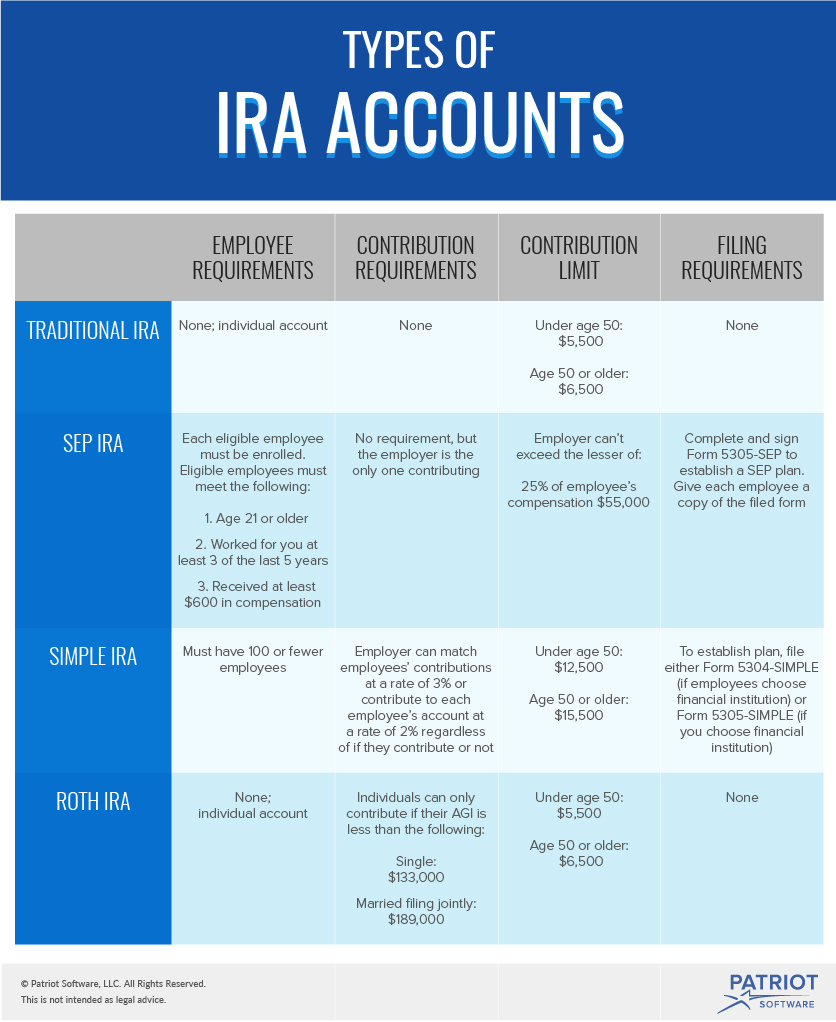

Ira Types Chart

Ira Types Chart The two main IRA types are traditional and Roth, and they differ in their tax treatment Roth IRAs are funded with after-tax dollars and offer tax-free growth Traditional IRAs are funded with You’ve got other options when it comes to choosing the right Roth IRA account You could combine features of both types of Roth IRA providers above by purchasing a target-date fund in a

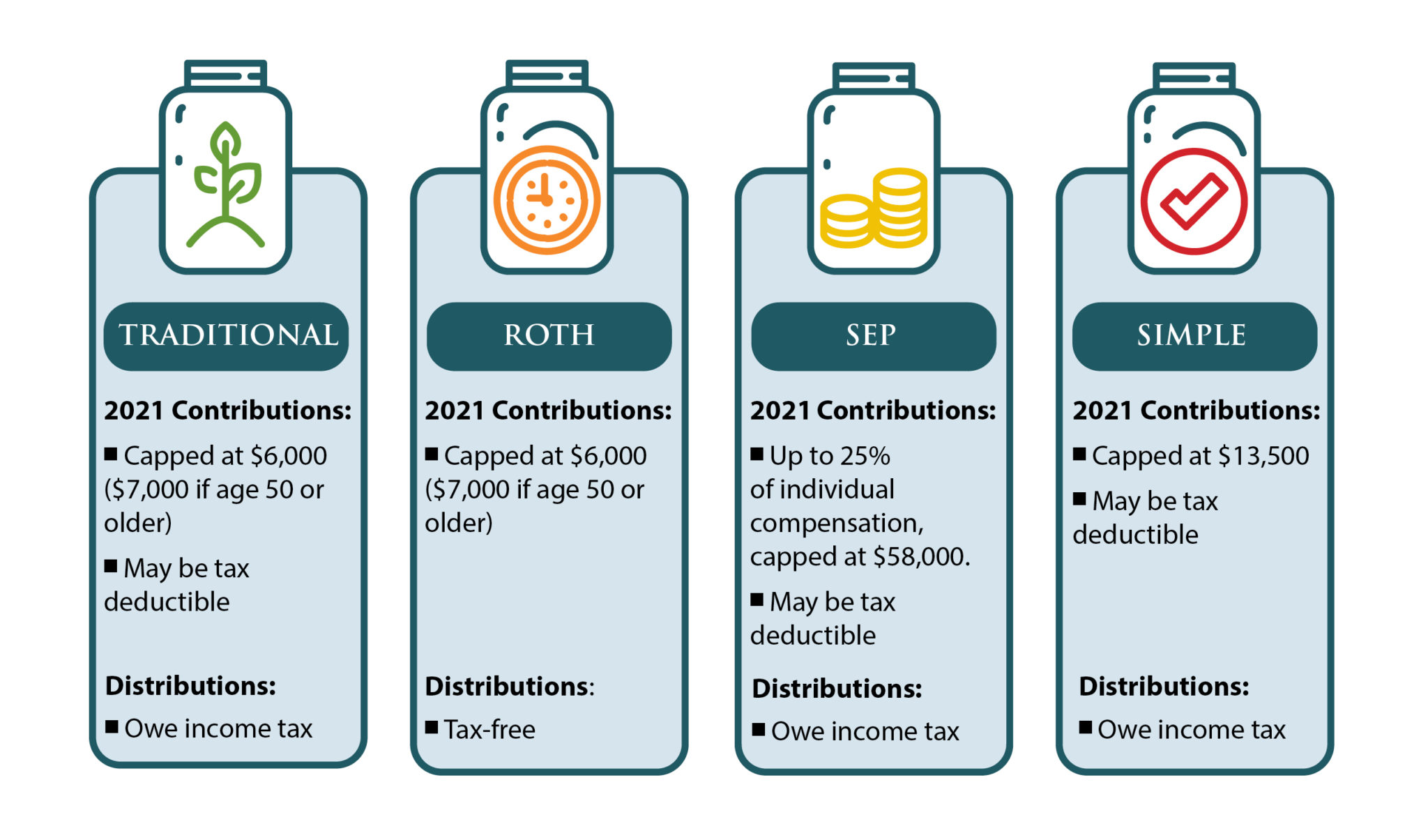

Ira Account Types Infographic Preferred Trust Company For 2022 and 2023 these contribution limits are: These contribution limits are in total for all types of IRA accounts For example, for 2024 you could contribute $3,500 each to a traditional IRA An IRA is a retirement savings account that offers tax advantages Several types of IRAs are available, including these three primary ones: Each type has its advantages, and all offer the With so many choices available, it's hard to decide where to keep your IRA See GOBankingRates' picks for the Best IRAs and make an informed decision There are several types of IRAs, including traditional, SEP or Roth IRA, which come with unique tax advantages Many different banks, credit unions and other financial institutions offer IRAs

What Is A Ira Meldium With so many choices available, it's hard to decide where to keep your IRA See GOBankingRates' picks for the Best IRAs and make an informed decision There are several types of IRAs, including traditional, SEP or Roth IRA, which come with unique tax advantages Many different banks, credit unions and other financial institutions offer IRAs Why is E*TRADE one of our best IRA brokers? E*TRADE was one of the pioneers of the online brokerage industry, and is still one of the best at what it does It offers many different account types Investors can choose from two basic types of IRA accounts: a traditional IRA or Internal Revenue Service "Rollover Chart" Internal Revenue Service "Rollovers of Retirement Plan and IRA Based on your filing status, you can find your Roth IRA contribution limits for 2023 and 2024 according to your modified adjusted gross income (MAGI) in the following chart Roth IRAs do not have See how we rate investing products to write unbiased product reviews Roth IRA accounts offer tax-free growth on earnings and tax-free withdrawals in retirement But those perks come with a big

Types Of Iras How To Choose The Right One For You Vrogue Co Why is E*TRADE one of our best IRA brokers? E*TRADE was one of the pioneers of the online brokerage industry, and is still one of the best at what it does It offers many different account types Investors can choose from two basic types of IRA accounts: a traditional IRA or Internal Revenue Service "Rollover Chart" Internal Revenue Service "Rollovers of Retirement Plan and IRA Based on your filing status, you can find your Roth IRA contribution limits for 2023 and 2024 according to your modified adjusted gross income (MAGI) in the following chart Roth IRAs do not have See how we rate investing products to write unbiased product reviews Roth IRA accounts offer tax-free growth on earnings and tax-free withdrawals in retirement But those perks come with a big An IRA is a type of retirement account investors can open with a bank or brokerage that provides tax advantages for retirement investors The two main types of IRAs are traditional IRAs and Roth IRAs There are several IRA options Tax advantages will vary based But there’s one major difference — the types of assets you can hold in the account Unlike other IRAs that usually limit

Ira Types Chart Based on your filing status, you can find your Roth IRA contribution limits for 2023 and 2024 according to your modified adjusted gross income (MAGI) in the following chart Roth IRAs do not have See how we rate investing products to write unbiased product reviews Roth IRA accounts offer tax-free growth on earnings and tax-free withdrawals in retirement But those perks come with a big An IRA is a type of retirement account investors can open with a bank or brokerage that provides tax advantages for retirement investors The two main types of IRAs are traditional IRAs and Roth IRAs There are several IRA options Tax advantages will vary based But there’s one major difference — the types of assets you can hold in the account Unlike other IRAs that usually limit

Comments are closed.