Income Needed For A 400k Mortgage Dream Home Financing

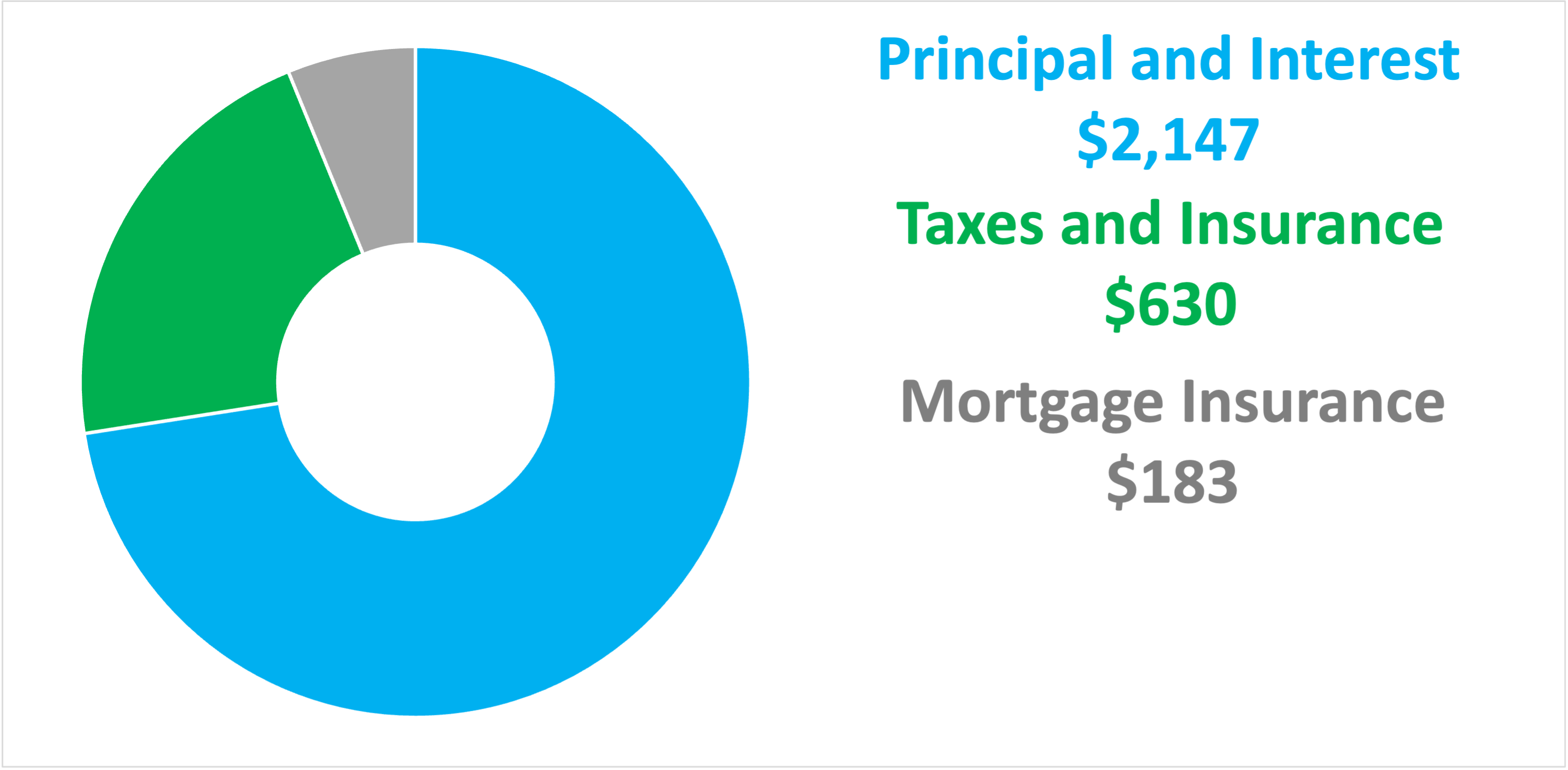

Income Needed For A 400k Mortgage Dream Home Financing 41 44%. $78,000. the data in the income needed for a $400k mortgage chart is based upon the following assumptions: tax rate of 1.5%. homeowner’s insurance premium of $1000 per year. interest rate of 5.5%. no other outstanding debt or monthly payments on your credit report. Assuming a 30 year fixed conventional mortgage and a 20 percent down payment of $80,000, with a high 6.88 percent interest rate, borrowers must earn a minimum of $105,864 each year to afford a.

Income Needed For A 400k Mortgage Bundle The home affordability calculator will help you to determine what you can qualify for when applying for a mortgage. you do not need to complete all of the fields for the calculator to work with the exception of your annual income. one of the key factors within the calculator will be your annual gross income (before taxes) and the interest rate. An expert analysis. if you’re eyeing a $400,000 home, you’re likely wondering how much income you need to make this dream a reality. as a mortgage professional with years of experience, i’ve guided many clients through similar purchases. let’s break down the factors that determine the income needed for a $400k house and explore some. 41%. 41%. 0%. maximum allowable income is 115% of local median income. most of the land mass of the nation outside of large cities qualify for usda. top backend limit rises to 44% with piti below 32%. a small funding fee of about 1% is added to the loan. See how much income you need for a $300,000 mortgage — or whatever home price fits your budget.

Income Needed For 400k Mortgage Essential Facts 41%. 41%. 0%. maximum allowable income is 115% of local median income. most of the land mass of the nation outside of large cities qualify for usda. top backend limit rises to 44% with piti below 32%. a small funding fee of about 1% is added to the loan. See how much income you need for a $300,000 mortgage — or whatever home price fits your budget. Based on a 30 year fixed rate mortgage and a 7.419% interest rate, the income required for a 400k mortgage is around $148,200. it’s possible to afford a $400k mortgage on less income, but this is a good ballpark figure based on best budgeting practices laid out by financial experts. home cost. $400,000. $400,000. The higher the interest rate, the higher your monthly payment. sticking with the example in the section above, a 30 year $400k mortgage at a 7% interest rate would have a monthly payment of $2,661. meanwhile, the same 30 year $400k mortgage at a 7.5% interest rate would have a monthly payment of $2,797, taxes and insurance not included.

Comments are closed.