Irs Hsa Contribution Limits 2024 Patty Bernelle

Irs Makes Historical Increase To 2024 Hsa Contribution Limits First If you are an eligible individual who is age 55 or older at the end of your tax year, your contribution limit is increased by $1,000. for example, if you have self only coverage, you can contribute up to $4,850 (the contribution limit for self only coverage ($3,850) plus the additional contribution of $1,000). Hsa contribution limits. every year, the internal revenue service (irs) sets the maximum that can be contributed to an hsa. for example, if your hsa contribution limit for the year is $4,150 (as it is in 2024) and your employer contributes $1,000, you can only contribute $3,150—unless you're eligible for a catch up contribution of $1,000.

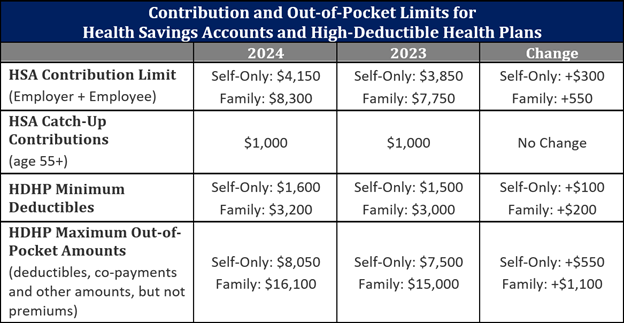

Irs Hsa Contribution Limits 2024 Patty Bernelle The irs announced one of the most significant increases to the maximum health savings account contribution limits for 2024. the new 2024 hsa contribution limit is $4,150 if you are single—a 7.8%. The 2024 annual hsa contribution limit is $4,150 for individuals with self only hdhp coverage (up from $3,850 in 2023), and $8,300 for individuals with family hdhp coverage (up from $7,750 in 2023). hdhp minimum deductibles. A self only healthcare plan must have a minimum annual deductible of $1,600 and an annual out of pocket limit of at least $8,050 in 2024. a family healthcare plan must have a minimum annual. Health savings account (hsa) irs limits. 2024 single plan family plan; maximum contribution limit: 4150: 8300: minimum deductible: 2024; maximum contribution.

Irs Announces Hsa And Hdhp Limits For 2024 A self only healthcare plan must have a minimum annual deductible of $1,600 and an annual out of pocket limit of at least $8,050 in 2024. a family healthcare plan must have a minimum annual. Health savings account (hsa) irs limits. 2024 single plan family plan; maximum contribution limit: 4150: 8300: minimum deductible: 2024; maximum contribution. Complete and up to date information on the irs guidelines for eligible expenses and contribution limits surrounding health savings accounts. Annual hsa contribution limits for 2024 are increasing in one of the biggest jumps in recent years, the irs announced may 16: the annual limit on hsa contributions for self only coverage will be.

Irs Makes Historical Increase To 2024 Hsa Contribution Limits First Complete and up to date information on the irs guidelines for eligible expenses and contribution limits surrounding health savings accounts. Annual hsa contribution limits for 2024 are increasing in one of the biggest jumps in recent years, the irs announced may 16: the annual limit on hsa contributions for self only coverage will be.

Comments are closed.