Hsa How To Use Your Health Savings Account To Boost Your Retirement

Hsa The Ultimate Retirement Account To get started, consider these 5 ways that hsas can help fortify your retirement. 1. understand the triple tax advantage and how hsas work. you can save in an hsa if you are enrolled in an hsa eligible health plan at work or in the private and public marketplaces. Hsas are savings accounts that can be used to pay for medical expenses for those with high deductible health plans. in order to be eligible for an hsa, your health plan’s annual deductible.

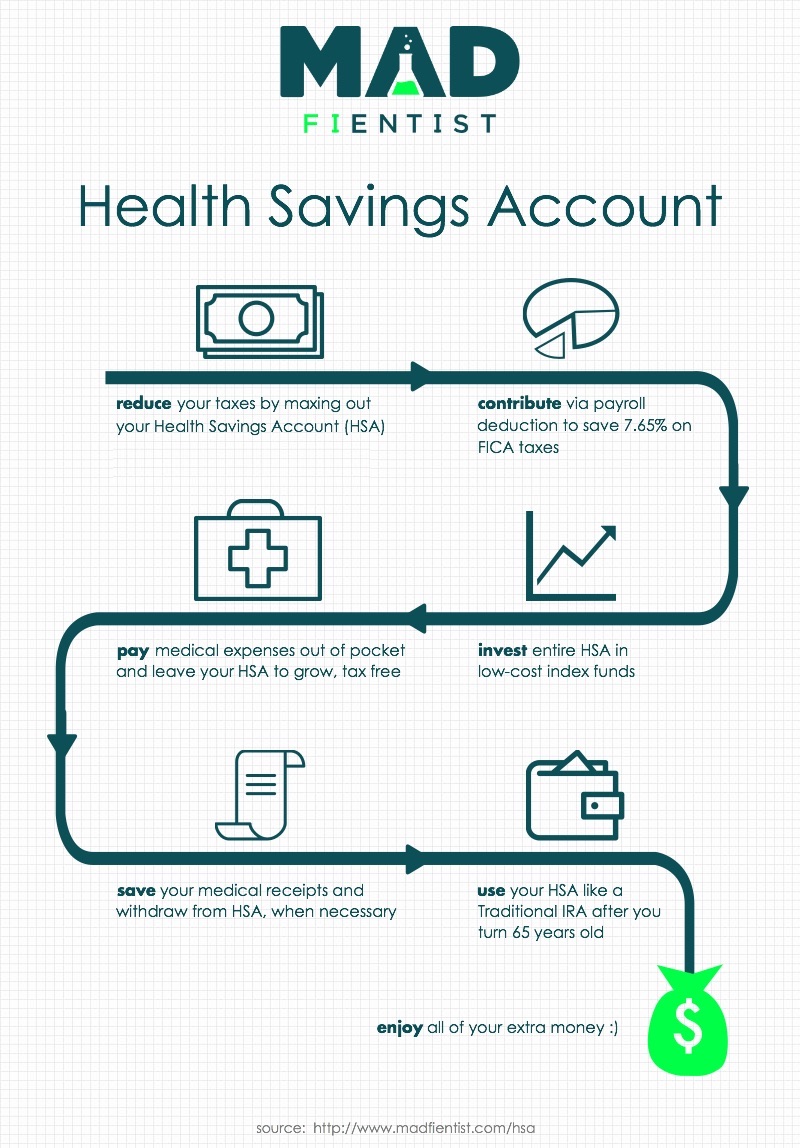

Hsa How To Use Your Health Savings Account To Boost Your Retirement Yes, you can use an hsa for retirement. the hsa rules relax once you reach age 65. at that point, you can continue using your hsa for qualified medical expenses tax free. and you can use it for. You may also use health savings account (hsa) funds to cover less common scenarios in retirement. for example, say that your adult child passes away and the care of their 10 year old child is. For hsas with an employer contribution in 2018, the average contribution rose to $839, from $604 in 2017, according to devenir. note that any amount your employer puts into your hsa counts toward. To use your health savings investment account as a valuable retirement planning tool, follow these four steps. open an hsa investment account. contribute the maximum allowed. save your receipts.

Comments are closed.