Is A Consumer Report A Credit Check

Consumer Credit Reports Explained Centrix A credit report is a file of your credit history, while an investigative consumer report is a file of your personal information. learn the differences, uses, and rights of both types of reports under the fair credit reporting act. Be sure to check before you apply for credit, a loan, insurance, or a job. if you find mistakes on your credit report, contact the credit bureaus and the business that supplied the information to get the mistakes removed from your report. check to help spot identity theft. mistakes on your credit report might be a sign of identity theft.

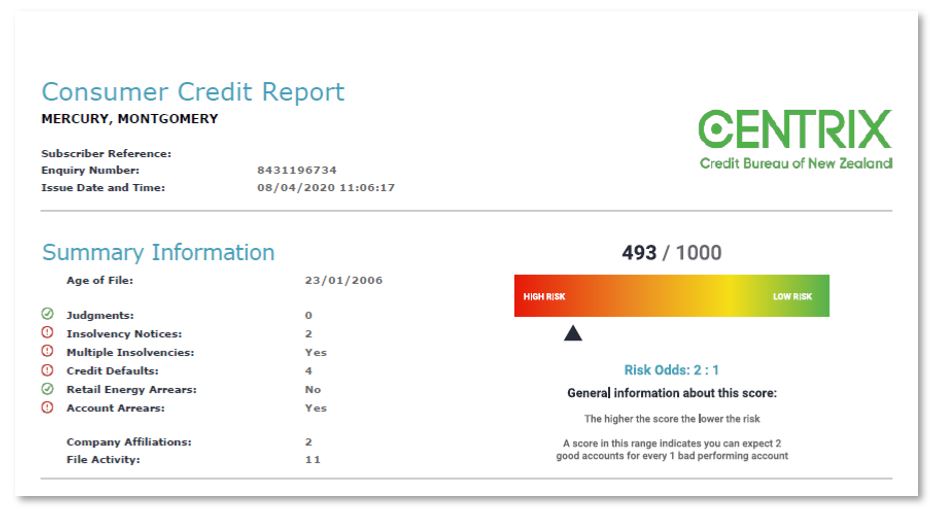

What Is A Consumer Credit Report You should check your credit reports at least once a year to make sure there are no errors that could keep you from getting credit or the best available terms on a loan. read more. once you request your credit reports, it’s important to know what kind of information you should be on the lookout for as you review them. read more. The fair credit reporting act (fcra) is a federal law that promotes the accuracy, fairness, and privacy of information maintained by credit bureaus. consumer protections under the fcra include: anyone who uses a credit report or another type of consumer report to deny your application for credit, insurance, or employment – or to take another. A credit report is a summary of your credit history, including the types of credit accounts you’ve had, your payment history and certain other information such as your credit limits. information in your credit reports is typically provided to the three nationwide consumer reporting agencies (cras) — equifax, transunion and experian — by. A credit report is a statement that has information about your credit activity and current credit situation such as loan paying history and the status of your credit accounts. most people have more than one credit report. credit reporting companies, also known as credit bureaus or consumer reporting agencies, collect and store financial data.

How To Read A Consumer Credit Report How To Get Rich Credit Score A credit report is a summary of your credit history, including the types of credit accounts you’ve had, your payment history and certain other information such as your credit limits. information in your credit reports is typically provided to the three nationwide consumer reporting agencies (cras) — equifax, transunion and experian — by. A credit report is a statement that has information about your credit activity and current credit situation such as loan paying history and the status of your credit accounts. most people have more than one credit report. credit reporting companies, also known as credit bureaus or consumer reporting agencies, collect and store financial data. By law, you can get a free credit report each year from the three credit reporting agencies (cras). these agencies include equifax, experian, and transunion. annualcreditreport is the only website authorized by the federal government to issue free, annual credit reports from the three cras. you may request your reports:. You can request your credit report in spanish directly from each of the three major credit bureaus: · transunion: call 800 916 8800. · equifax: visit the link or call 888 378 4329. · experian.

What Is A Credit Report And Why Is It Important Lexington Law By law, you can get a free credit report each year from the three credit reporting agencies (cras). these agencies include equifax, experian, and transunion. annualcreditreport is the only website authorized by the federal government to issue free, annual credit reports from the three cras. you may request your reports:. You can request your credit report in spanish directly from each of the three major credit bureaus: · transunion: call 800 916 8800. · equifax: visit the link or call 888 378 4329. · experian.

Comments are closed.