Income Tax Benefit On Life Insurance Simple Tax India

Income Tax Benefit On Life Insurance Simple Tax India The insurance company is liable to deduct tax at 5% of the income component of the payment, before releasing the payment to the taxpayer. here, the tds would be on the net maturity proceeds i.e., on rs 65,000 (1,10,000 45,000). the tds would be 5% on rs 65,000 amounting to rs 3,250. Tax at source (tds) @ 1% under section 194da of income tax act shall be deducted from maturity amount ,where maturity amount is not exempted under section 10 (10d) of income tax act,if maturity amount of life insurance policy is more than rs 1 lakh. comparison of section 10 (10d) with section 80c related to life insurance.

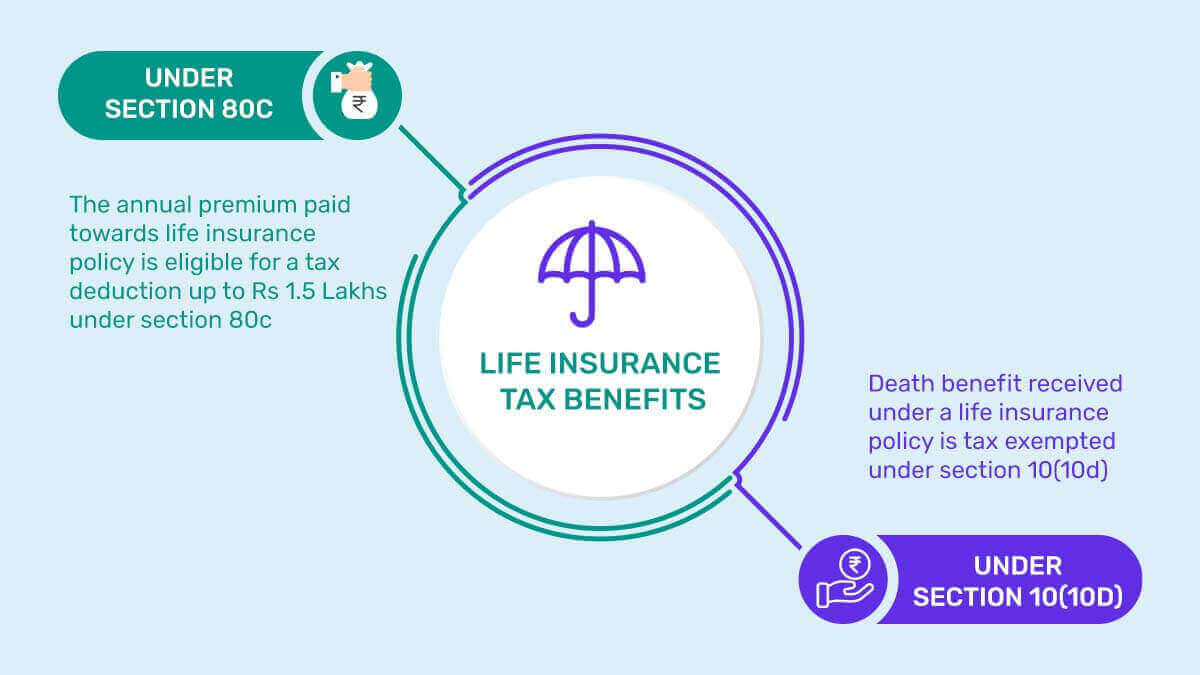

Life Insurance Tax Benefits In India 2024 Policybachat Phase 1: entry advantage. in this stage, you are eligible for tax deductions under sections 80c, 80ccc and 80d of the income tax act. section 80c is for life insurance, 80ccc is for pension plans, and 80d is for health insurance. phase 2: earnings advantage. your investment in the life insurance policy will grow over time and is tax free. Role of tax benefits in life insurance policy under section 10 (10d) on one hand, is the financial security offered to the nominee after the insured person’s death and the other is the deduction from the total income paid through the premiums collectively. under section 10 (10d), the money received as a death benefit is exempted from any sort. These include: tax benefit under section 80c: section 80c of the income tax act 1961 states that tax benefits can be availed on premiums paid for the term life insurance policies. deductions of up to 1.5 lakh are offered under this section of ita. tax benefit under section 10 (10d): this section ensures that in case of an unexpected death event. Section 10 (10d) states that a policy proceeds are tax exempt if its premium is below 10% of the actual sum assured. however, if it exceeds 10%, the proceeds from that policy are not tax exempt. this scenario is referred to as excess premium on life insurance policies. high premium life insurance policies.

Comments are closed.