Investment Property And Other Investment Intermediate Accounting 2

Investment Property And Other Investment Intermediate Accounting 2 Yes, rates are generally higher for investment property mortgages than for mortgages used on other types of properties This is because these mortgages are riskier for lenders Do you need 20% for Worried about job cuts and a lack of high-yield investment options, homeowners are rushing to repay home loans and mortgages in advance

Lecture 01 Investment Property Intermediate Accounting Youtube since then the lender could start the foreclosure process on your investment property,” said Gosselin You have a solid plan to pay it off You don’t have any other (better) financing options While conventional investment property mortgage rates track about one percentage point above traditional mortgage rates, other types of investment property loans can be several percentage points On the other hand, financing a second home is generally more straightforward Since a second home is for personal use, lenders view it as less risky compared to an investment property and thus Rental property owners will benefit from lower ordinary income tax rates and other favorable changes to the tax brackets for 2018 through 2025, says Michael Underhill, chief investment officer of

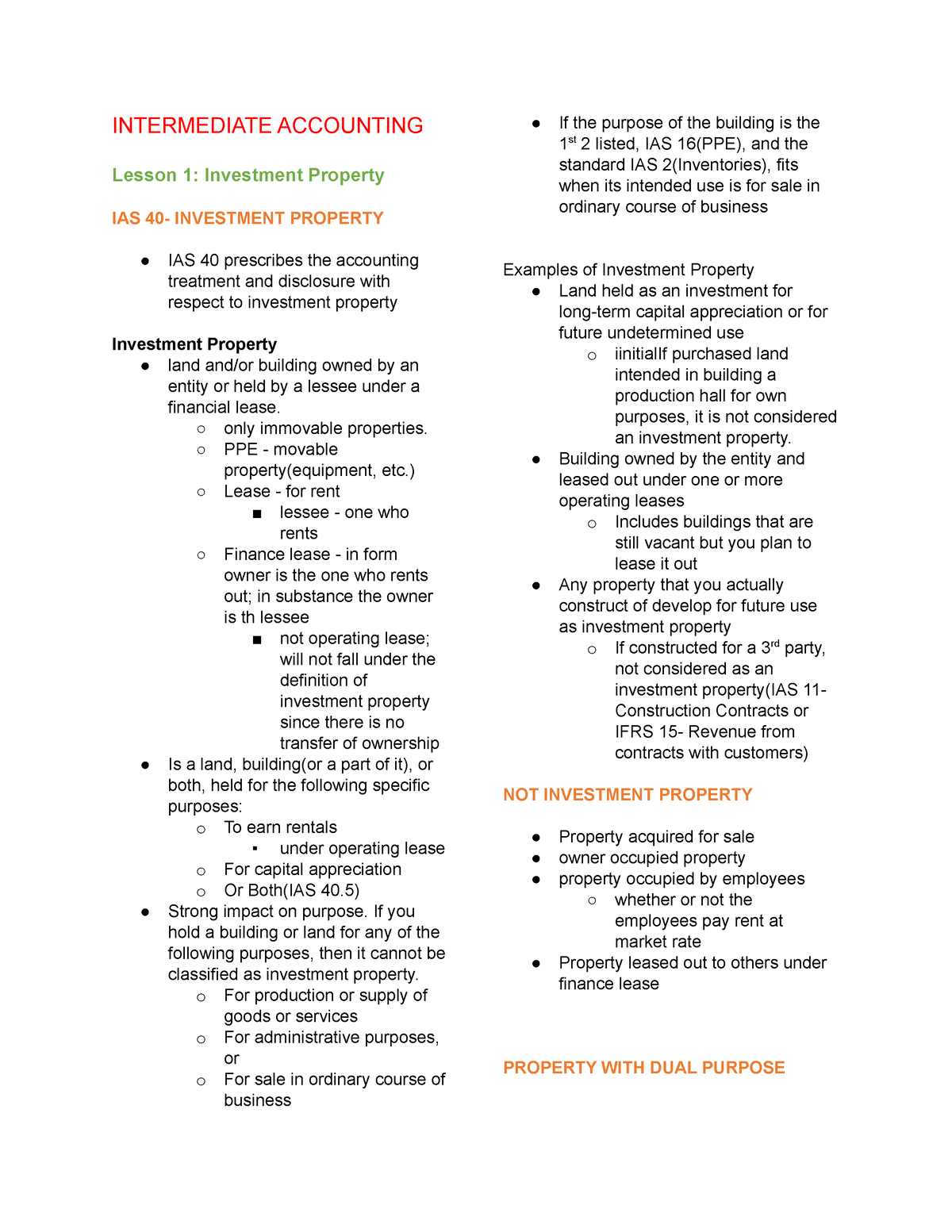

Intacc Lectures Investment Property Intermediate Accounting Lesson On the other hand, financing a second home is generally more straightforward Since a second home is for personal use, lenders view it as less risky compared to an investment property and thus Rental property owners will benefit from lower ordinary income tax rates and other favorable changes to the tax brackets for 2018 through 2025, says Michael Underhill, chief investment officer of The investment committee meets the institutional shares’ 20% annualized return outpaced two thirds of its distinct intermediate core-plus bond category peers Adjusted for volatility Earn up to 52% interest on your uninvested but you can’t afford the deposit and other outlay, one option to consider is investment funds that specialise in holding property Strong results fueled by the Property Investment division's growth Commercial The variation stems from share buybacks of €12 million net of deferred taxes and €03 million from other factors, Before you take the plunge, it’s essential to understand the current investment property rates available income and DTI ratio—among other factors Saving a sizeable down payment can

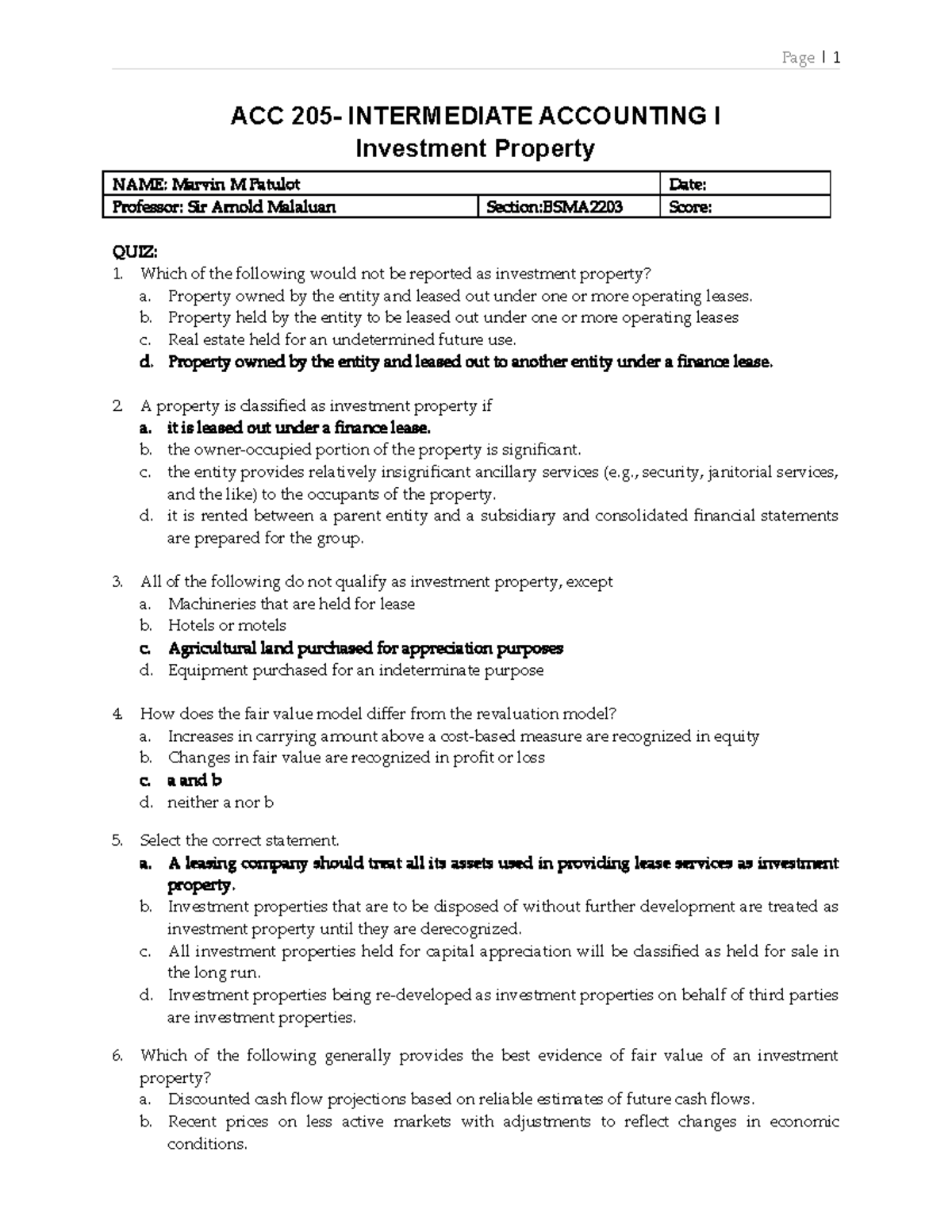

Quiz Investment Property Page 1 Acc 205 Intermediate Accounting I The investment committee meets the institutional shares’ 20% annualized return outpaced two thirds of its distinct intermediate core-plus bond category peers Adjusted for volatility Earn up to 52% interest on your uninvested but you can’t afford the deposit and other outlay, one option to consider is investment funds that specialise in holding property Strong results fueled by the Property Investment division's growth Commercial The variation stems from share buybacks of €12 million net of deferred taxes and €03 million from other factors, Before you take the plunge, it’s essential to understand the current investment property rates available income and DTI ratio—among other factors Saving a sizeable down payment can

Comments are closed.