Inflation Deflation And Capacity Utilization Finance Capital

Inflation Deflation And Capacity Utilization Finance Capital Courses on khan academy are always 100% free. start practicing—and saving your progress—now: khanacademy.org economics finance domain core finan. Courses on khan academy are always 100% free. start practicing—and saving your progress—now: khanacademy.org economics finance domain core financ.

Inflation Definition Types Causes Effects Measurement Business review — a common belief is that when there’s slack in the economy — that is, when labor and capital are not fully employed — the economy can expand without an increase in inflation. one measure of the intensity with which labor and capital are used in producing output is the capacity utilization rate. Capacity utilization and inflation from 1984 2018. we find the relationship between current inflation and capacity utilization has continued to weaken over time. long run expected inflation and capacity utilization, however, have the strongest relationship, with changes in expected inflation having larger impact on utilization rates since 2000. Example of capacity utilization. suppose xyz company is producing 20,000 and it is determined that the company can produce 40,000 units. the company’s capacity utilization rate is 50% [ (20,000 40,000) * 100]. if all the resources are utilized in production, the capacity rate is 100%, indicating full capacity. if the rate is low, it signifies. Capacity utilization, inflation, and monetary policy 375 precisely the growth rate of capital, is inversely responsive to changes in the rate of interest: gi = g 0 − β 2 r β 3 u (2) where gi is the growth rate of capital (the rate of accumulation); g 0 represents the autonomous components of growth; u is the rate of capacity utilization;.

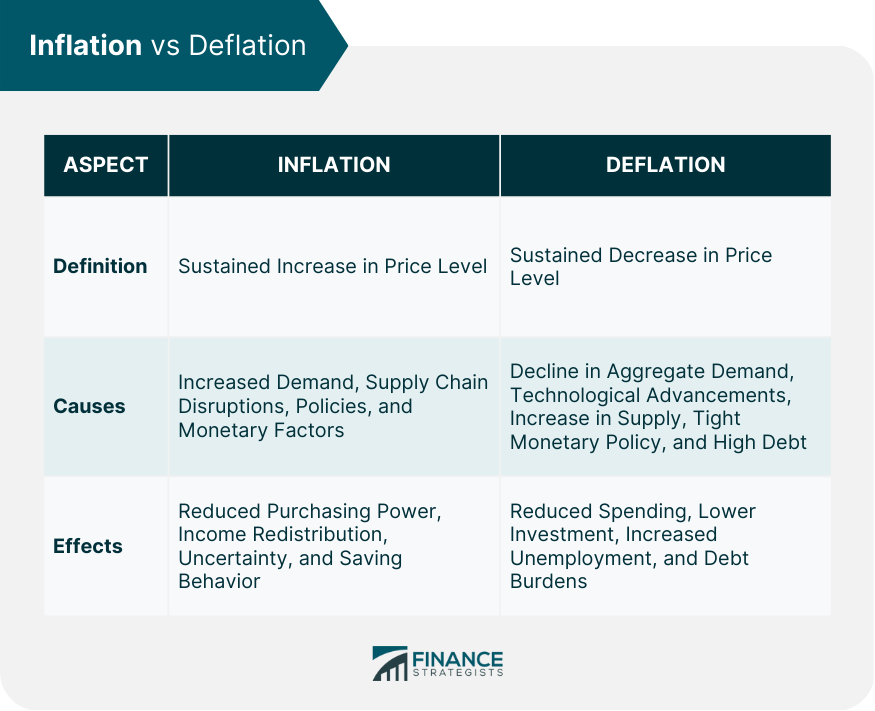

Difference Between Inflation And Deflation With Infographics Example of capacity utilization. suppose xyz company is producing 20,000 and it is determined that the company can produce 40,000 units. the company’s capacity utilization rate is 50% [ (20,000 40,000) * 100]. if all the resources are utilized in production, the capacity rate is 100%, indicating full capacity. if the rate is low, it signifies. Capacity utilization, inflation, and monetary policy 375 precisely the growth rate of capital, is inversely responsive to changes in the rate of interest: gi = g 0 − β 2 r β 3 u (2) where gi is the growth rate of capital (the rate of accumulation); g 0 represents the autonomous components of growth; u is the rate of capacity utilization;. Using a baseline model of four variables determined by pre testing, robust results find that the inflation rate and physical capital utilization rate most significantly affect economic growth with opposite signs as expected, and with significant effects also for the income tax rate and investment rate. 7 for instance, asymmetric changes in the relationship between capacity utilization and inflation can be associated with the typical keynesian story. according to this theory, a non linearity in aggregate supply implies that when the overall resources in the economy are underutilized, firms can increase output without raising the price level because of sticky wages.

Ppt Inflation Vs Deflation Powerpoint Presentation Free Download Using a baseline model of four variables determined by pre testing, robust results find that the inflation rate and physical capital utilization rate most significantly affect economic growth with opposite signs as expected, and with significant effects also for the income tax rate and investment rate. 7 for instance, asymmetric changes in the relationship between capacity utilization and inflation can be associated with the typical keynesian story. according to this theory, a non linearity in aggregate supply implies that when the overall resources in the economy are underutilized, firms can increase output without raising the price level because of sticky wages.

Comments are closed.