Irs Releases 2024 Limits For Hsas Ebhras Hdhps Xd0xb2xd1x92xd1x9e Gogetcovered

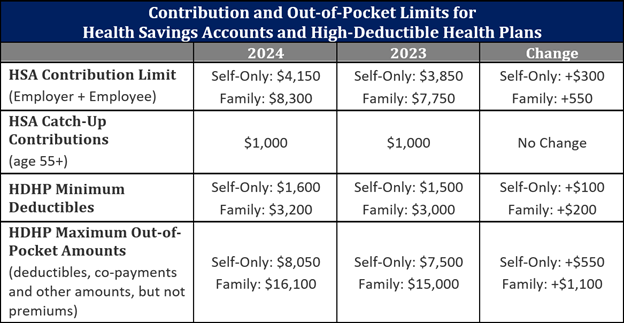

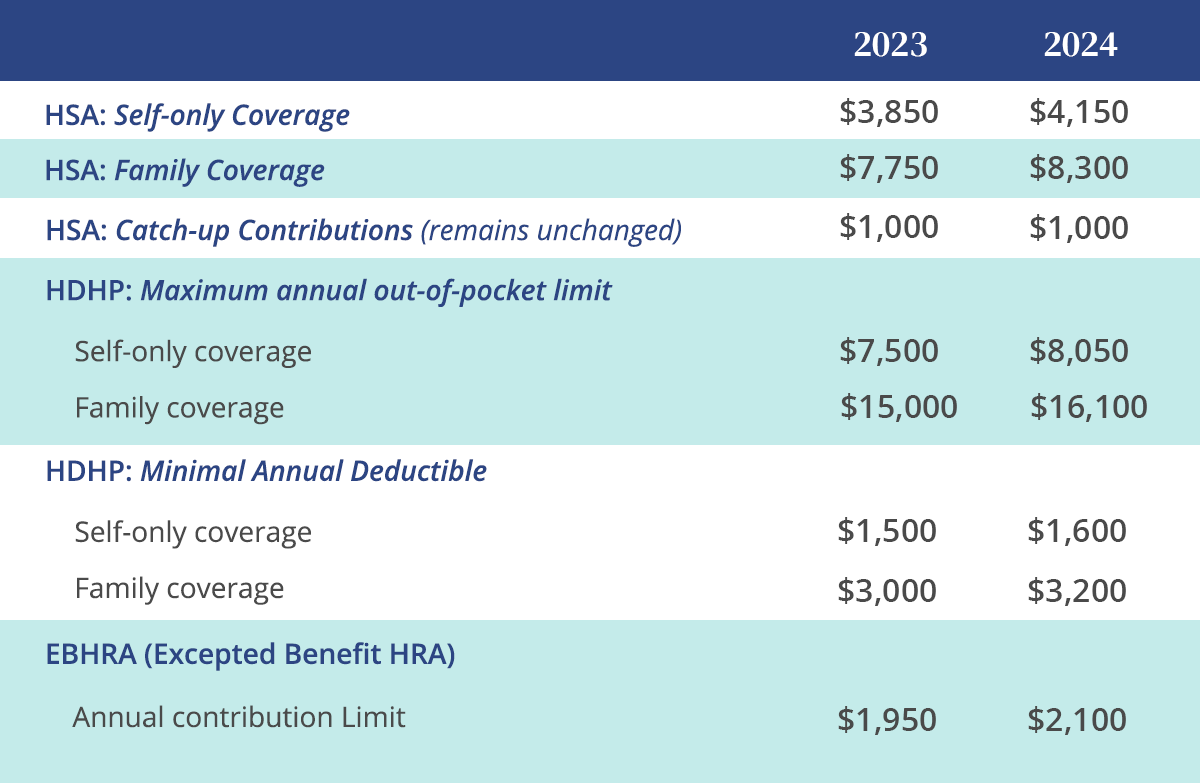

2024 Hsa Limits Table Irs Minne Tabatha If you have one plan for self only and family coverage and have a non embedded oop, the maximum amounts for 2024 are $8,050 for an individual and $9,450 for a family. hsa contribution limits: $4,150 for self only coverage ($300 increase from 2023) $8,300 for family coverage ($550 increase from 2023) the annual “catch up” contribution amount. This week, the irs released 2023 and 2024 limits for health savings accounts (hsas), excepted benefit health reimbursement arrangements (ebhras), and high deductible health plans (hdhps). below is a comparison of the 2023 and 2024 limits for hsas and hdhps. related posts irs releases 2022 limits for hsasthis week, the irs released revenue procedure 2021 25, which includes […].

Irs Announces Hsa And Hdhp Limits For 2024 Telehealth and other remote care services. public law 117 328, december 29, 2022, amended section 223 to provide that an hdhp may have a $0 deductible for telehealth and other remote care services for plan years beginning before 2022; months beginning after march 2022 and before 2023; and plan years beginning after 2022 and before 2025. also, an “eligible individual” remains eligible to. Each year the irs announces updates to contribution limits for flexible spending accounts (fsa), health savings accounts (hsa), health reimbursement arrangements (hra), and other tax advantaged accounts. here’s a look at what’s changing: limit category 2024 limits 2023 limits health fsa: max contribution limit $3,200 $3,050 health fsa: rollover max $640 $610 dcfsa: max contribution limit […]. Annual hsa contribution limit (employer and employee). the 2024 self only maximum is $4,150 an increase of $300 from 2023. the 2024 family maximum is $8,300 an increase of $550 from 2023. hsa catch up contributions for employees age 55 or older remains unchanged with a maximum $1,000 for 2024 minimum annual hdhp deductible . the self only. The irs has announced the inflation adjusted limits for health savings accounts (hsas) and high deductible health plans (hdhps) for the year 2024. this information has been published in rev. proc. 2023 23, which outlines the updated amounts for the upcoming year. maximum hsa contribution.

Irs Releases 2024 Limits For Hsas Ebhras Hdhps вђў Goge Annual hsa contribution limit (employer and employee). the 2024 self only maximum is $4,150 an increase of $300 from 2023. the 2024 family maximum is $8,300 an increase of $550 from 2023. hsa catch up contributions for employees age 55 or older remains unchanged with a maximum $1,000 for 2024 minimum annual hdhp deductible . the self only. The irs has announced the inflation adjusted limits for health savings accounts (hsas) and high deductible health plans (hdhps) for the year 2024. this information has been published in rev. proc. 2023 23, which outlines the updated amounts for the upcoming year. maximum hsa contribution. The maximum hsa contribution limit will rise in 2024 to $4,150 for individuals with self only hdhp coverage, compared to the current limit of $3,850. for those with family coverage under an hdhp, the maximum hsa contribution will increase to $8,300, up from $7,750. this adjustment allows individuals and families to allocate more funds into. The internal revenue service (irs) recently announced in revenue procedure 2023 23 inflation adjustments to the applicable dollar limits for health savings accounts (hsas) and high deductible health plans (hdhps) for 2024, along with the maximum amount for excepted benefit health reimbursement arrangements (ebhras) [1] for 2024.

2024 Limits Announced For Hdhps Hsas And Excepted Benefit Hras The maximum hsa contribution limit will rise in 2024 to $4,150 for individuals with self only hdhp coverage, compared to the current limit of $3,850. for those with family coverage under an hdhp, the maximum hsa contribution will increase to $8,300, up from $7,750. this adjustment allows individuals and families to allocate more funds into. The internal revenue service (irs) recently announced in revenue procedure 2023 23 inflation adjustments to the applicable dollar limits for health savings accounts (hsas) and high deductible health plans (hdhps) for 2024, along with the maximum amount for excepted benefit health reimbursement arrangements (ebhras) [1] for 2024.

Hsa Limits 2024 Comparison Operators Aidan Zorine

Comments are closed.