Ira And Roth Ira Comparison Chart A Visual Reference Of Charts Chart

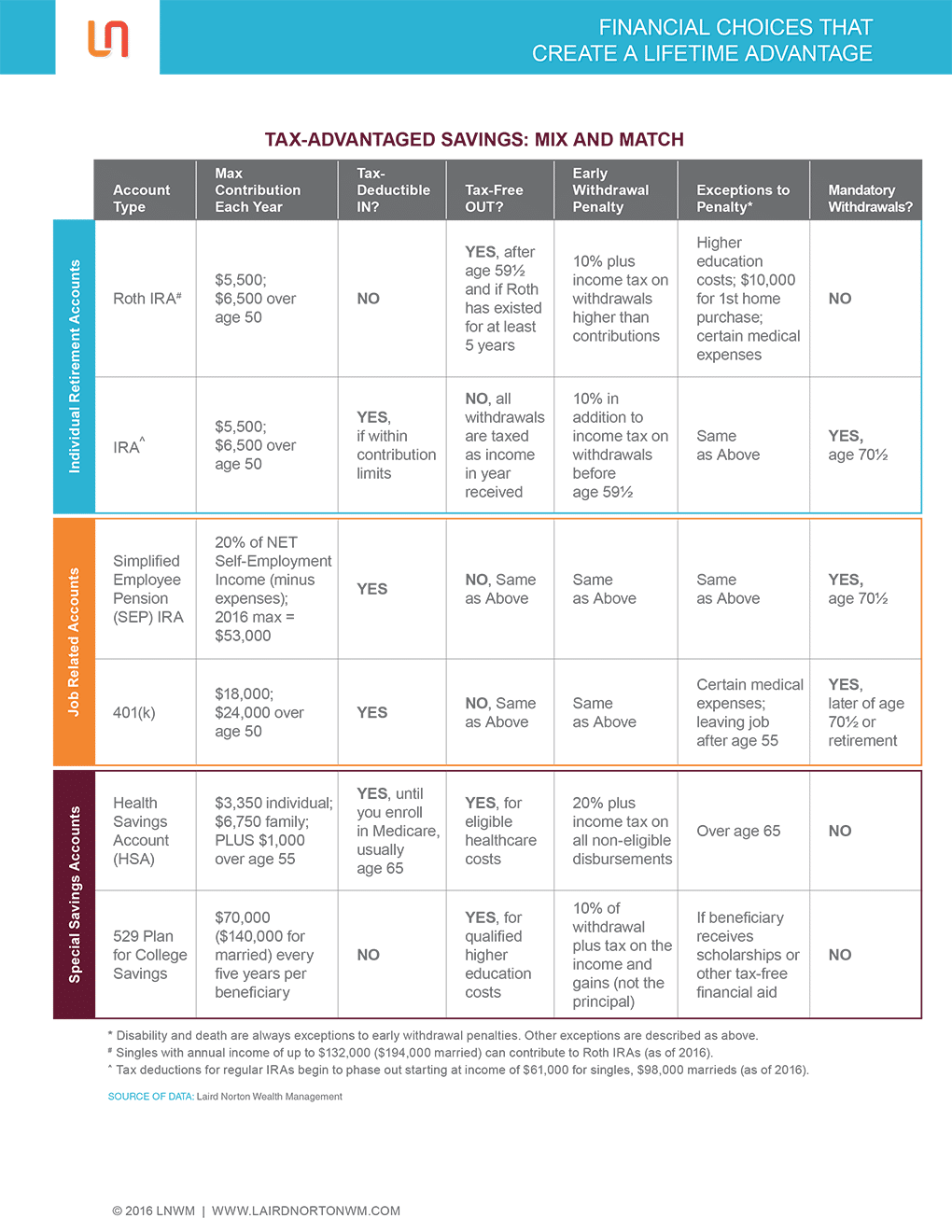

Ira And Roth Ira Comparison Chart A Visual Reference Of Charts Chart Ira comparison table. use this table to see a side by side comparison of traditional and roth ira features and benefits. this table will help you compare the key features and benefits of traditional and roth iras. you (or your spouse if filing a joint return) can contribute if you have earned income (a salaried job, investments or other sources). Fidelity brokerage services llc, member nyse, sipc, 900 salem street, smithfield, ri 02917. compare a roth ira vs a traditional ira with this comparison table. understand the income requirements, tax benefits as well as contribution limits that can help with your retirement needs.

Ira And Roth Ira Comparison Chart A Visual Reference Of Charts Chart Option 2: a roth ira provides tax free withdrawals in retirement, but contributions to the account are not deductible. when you choose a roth ira you forgo the upfront tax break offered in a traditional ira. the irs takes its cut off the top before you contribute money to the account. First contributed directly to the roth ira. rolled over a roth 401(k) or roth 403(b) to the roth ira. converted a traditional ira to the roth ira. if you're under age 59½ and you have one roth ira that holds proceeds from multiple conversions, you're required to keep track of the 5 year holding period for each conversion separately. Unlike with a traditional ira, you can withdraw sums equivalent to your roth ira contributions penalty and tax free before the due date of your tax return, for any reason, and even before age 59½. Partial $146,000 $161,000. married filing jointly – $230,000. partial $230,000 $240,000. married filing separately – $0. partial $0 $10,000 special rules apply for married couples filing separately. • the lesser of $7,000 or 100% of earned income. $14,000 ($7,000 for each spouse) if married filing jointly. • $1,000.

Traditional Vs Roth Ira Comparison Chart A Visual Reference O Unlike with a traditional ira, you can withdraw sums equivalent to your roth ira contributions penalty and tax free before the due date of your tax return, for any reason, and even before age 59½. Partial $146,000 $161,000. married filing jointly – $230,000. partial $230,000 $240,000. married filing separately – $0. partial $0 $10,000 special rules apply for married couples filing separately. • the lesser of $7,000 or 100% of earned income. $14,000 ($7,000 for each spouse) if married filing jointly. • $1,000. Ira comparison chart 2021. traditional ira. roth ira. 2021 contribution limits. the most you can contribute to all your traditional and roth iras is the lesser of: $6,000 under age 50 ($7,000 if age 50 or older); or. your taxable compensation for the year. the most you can contribute to all your traditional and roth iras is the lesser of:. The roth ira is a unique and powerful tool for retirement savings. that’s because this type of individual retirement account comes with tax free withdrawals, a huge advantage that gives you more.

Comments are closed.