Irs Increases 401k Contribution Limits For 2018 Bemanaged

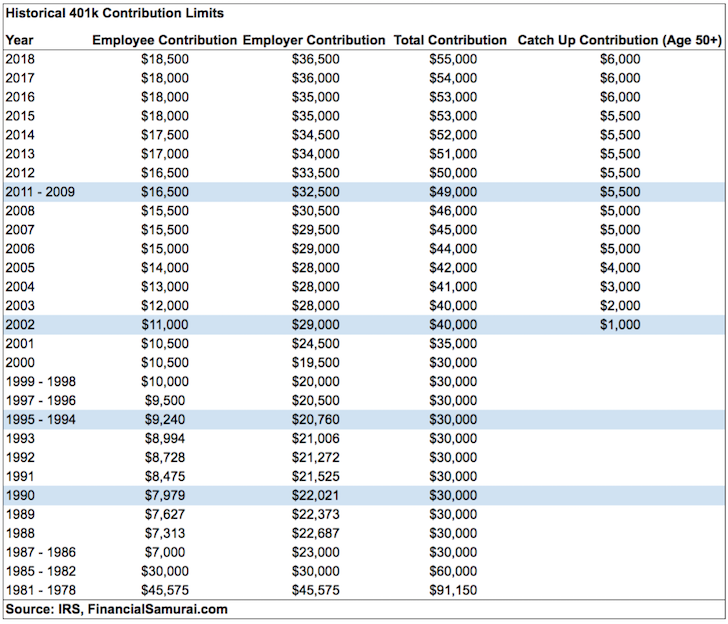

Infographics Irs Announces Revised Contribution Limits For 401 K Today, the irs increased 401k contribution limits to $18,500 for 2018. it is good news for individuals looking to maximize their retirement contributions. unfortunately, ira contribution limits remain unchanged. recommendation: set a reminder on your phone or calendar to review your 401k 403b contribution in mid to late december to ensure you are maximizing your 2018 retirement savings.…. The 2024 401 (k) individual contribution limit is $23,000, up from $22,500 in 2023. in 2024, employers and employees together can contribute up to $69,000, up from a limit of $66,000 in 2023. if you are 50 years old or older, you can also contribute up to $7,500 in "catch up" contributions on top of your individual and employer contributions.

401k Maximum Contribution Limit Finally Increases For 2018 Here are the new 401 (k) and ira contribution limits for 2018. workers can stash away $500 more in their 401 (k)s next year. the irs announced thursday that it was increasing the 401 (k) contribution limit from $18,000 to $18,500 — the first jump in that ceiling since 2015. the new limits, announced thursday, also apply to 403 (b)s, the. Salary deferral limit for 457 plans. increases from $18,000 to $18,500. catch up contribution limit for 401 (k) plans. remains unchanged at $6,000. catch up contribution limit for simple iras. remains unchanged at $3,000. annual additions limit for defined contribution plans. increases from $54,000 to $55,000. January 1, 2018. the irs said that the limit on elective deferral for contributions to 401 (k) plans, 403 (b) plans, most 457 plans, and the federal government's thrift savings plan has increased from $18,000 in 2017 to $18,500 for 2018. however, the catch up contribution limit for those 50 and older remains $6,000 (notice 2017 64). most. There are separate, smaller limits for simple 401(k) plans. example 1: in 2020, greg, 46, is employed by an employer with a 401(k) plan, and he also works as an independent contractor for an unrelated business and sets up a solo 401(k). greg contributes the maximum amount to his employer’s 401(k) plan for 2020, $19,500.

Comments are closed.