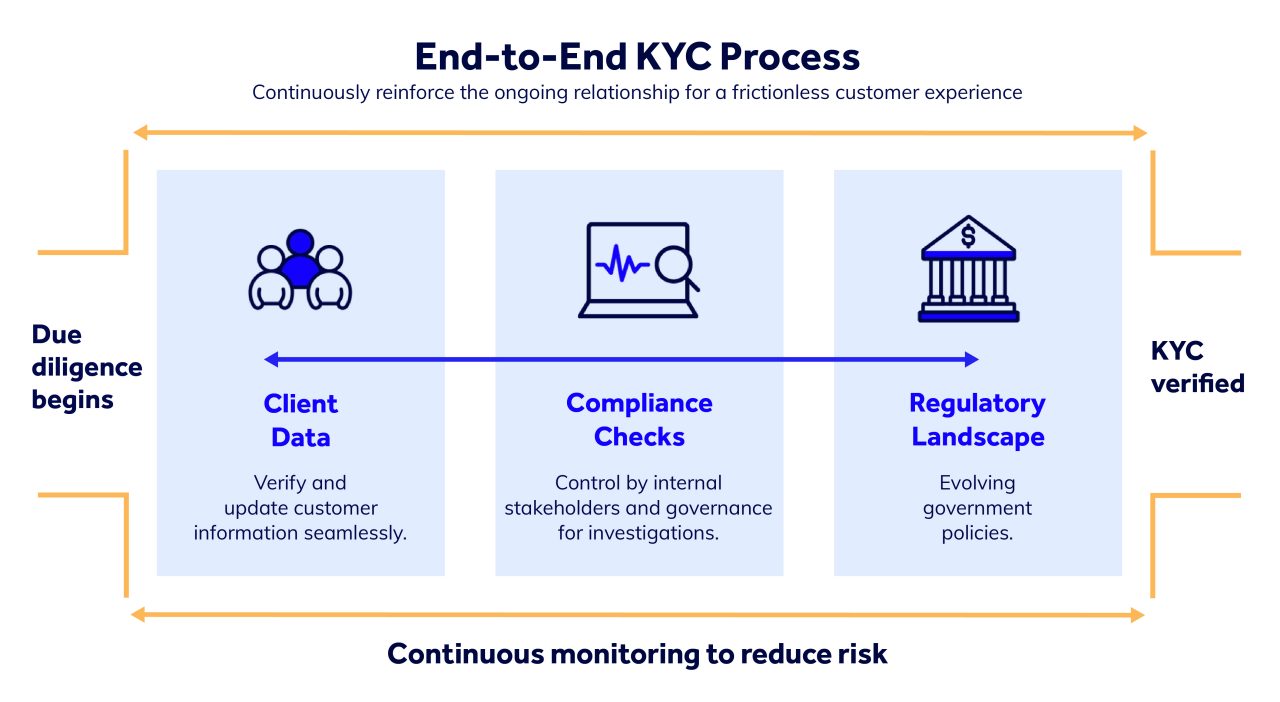

Kyc Process The Complete Guide Appian Kyc is a set of guidelines to verify the identity, suitability, and risks of a customer. it consists of three steps: customer identification, customer due diligence, and enhanced due diligence. Learn what kyc is, why it is important, and how it works for financial and non financial organizations. find out the four main components of kyc and the countries that have kyc laws and regulations. Learn how to implement a holistic and continuous kyc process to prevent financial crime and improve customer experience. the guide covers the basics, steps, and challenges of kyc, as well as the benefits of automation and digital transformation. A risk based approach. the rise of the kyc registries. kyc, or "know your customer", is a set of processes that allow banks and other financial institutions to confirm the identity of the organisations and individuals they do business with, and ensures those entities are acting legally. effective kyc protects companies from doing business with.

Comments are closed.