Hsa Contribution Limits For 2024 Irs Lidia Suzanne

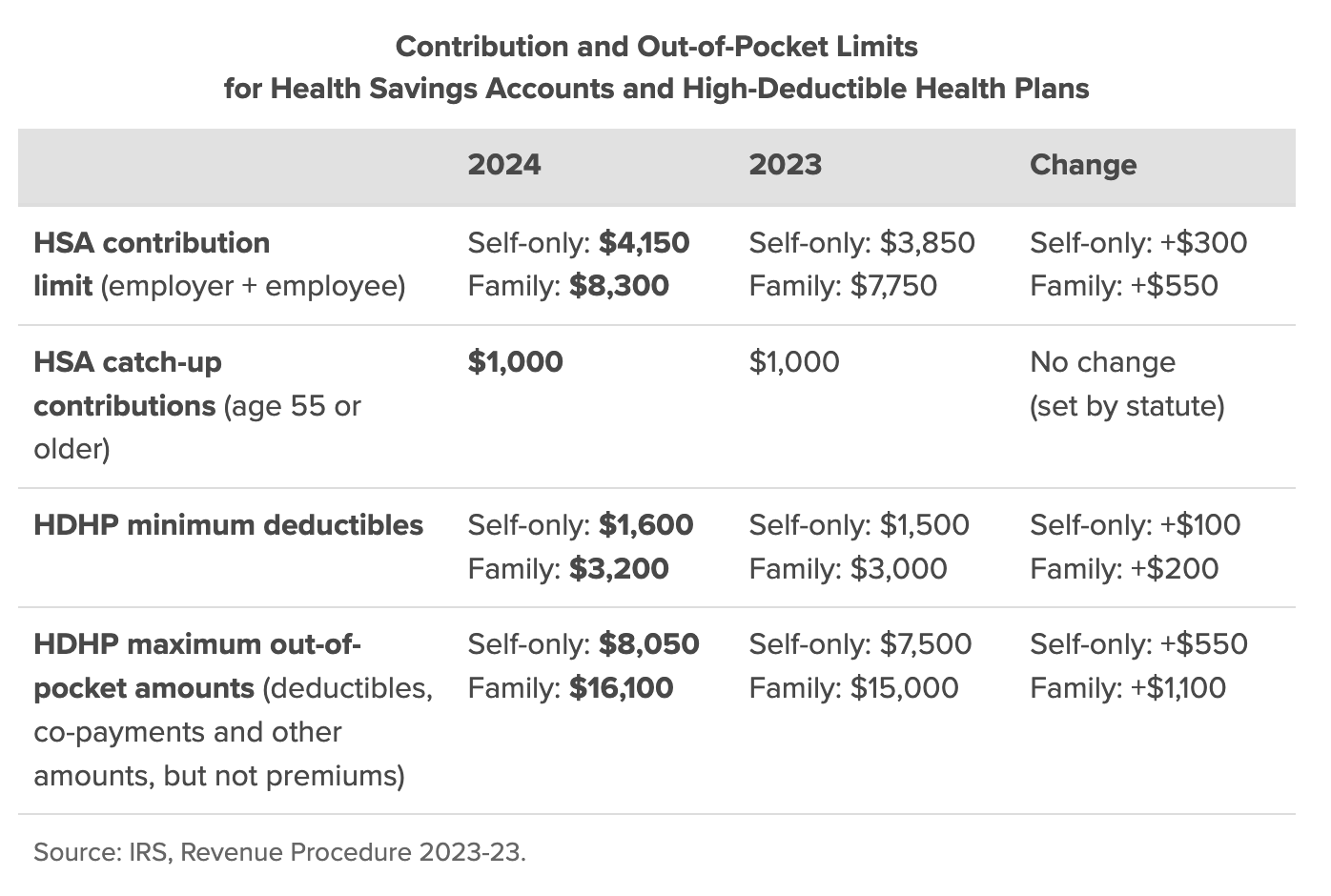

Hsa Contribution Limits For 2024 Irs Lidia Suzanne Health savings accounts, or HSAs, have higher contribution limits in 2024 The IRS allows those who are enrolled in an eligible healthcare plan to make a full year’s worth of HSA Your HSA contributions are tax-deductible, so they help reduce your taxable income But contributions to your health savings account are limited each year by the IRS, so the amount you can

Irs Makes Historical Increase To 2024 Hsa Contribution Limits First The limit for annual contributions to Roth and traditional individual retirement accounts (IRAs) for the 2024 tax year to pay attention to the IRS's contribution limits for the year, keep And if you exceed those contribution limits, you could face financial penalties Here's some good news: FSA contribution limits are higher for 2024 than plan with an HSA, opening an FSA The IRS has announced the Health savings account (HSA) contribution limits for 2025 While the increases are modest compared to the record-high HSA limit increase for 2024, they still offer The IRS released Rev Proc 2024-25, 2024-22 IRB 1333, dated May 9, 2024, which outlines the inflation-adjusted contribution limits for Health for 2025 To qualify for HSA contributions, your

2024 Hsa Contribution Limits Claremont Insurance Services The IRS has announced the Health savings account (HSA) contribution limits for 2025 While the increases are modest compared to the record-high HSA limit increase for 2024, they still offer The IRS released Rev Proc 2024-25, 2024-22 IRB 1333, dated May 9, 2024, which outlines the inflation-adjusted contribution limits for Health for 2025 To qualify for HSA contributions, your The Internal Revenue Service (IRS) has announced several increases to retirement plan limits for 2024, including higher contribution limits for 401(k), 403(b), and IRA plans These changes reflect The official IRS announcement will come in late For employees (ages 60-63), the catch-up contribution limits could rise from $7,500 in 2024 to these limits: The limit could stay the same The plan allows employees to select a specific amount of money, called a contribution, which they can deduct from their paycheck each pay period The Internal Revenue Service (IRS) determines the An HSA is a type of savings expenses throughout the year The IRS sets contribution limits for HSAs, adjusted each year for inflation For 2024, the contribution limit is $4,150 for

Comments are closed.