Income Tax Accounting Fall 2024 Chapter 1 Intro Lo 1

When Can You File Your Taxes 2024 Income Tax Lelah Natasha Income tax accounting, fall 2024, chapter 4 introduction part 1. Income tax accounting, fall 2024, chapter 4, lo4 4, 1 2 self employment tax deduction.

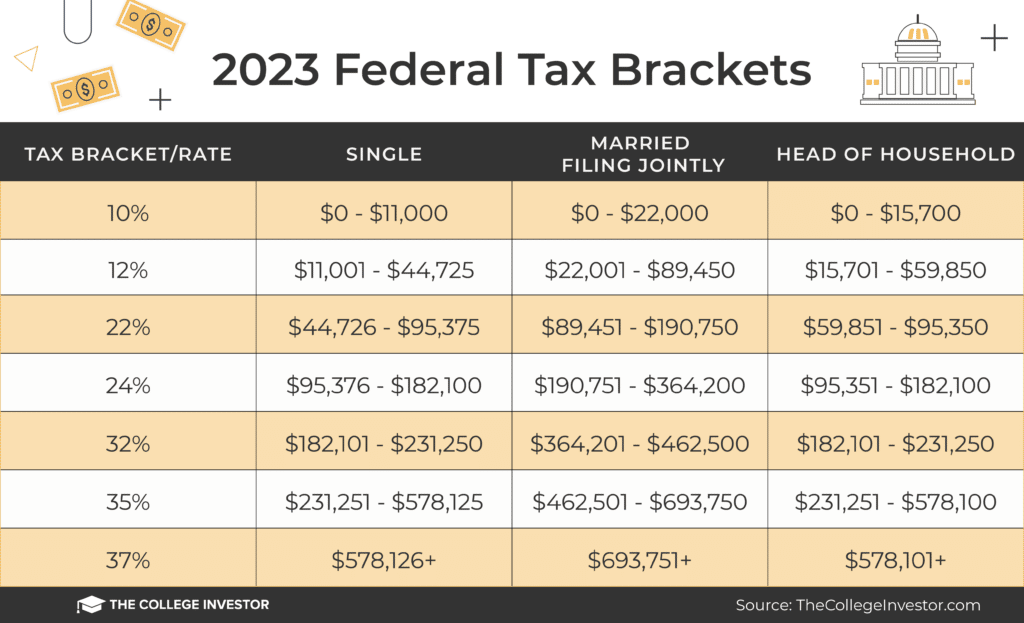

Federal Tax Income Brackets For 2023 And 2024 Forex Systems Research W2 lab. ag notes chapter 3 employment income. ag notes chapter 1 and 2 introduction. actg 4710 sample exam. canadian income tax notes, intro to income taxation chapter introduction to income tax objectives after successfully completing this chapter, you will be able. Income tax accounting, fall 2024, chapter 4, lo4 1, student loan interest deduction. 2023 2024 introduction to federal income taxation in canada, 44th edition with study guide 44th edition is written by nathalie johnstone, devan mescall, julie robson and published by wolters kluwer tax and accounting cch, inc. the digital and etextbook isbns for 2023 2024 introduction to federal income taxation in canada, 44th edition with study guide are 9781773792125, 1773792121 and the. Upon completing this chapter, you should be able to: lo 1 1. ce basic business, investment,p. lo 1 2. tax and t. objectivesof taxes.lo 1 3describe the different tax rat. es and calculate a tax.lo 1 4identify the various. state, and local taxes.lo 1 5apply appropriate criteria t. alternate tax systems.margaretis a junio.

Income Tax Calculation Statement Form 2024 25 Image To U 2023 2024 introduction to federal income taxation in canada, 44th edition with study guide 44th edition is written by nathalie johnstone, devan mescall, julie robson and published by wolters kluwer tax and accounting cch, inc. the digital and etextbook isbns for 2023 2024 introduction to federal income taxation in canada, 44th edition with study guide are 9781773792125, 1773792121 and the. Upon completing this chapter, you should be able to: lo 1 1. ce basic business, investment,p. lo 1 2. tax and t. objectivesof taxes.lo 1 3describe the different tax rat. es and calculate a tax.lo 1 4identify the various. state, and local taxes.lo 1 5apply appropriate criteria t. alternate tax systems.margaretis a junio. The essential accounting for income taxes is to recognize tax liabilities for estimated income taxes payable, and determine the tax expense for the current period. before delving further into the income taxes topic, we must clarify several concepts that are essential to understanding the related income tax accounting. the concepts are noted below. 2023 2024 introduction to federal income taxation in canada 44th edition. canadian income tax act with regulations, 115th edition, 2023 financial accounting.

Comments are closed.