Irs Reduces 2018 Family Hsa Contribution Limit By 50 Arcor

Irs Reduces Hsa Family Contribution Limit For 2018 Flexibl The irs has announced that the 2018 contribution limit for health savings accounts (hsas) linked to family coverage will be $6,850–not $6,900, $50 less than previously announced. this recalculated limit is due to the tax cuts and jobs act passed at the end of 2017. Yes, you read that correctly. previously, the 2018 family contribution limit for health savings accounts was $6,900, and due to an inflation calculation change, this has been reduced by $50 to $6,850 as of march 5th, 2018. fortunately, self only and catch up contribution rates were unchanged. this has come about as of irs bulletin 2018 10 :.

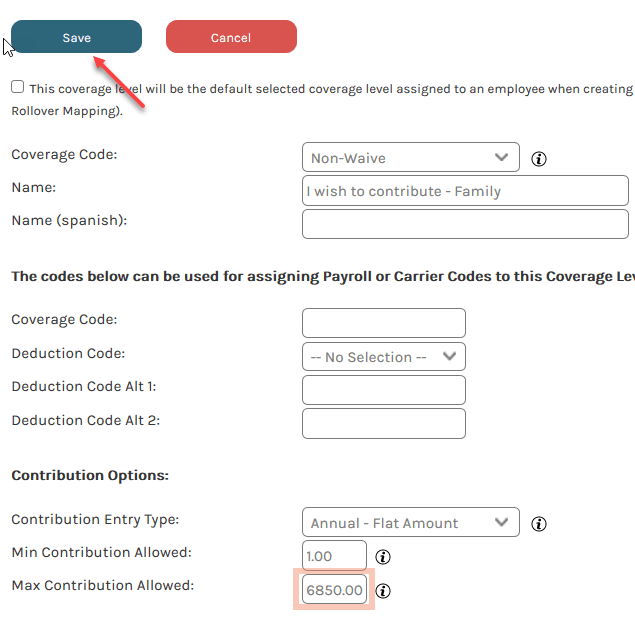

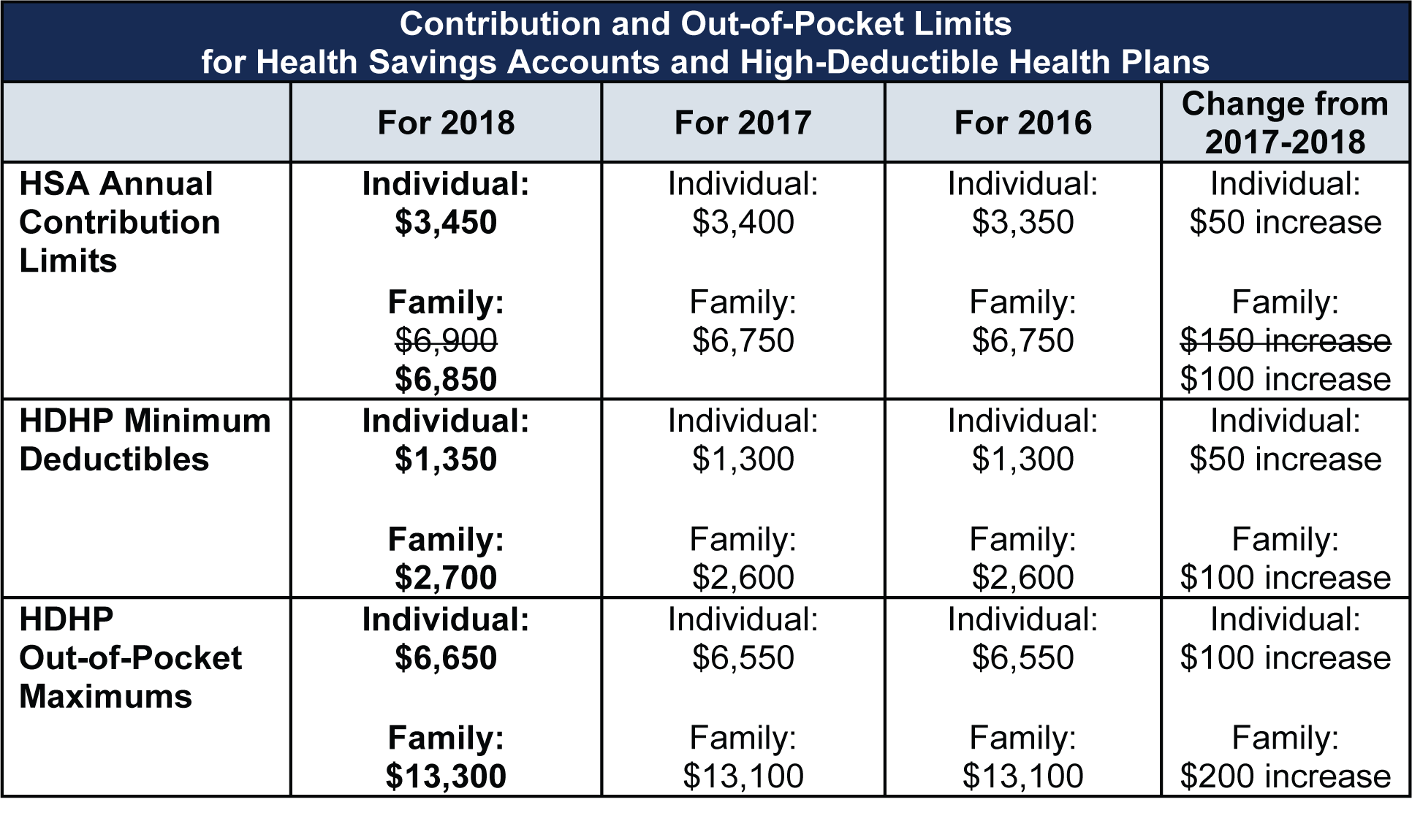

Irs Reduces 2018 Family Hsa Contribution Limit By 50 The maximum contribution families can make to health savings accounts for 2018 is $6,900, after the irs reversed its march decision to lower the limit by $50. The internal revenue service (irs) recently issued internal revenue bulletin no. 2018 10, which revises certain 2018 inflation adjusted amounts previously released. among the most disruptive changes is the downward revision in the maximum family health savings account (hsa) contribution limit from $6,900 to $6,850. no other hsa limits are impacted. On march 5, 2018, the internal revenue service released rev. proc. 2018 18 under internal revenue bulletin no. 2018 10, reducing from $6,900 to $6,850 the maximum amount an individual with family coverage may contribute to a health savings account (hsa) for the 2018 calendar year. the $50 reduction is effective immediately for the 2018 calendar year.the irs had previously announced, in rev. Irs revenue procedure 2018 18 reduces the 2018 hsa contribution limit for family coverage to $6,850. this change is effective immediately. the contribution limit for single coverage remains at $3,450. this mid year change in the hsa contribution limit creates an administrative challenge for employers with high deductible health plans who make.

Hsa 2018 Contribution Limits Adjusted By Irs Medcost On march 5, 2018, the internal revenue service released rev. proc. 2018 18 under internal revenue bulletin no. 2018 10, reducing from $6,900 to $6,850 the maximum amount an individual with family coverage may contribute to a health savings account (hsa) for the 2018 calendar year. the $50 reduction is effective immediately for the 2018 calendar year.the irs had previously announced, in rev. Irs revenue procedure 2018 18 reduces the 2018 hsa contribution limit for family coverage to $6,850. this change is effective immediately. the contribution limit for single coverage remains at $3,450. this mid year change in the hsa contribution limit creates an administrative challenge for employers with high deductible health plans who make. On march 5, 2018, the irs released revenue procedure 2018 18, which, among other things, adjusts downward the 2018 total contribution limit to health savings accounts (hsas) for. The irs has revised certain 2018 health and welfare benefits limits including employee contributions to family hsas.

Irs Reduces Hsa Limit For Family Coverage For 2018 Murray On march 5, 2018, the irs released revenue procedure 2018 18, which, among other things, adjusts downward the 2018 total contribution limit to health savings accounts (hsas) for. The irs has revised certain 2018 health and welfare benefits limits including employee contributions to family hsas.

Irs Reduces 2018 Health Savings Account Limit For Family Coverage

Comments are closed.