Irs Announces 2018 Hsa Contribution Limits Corporate Benefits Network

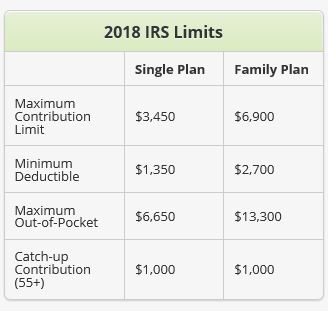

Irs Announces 2018 Hsa Contribution Limits Corporate Benefits Network Employee benefits. enrollment options; cafeteria plans fsa; hr technology & benefits administration. home » blog » irs announces 2018 hsa contribution limits. Hdhp maximum out of pocket amounts (deductibles, co payments and other amounts, but not premiums) self only: $6,550. family: $13,100. self only: $6,650. family: $13,300. self only: $100. family: $200. * catch up contributions can be made any time during the year in which the hsa participant turns 55. ** unlike other limits, the hsa catch up.

Irs Announces 2018 Hsa Contribution Limits Corporate Benefits Network The 2018 limit on out of pocket expenses (including items such as deductibles, copayments, and coinsurance, but not premiums) for self only hdhp coverage will be $6,650 (a $100 increase from 2017), and the 2018 out of pocket limit for family hdhp coverage will be $13,300 (a $200 increase from 2017). The $6,900 contribution limit for 2018 was originally published in revenue procedure 2017 37, but was reduced earlier this year by $50 to $6,850 in revenue procedure 2018 18 due to changes in the inflation indexing measure under the tax cuts and jobs act. the irs later increased the limit back to the originally announced amount of $6,900. The above changes apply to the 2018 calendar year. employees contributing to an hsa should be informed of the reduced maximum limit, and adjustments in contributions for the remainder of 2018 may be needed. employees who have already contributed the maximum amount for 2018, such as a one time hsa contribution from a beginning of the year bonus. The internal revenue service recently released revenue procedure 2018 18 (rev. proc. 2018 18). among several changes, rev. proc. 2018 18 recalculates a number of cost of living adjustments for calendar year 2018 due to the recently enacted tax cuts and jobs act (the "tax reform act"), which was signed into law on december 22, 2017.

Comments are closed.