Irs Announces New Retirement Plan Limits For 2024 Connecticut State

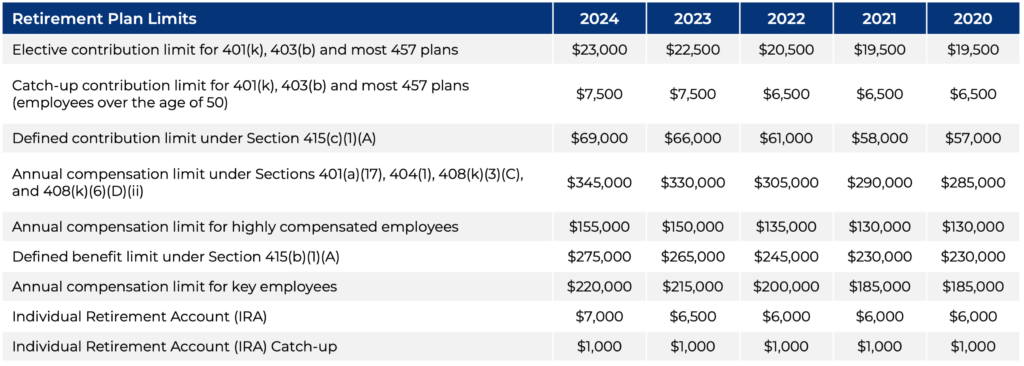

Irs Announces New Retirement Plan Limits For 2024 Employme Ir 2023 203, nov. 1, 2023. washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2024 has increased to $23,000, up from $22,500 for 2023. the irs today also issued technical guidance regarding all of the cost‑of‑living adjustments affecting dollar limitations for. The annual compensation limit is increasing from $330,000 in 2023 to $345,000 in 2024. [the limit in 2014 was $260,000.] the compensation amount used in definition of highly compensated employees is increasing from $150,000 in 2023 to $155,000 in 2024. [the limit in 2014 was $115,000.] the age 50 catch up limit for a 401 (k) plan is not.

.jpg?width=600&height=1500&name=2024 Contribution Limits Retirement Plans Infographic (1).jpg)

Irs Announces 2024 Retirement Plan Limits May 3, 2024. fy 2024 2025 state employee retirement plan (sers) tier iv “shortfall contributions”. download memo. november 22, 2023. 2024 irs maximum contribution limits and the need to restart contributions for participants who stopped contributions during 2023. download memo view memo. On november 1, 2023, the internal revenue service issued notice 2023 75 announcing retirement plan cost of living adjustments (colas) applicable to 2024. after an increase to the traditional and roth individual retirement account (ira) regular contribution limit in 2023, the limit will again increase $500 for 2024. The contribution limit for 401(k), 403(b), thrift savings plans and most 457 plans will be $23,000 in 2024, rising from $22,500 in 2023. catch up contributions for people ages 50 and older will remain $7,500. On november 1, 2023, the internal revenue service (irs) announced cost of living adjustments to the dollar limits on benefits and contributions in retirement plans for 2024. these adjustments are in addition to previously announced increases in limits to other employee benefit plans. in addition, the social security administration recently.

Irs Announces Higher Retirement Account Contribution Limits For 2024 The contribution limit for 401(k), 403(b), thrift savings plans and most 457 plans will be $23,000 in 2024, rising from $22,500 in 2023. catch up contributions for people ages 50 and older will remain $7,500. On november 1, 2023, the internal revenue service (irs) announced cost of living adjustments to the dollar limits on benefits and contributions in retirement plans for 2024. these adjustments are in addition to previously announced increases in limits to other employee benefit plans. in addition, the social security administration recently. The irs recently issued the retirement plan limits for the 2024 year as detailed in the chart linked to below. most limits related to retirement plans will be slightly increased. for example, the individual deferral limit for 401(k) and 403(b) plans will increase from $22,500 to $23,000. The catch up contribution limit for employees 50 and over who participate in simple plans remains $3,500 for 2024. the annual limit for defined contribution plans under section 415 (c) (1) (a) increases to $69,000 (from $66,000). the limitation on the annual benefit for a defined benefit plan under section 415 (b) (1) (a) also increases to.

Irs Announces 2024 Retirement Plan Limitations The irs recently issued the retirement plan limits for the 2024 year as detailed in the chart linked to below. most limits related to retirement plans will be slightly increased. for example, the individual deferral limit for 401(k) and 403(b) plans will increase from $22,500 to $23,000. The catch up contribution limit for employees 50 and over who participate in simple plans remains $3,500 for 2024. the annual limit for defined contribution plans under section 415 (c) (1) (a) increases to $69,000 (from $66,000). the limitation on the annual benefit for a defined benefit plan under section 415 (b) (1) (a) also increases to.

Comments are closed.