Irs Fsa Limits 2024 Brooks Leticia

Irs Fsa Limits 2024 Brooks Leticia Washington — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may be eligible to use tax free dollars to pay medical expenses not covered by other health plans through their fsa. for 2024, there is a $150 increase to the contribution limit for these accounts. an. In 2024, the fsa contribution limit is $3,200, or roughly $266 a month. simple tax filing with a $50 flat fee for every scenario. the irs limits fsa rollovers at $610 for 2023 and $640 in 2024.

Irs Announces 2024 Increases To Fsa Contribution Limits Sehp News Fsa annual contribution limits. the latest mandated fsa employee contribution limits on how much employees can contribute to these accounts is shown in the table below. [2024 fsa updates] health care fsa plans saw a $150 increase in annual limits. dcfsa saw no change to limits, which are set by statue and not linked to inflation. In 2024, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050). if the fsa plan allows unused fsa amounts to carry over, employees can carry over up to $640 (up from $610). read irs revenue procedure 2024 34 > 2024 hsa limits. hsa contribution limits will substantially jump in 2024. these. Adoption assistance limits for 2024. for 2024, the maximum adoption assistance limit increases to $16,810. that’s up from $15,950 in 2023. employer assistance remains completely excludable from an employee’s gross income up to a modified adjusted gross income of $252,150. above that income level, the tax free provision gradually phases out. In revenue procedure 2023 24, the irs sets forth a variety of 2024 adjusted tax limits. among other things, the notice indicates that employee contribution limits toward health flexible spending arrangements (health fsas) and qualified transportation fringe benefits will increase for 2024. the limit on annual employee contributions toward health fsas for 2024 is $3,200 (increased from $3,050.

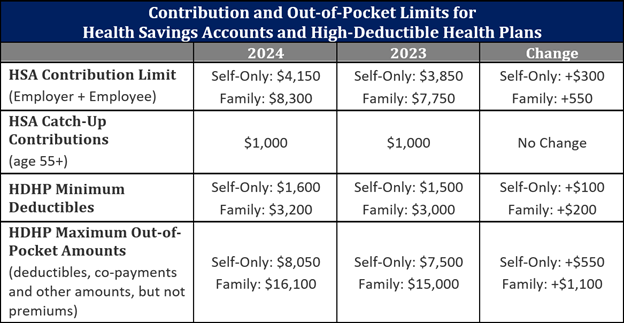

Irs Announces Hsa And Hdhp Limits For 2024 Adoption assistance limits for 2024. for 2024, the maximum adoption assistance limit increases to $16,810. that’s up from $15,950 in 2023. employer assistance remains completely excludable from an employee’s gross income up to a modified adjusted gross income of $252,150. above that income level, the tax free provision gradually phases out. In revenue procedure 2023 24, the irs sets forth a variety of 2024 adjusted tax limits. among other things, the notice indicates that employee contribution limits toward health flexible spending arrangements (health fsas) and qualified transportation fringe benefits will increase for 2024. the limit on annual employee contributions toward health fsas for 2024 is $3,200 (increased from $3,050. The limit on annual employee contributions toward health fsas for 2024 is $3,200 (increased from $3,050 in 2023), with the ability to carryover up to $640 (increased from $610 in 2023). the limit on monthly contributions toward qualified transportation and parking benefits for 2024 is $315 (increased from $300 in 2023). 2024. qualified transportation and health fsa limits. qualified parking, transit passes or commuter highway vehicle. 2025 projected. $325. 2024. $315. qualified transportation and health fsa limits. health fsa limit (irc $ 125 (i)).

Comments are closed.