Ira Vs 401k Chapter 6 Difference Between Ira 401k Intuit Mint

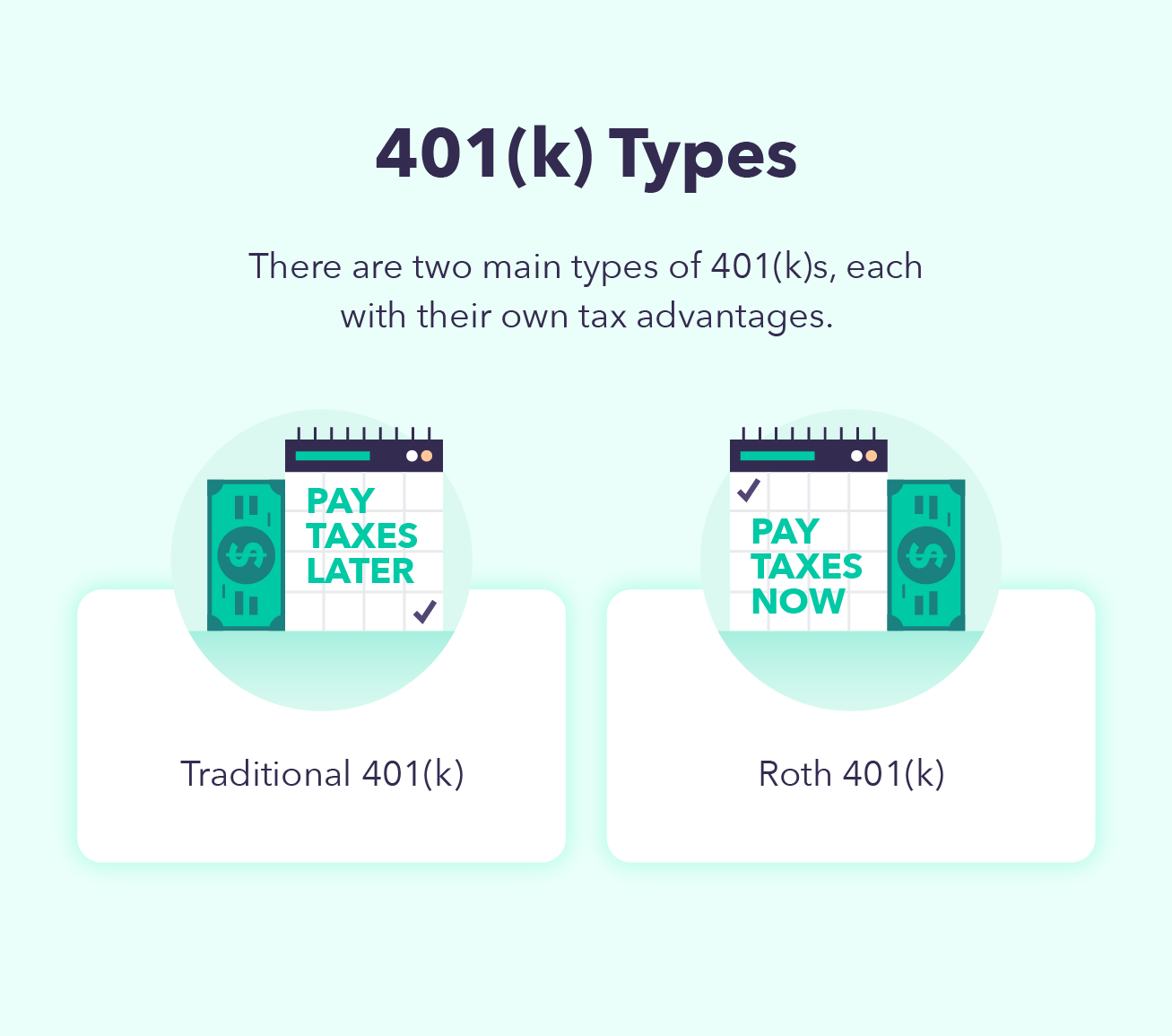

Ira Vs 401k Chapter 6 Difference Between Ira 401k Intuit Mint Two popular vehicles people contribute to for retirement are 401 (k) and iras. employers may offer a 401 (k) that allows employees to contribute their pre taxed dollars for retirement. that’s a double benefit because you not only invest money for your future, but you’re also lowering your taxable income. on top of that, some (but not all. Comparatively, 401 (k)s have a much higher contribution limit than roth iras. for the year 2024, individual contribution limits are: $23,000, if you’re under age 50. $30,500, including the allowance for a catch up contribution of an extra $7,500 if you are 50 years or older. 2024 combined employer contribution limits:.

Ira Vs 401k Chapter 6 Difference Between Ira 401k Intuit Mint Iras have lower contribution limits than 401 (k)s. in 2024, individuals can contribute up to $7,000 in an ira (or $8,000 if you’re age 50 or older). that’s $16,000 less than the maximum allowed in a 401 (k) if you’re under 50, or $22,500 less if you’re over 50. there are no “matching” contributions for iras. Below are the 2023 limits. ira holders below 50 — $6,500. ira holders 50 and older — $7,500. 401 (k) holders below 50 — $22,500. 401 (k) holders 50 and older — $30,000. tip: if your company offers a 401 (k) with a company match, you should consider setting up your 401 (k) and contribute the total match amount. Ira vs. 401 (k) the main difference between 401 (k)s and iras is that 401 (k)s are offered through employers, whereas iras are opened by individuals through a broker or a bank. iras typically. The 401 (k) is simply objectively better. the employer sponsored plan allows you to add much more to your retirement savings than an ira – $23,000 compared to $7,000 in 2024. plus, if you’re.

Differences Between An Ira And 401k A Simple Guide Ira vs. 401 (k) the main difference between 401 (k)s and iras is that 401 (k)s are offered through employers, whereas iras are opened by individuals through a broker or a bank. iras typically. The 401 (k) is simply objectively better. the employer sponsored plan allows you to add much more to your retirement savings than an ira – $23,000 compared to $7,000 in 2024. plus, if you’re. An ira is typically held by a brokerage or investment firm. in general, it offers more investment options than a 401 (k), but contribution limits are much lower. for tax year 2024, you can't. The major differences between 401 (k)s and iras include: anyone with eligible earned income can open an ira, but a 401 (k) is only available through an employer. a 401 (k) has a higher.

Comments are closed.